(The following is a section from the chapter 'Public Miners Sentiment and Performance' in the Bitcoin Mining Market Review (2025-2026 edition). This report is a collaborative effort with Digital Mining Solutions and is proudly sponsored by NiceHash ❤ )

The performance of public Bitcoin mining equities in 2025 signalled a shift in investor preference. Year-to-date (YTD) returns revealed a clear divergence between hybrid miners and pure players.

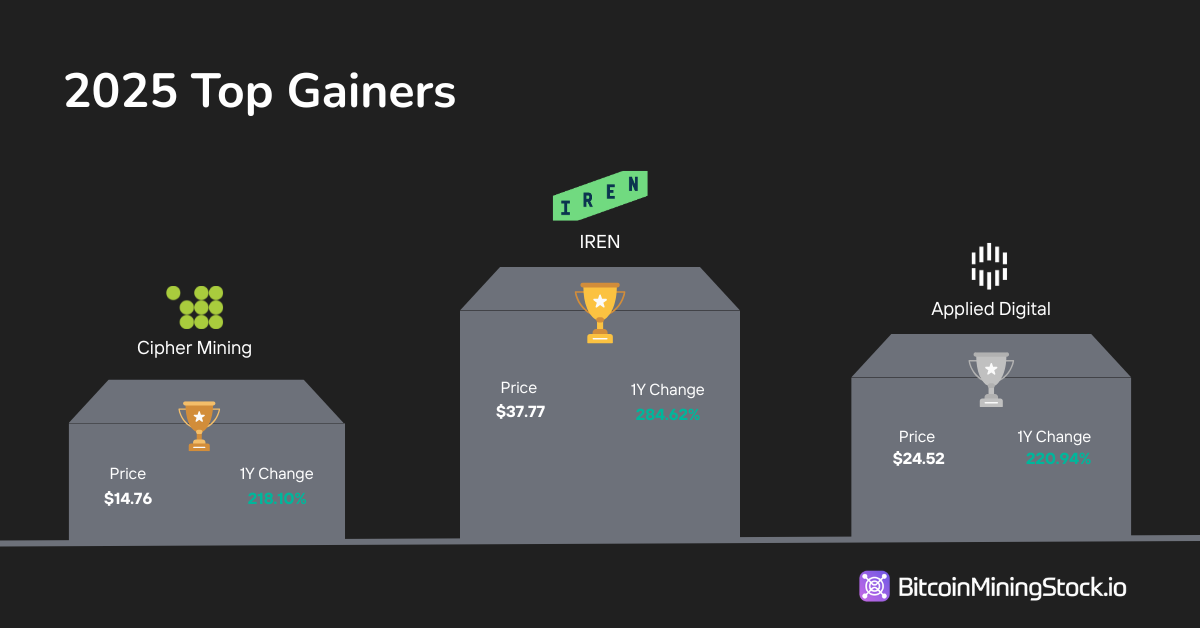

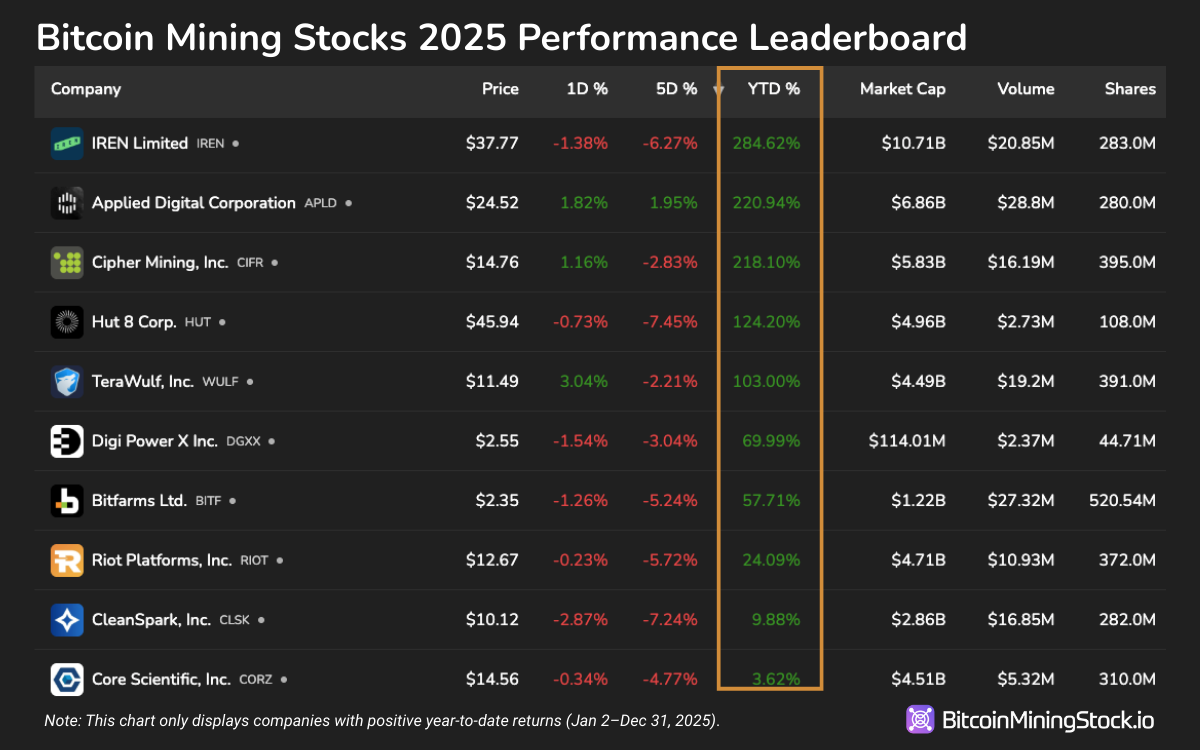

At the top of the leaderboard was IREN (IREN), Applied Digital (APLD), and Cipher Mining (CIFR), each delivering >200% YTD returns. All three companies had one thing in common: multi-billion-dollar hyperscaler agreements secured in 2025. Hut 8 (HUT) and TeraWulf (WULF), which also locked in major HPC contracts, followed closely with over 100% return. These results highlight how the capital markets increasingly reward miners that can monetize their infrastructure beyond Bitcoin, particularly through partnerships with hyperscale clients.

Broadening the scope, every Bitcoin miner with positive YTD returns in 2025 had either generated HPC revenue or had made visible, strategic moves toward HPC or AI-related services. In contrast, nearly all miners operating as pure Bitcoin plays posted negative YTD performance.

However, among companies with AI or HPC elements, investor response was not uniformly enthusiastic. Northern Data AG (NB2.DE), Bitdeer (BTDR) and MARA Holdings (MARA) all reported negative YTD returns despite having some level of AI exposure. For Northern Data, it had disappointing financial numbers and a business combination deal that outweighed its position as a HPC/AI infrastructure provider. In MARA's case, the company retained a Bitcoin-centric strategy throughout the year. BTDR, while deploying hosting services and equipment sales, lacked the scale or narrative clarity that seemed to drive peer re-ratings. This suggests that simply having an AI position or non-Bitcoin business segments is not sufficient; execution visibility and investor messaging matter.

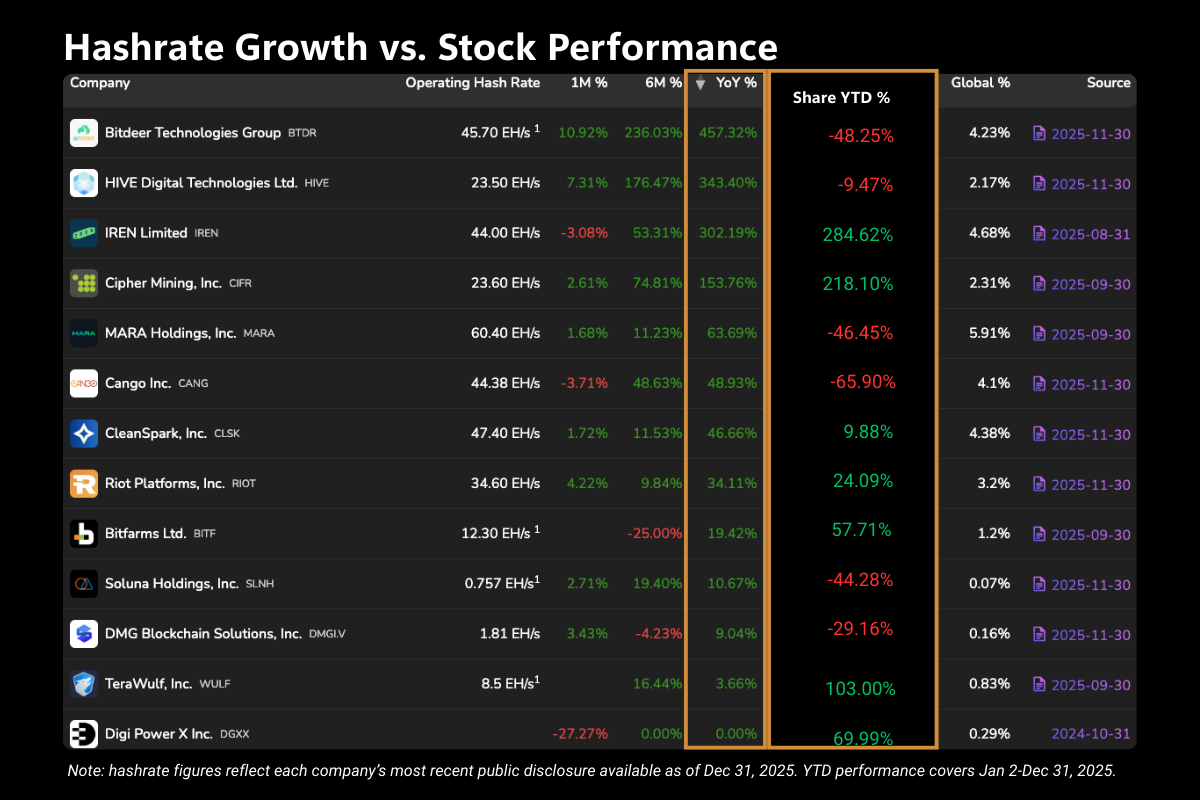

Another observation is that hashrate size did not guarantee positive stock performance. Several of the sector's largest operators underperformed despite leading in Exahash capacity. MARA, BTDR and CANG, all among the top five miners by hashrate, ended the year in the red. Meanwhile, smaller miners by hashrate but growing HPC operations, such as Cipher Mining (CIFR), and TeraWulf (WULF), saw outsized gains. The takeaway here appears to be that scale alone is not enough unless paired with a pathway to diversified and higher-margin revenues.

CleanSpark (CLSK) serves as a case study in market sentiment. For much of the first half of 2025, the company emphasised its identity as America’s Bitcoin miner. Its share price struggled to break out of the $15 range even as smaller competitors saw their valuations expand. The tone shifted following leadership changes in August, including the appointment of a new CEO, Matt Schultz, who explicitly signalled intent to explore HPC and AI revenue streams. As the company began to disclose tangible steps toward that pivot, investor sentiment improved. CleanSpark's stock reversed course from a negative 1-year return to positive territory, reflecting the premium placed on diversification narratives in the current market.

Micro-cap miners (market cap < $100M) with no AI ambitions were hit the hardest. These firms experienced the worst drawdowns across the board, with some losing over 70% of their market value during 2025. In contrast, a handful of names, such as Cathedra Bitcoin (CBIT), Argo Blockchain (ARBK) and Mawson Infrastructure (MIGI), appeared to post outsized gains on the surface. But these were largely technical artefacts driven by reverse stock splits or low float trading activity, which are not fundamental re-ratings. Adjusting for these structural changes, true market outperformance remained concentrated among the hybrid miners.

This dispersion in stock performance further reinforces the growing influence of the HPC/AI pivot on capital markets.

For those who want to track the ongoing performance of Bitcoin mining stocks, please visit: BitcoinMiningStock.io/gainers-losers

😃 Enjoy the read? Join the waitlist for our 2025 Bitcoin Mining Market Review here.