Last week, U.S. stock markets saw a broad pullback. Rising Treasury yields, renewed U.S.-China trade tensions, and uncertainty around upcoming Fed policy decisions weighed heavily on investor sentiment. The 30-year Treasury yield even crossed the 5% mark — its highest level since 2023 — while talk of a sweeping tax proposal added to the volatility. With that backdrop, let’s take a close look at the Bitcoin mining sector.

Index Update

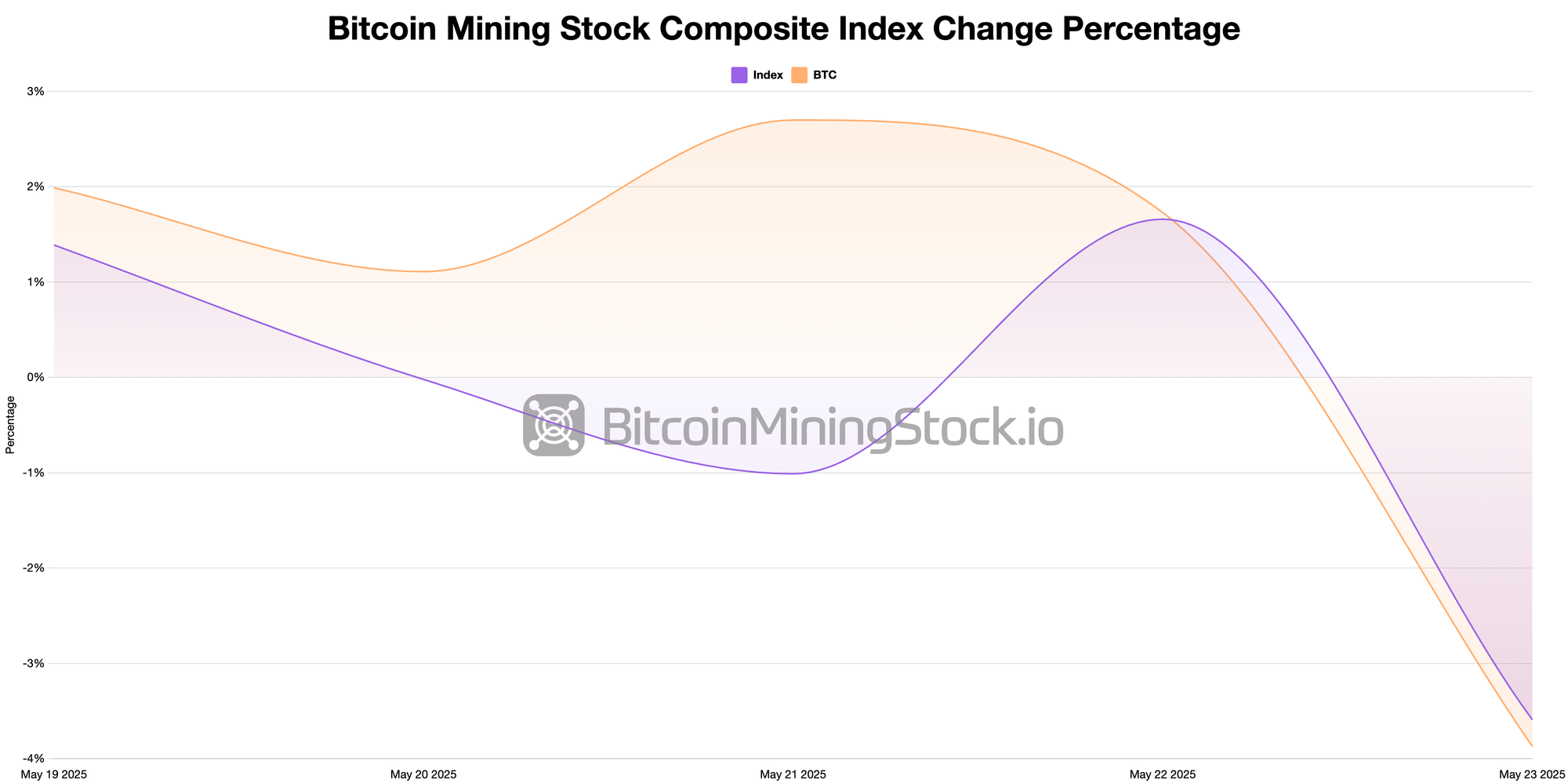

5-D Volatility: Last week’s volatility was unusual — Bitcoin saw both stronger rallies and sharper pullbacks, ending with positive returns despite the swings. Here’s how they performed compared to other major stocks 👇👇

Major Company Updates

- Soluna to launch first solar-powered data center with 75 MW project (link)

- US Data Centers Inc., a subsidiary of Digi Power X, to collaborate with Super Micro for initial deployment of customized B200 GPU infrastructure (link)

- HIVE Digital Technologies celebrates record 9.5 EH/s milestone, driving shareholder value on path to 25 EH/s by 2025 (link)

- Northern Data Group announces an AI factory partnership with Deloitte to accelerate European AI transformation (link)

- Cipher Mining prices convertible senior notes offering and hedging transaction to place borrowed common stock (link)

- Riot Platforms announces upsizing of credit facility to $200 million with Coinbase (link)

While we’re building a new feature for the Earnings page, we’ve also refreshed the company profiles — and this is just the beginning. Check them out! (example)

That’s all for last week! Feel free to drop us a message if you have any suggestions, feedback, or just want to say hi.

Thanks for being part of our journey-see you next week!

Cindy & the BMS Team 💜