👀 It’s official: President Donald Trump signed the GENIUS Act into law last Friday, which is setting the stage for a regulated stablecoin era and a new chapter in U.S. digital asset policy.

Index Update

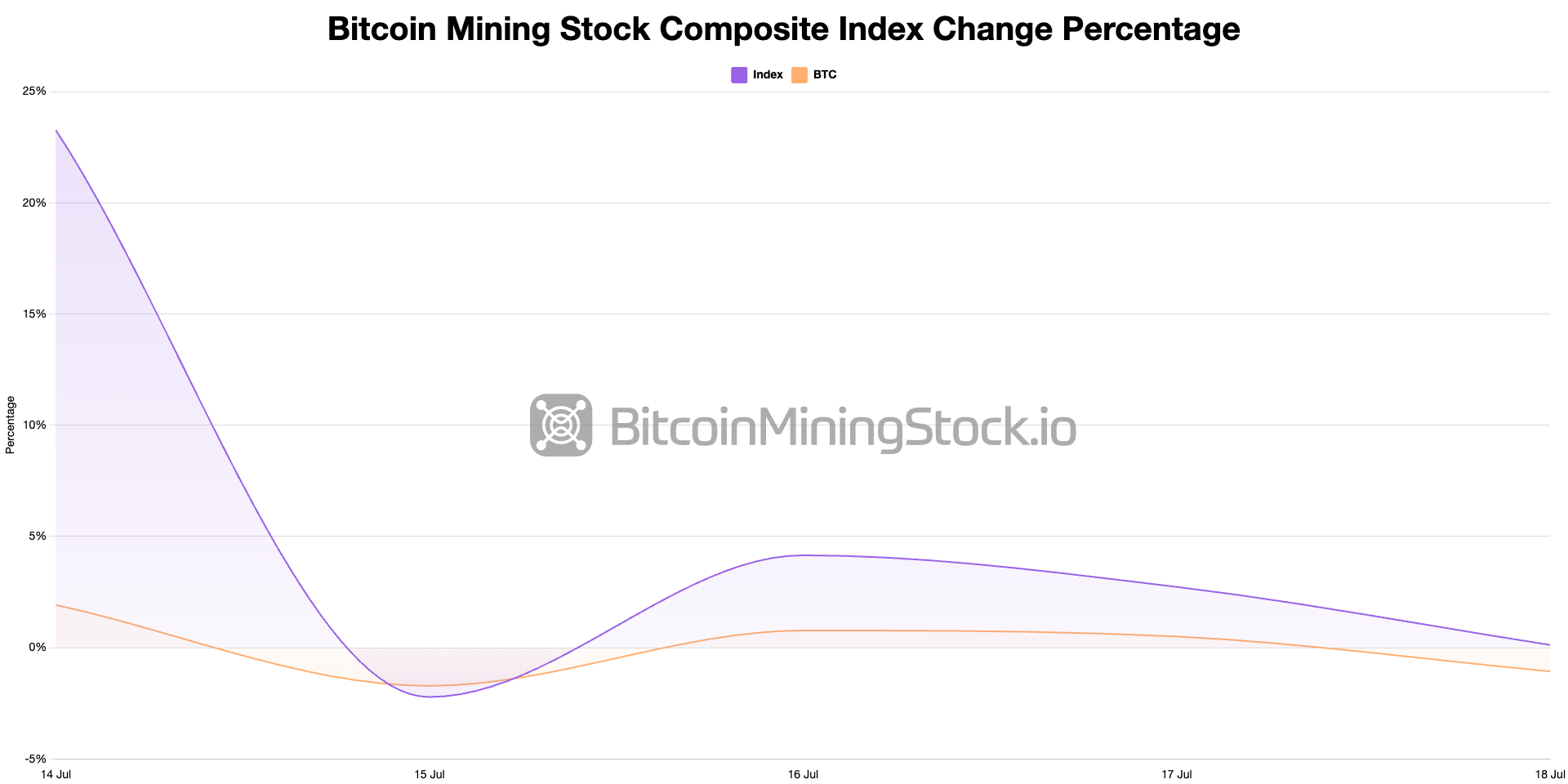

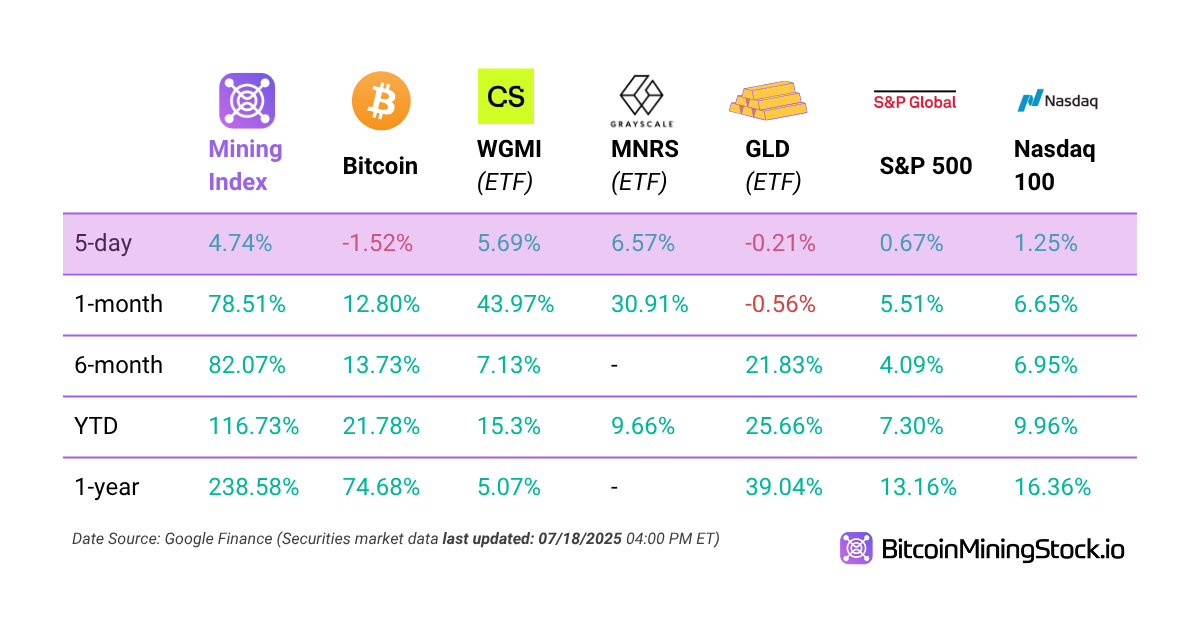

5-D Volatility: Bitcoin mining stocks mirrored Bitcoin’s volatility—but in more amplified way. Here’s how they performed compared to other major stocks 👇👇

Major Company Updates

- Bit Digital Inc. continues expansion of Ethereum holdings to approximately 120,000 ETH, reinforcing treasury strategy (link)

- Cathedra Bitcoin announces early repayment of outstanding debt (link)

- Canaan Inc. to produce A15Pro miners for Cipher Mining (link)

- Bit Origin secures $500 million equity and debt facilities to launch Dogecoin treasury (link)

- Soluna Holdings, Inc. announces closing of $5 million public offering (link)

- Digi Power X acquires Supermicro NVIDIA B200 systems to launch Tier 3 NeoCloud AI infrastructure (link)

- Cango Inc. announces results of second extraordinary general meeting (link)

- Riot Platforms, Inc. reports beneficial ownership of 9.85% in Bitfarms Ltd. (link)

- Bit Digital, Inc. announces public filing for WhiteFiber's proposed initial public offering (link)

Must Read: President Donald J. Trump signs GENIUS Act into law (link)

What Happened: On July 18, 2025, President Donald J. Trump signed the GENIUS Act (Guiding And Establishing National Innovation for U.S. Stablecoins) into law, marking a major turning point in U.S. digital asset policy. The act creates the nation’s first federal regulatory framework for stablecoins—cryptocurrencies pegged to the U.S. dollar—requiring 100% reserve backing in dollars or short-term Treasuries, mandatory reserve disclosures, and compliance with strict consumer protection and anti-money laundering rules. Aimed at reinforcing the U.S. dollar’s status as the world’s reserve currency, the law is expected to attract significant investment and innovation.

Cindy's Thoughts: Following the passage of the GENIUS Act, we can expect a wave of innovation in the payments space, with many institutions likely to issue their own stablecoins. This trend is poised to accelerate activity on multiple blockchains, especially Ethereum, which potentially driving renewed interest and growth in altcoin treasuries. For investors who view stablecoins as a key catalyst for the next market cycle, Bit Digital (BTBT) and BitMine Immersion Technologies (BMNR) stand out as two of the few publicly listed Bitcoin mining companies holding significant Ethereum reserves.

That’s all for this week! Feel free to drop us a message if you have any suggestions, feedback, or just want to say hi.

Thanks for being part of our journey-see you next week!

Cindy & the BMS Team 💜