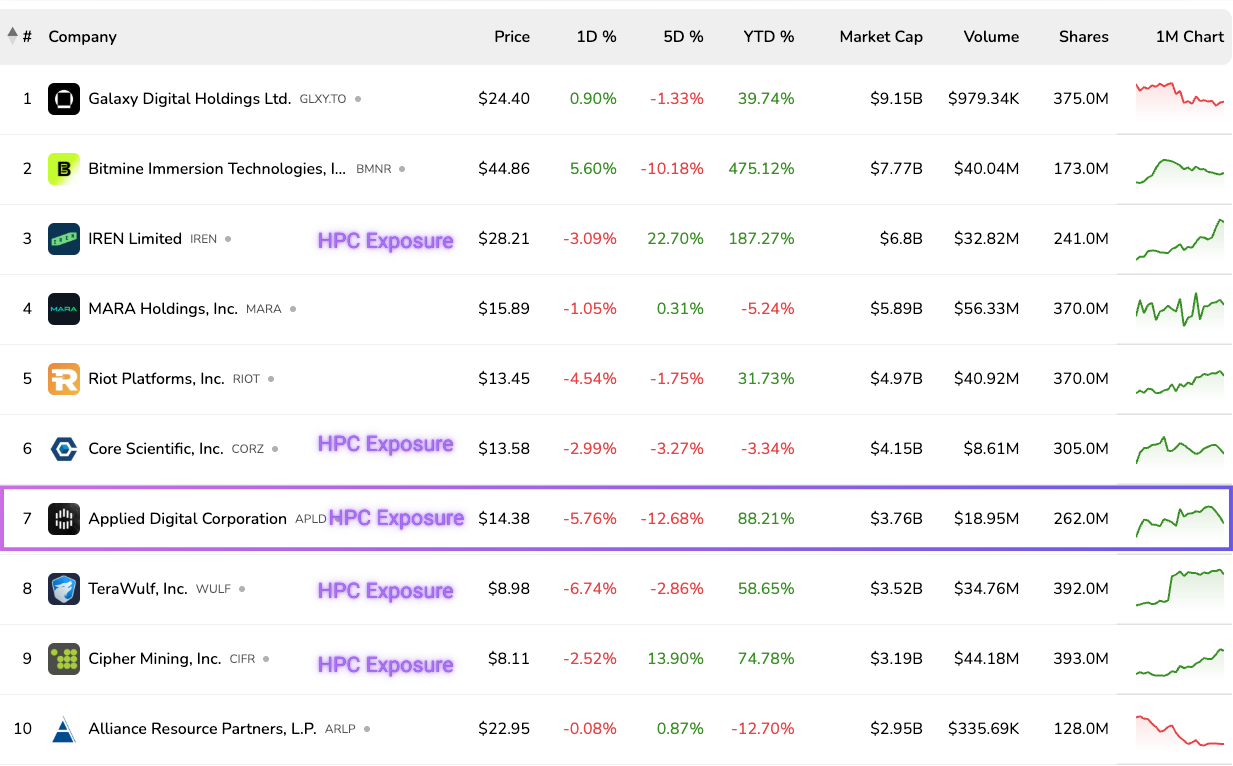

Bitcoin mining stocks with exposure to AI/HPC have been some of the biggest winners year-to-date. IREN, Cipher, and Hut 8 are among the most talked-about names on X. TeraWulf also drew attention after announcing a multibillion-dollar hosting deal with Fluidstack, backstopped by Google. But one company hasn’t gotten much discussions on X. This company, Applied Digital (Nasdaq: APLD), currently ranks #7 by market cap on our website.

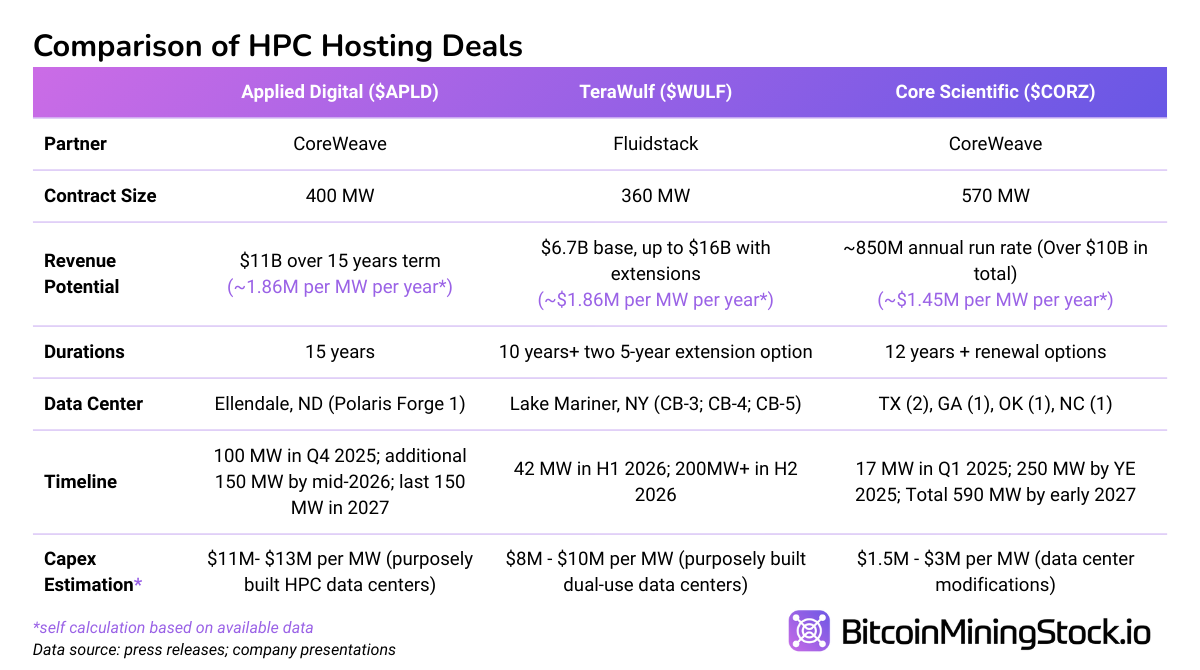

Last week, Applied Digital announced that CoreWeave had exercised additional lease options, which projects to bring a total $11 billion in revenue (400 MW critical IT load) over the lease term. This makes it one of the largest known revenue deals among publicly listed Bitcoin mining companies, on par with the HPC contracts secured by Core Scientific and TeraWulf.

When I first flagged Applied Digital last September in “How Bitcoin Miners Are Tapping into the AI Gold Rush (Part 2)”, I noted the company was in talks to sign a 400 MW hyperscale deal, and 90% of the deal was negotiated. For investors who acted early, the stock has surged over 300% since that initial mention. This isn’t a victory lap. Rather, it’s a prompt to re-examine what’s now baked in and what still might be overlooked. So let’s dive in!

Company Transformation: From Mining to Digital Infrastructure

Headquartered in Dallas, Texas, Applied Digital has undergone a fundamental shift in its business model. Previously involved in self-mining, the company no longer operates any proprietary mining and has transitioned into a fully hosting-focused business*, serving both blockchain and high-performance computing (HPC) clients.

*As disclosed in its Fiscal Year 2025 report, the company classified its Cloud Services Business as “held for sale” and has reported it under discontinued operations. As a result, Applied Digital’s HPC segment now consists solely of hosting services that are co-location.

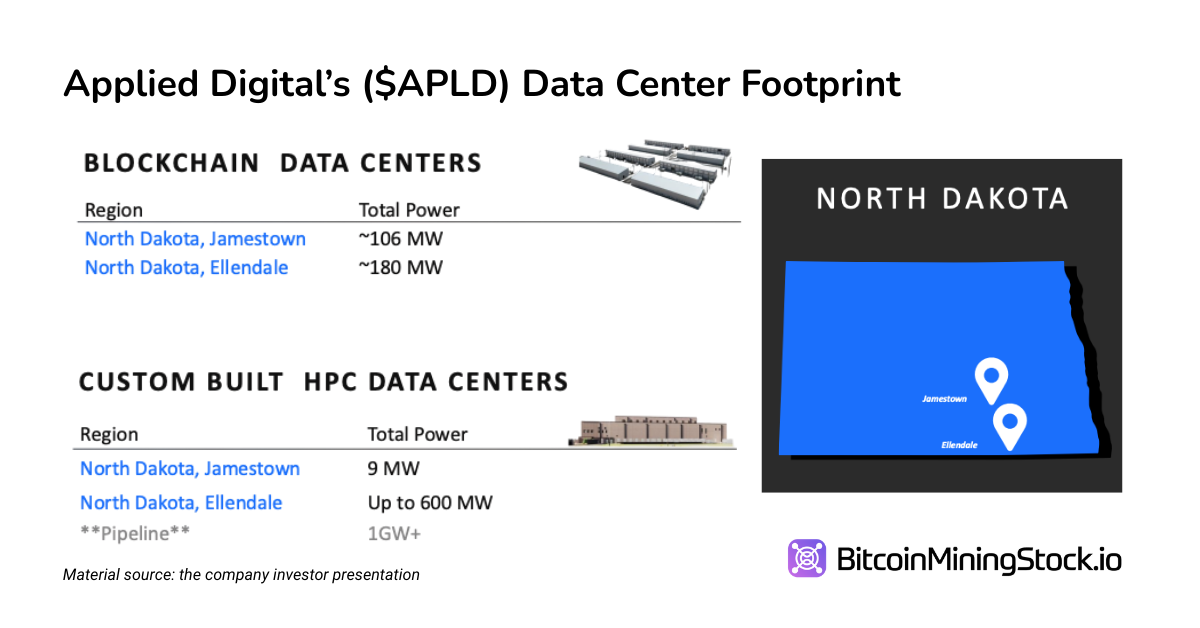

The company’s current operations are primarily based in North Dakota, with the following data center footprint:

- Jamestown, ND: 106 MW of hosting capacity dedicated to crypto mining, currently operating at full capacity.

- Ellendale, ND: 180 MW of crypto mining hosting capacity already online, alongside a separate HPC campus, Polaris Forge 1, under development. This campus is expected to deliver 400 MW of HPC capacity to CoreWeave across three phases: 1) First 100 MW facility: service-ready by Q4 2025. 2) Second 150 MW facility: expected mid-2026. 3) Third 150 MW facility: targeted for 2027

For the fiscal year ending May 31, 2025, Applied Digital reported $51.84 million in total revenue, consisting of $63.92 million from blockchain hosting services and offset by a $12.08 million loss from discontinued Cloud Services operations. The HPC hosting business has yet to begin generating revenue. However, with construction milestones approaching and long-term lease agreements in place, the company is positioning for a shift. Given that its crypto mining hosting contract is limited to a single customer with approximately 2.5 years remaining, HPC hosting is expected to become the dominant revenue driver in the years ahead.

Inside the $11B Deal: One Hyperscaler, Three Buildings, Multiple Phases

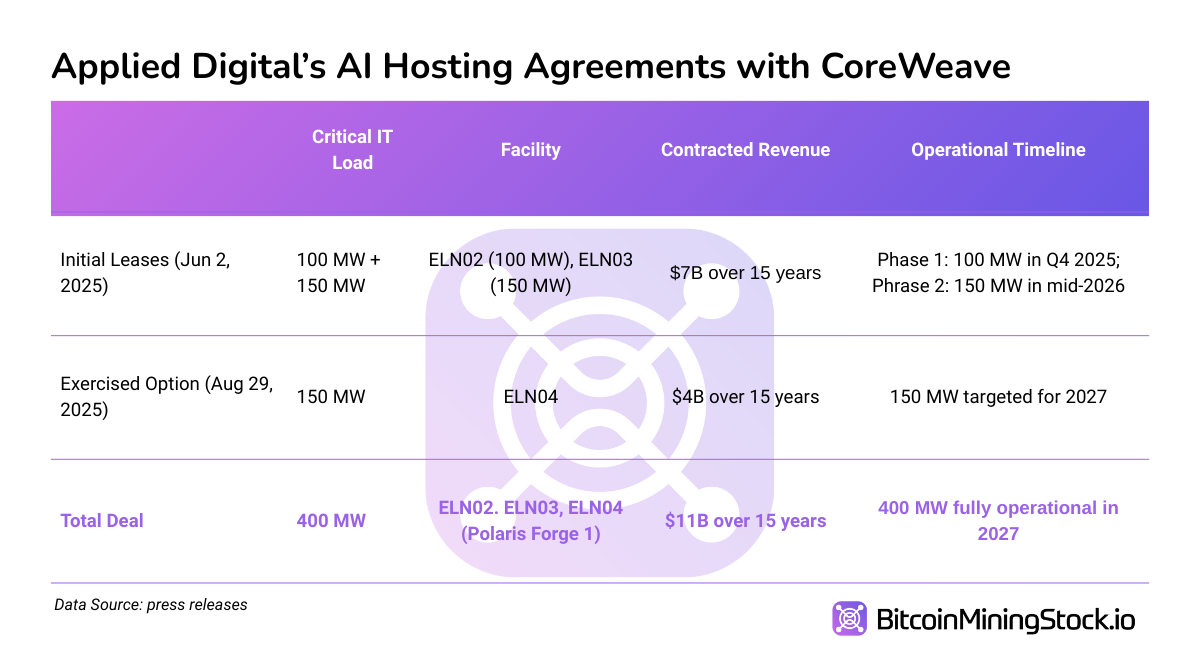

CoreWeave, the hyperscaler that made headlines in 2024 through its landmark contracts with Core Scientific, is now central to Applied Digital’s HPC hosting transformation. The two companies have signed three long-term lease agreements totaling 400 MW of critical infrastructure capacity. These leases span approximately 15 years and are structured as fixed payment agreements, providing predictable revenue streams that are not subject to market volatility or variable demand.

The initial announcement came on June 2, 2025, detailing 2 leases and a total of 250 MW HPC hosting. One 100 MW building (ELN02) is set to be service-ready by Q4 2025, while the second 150 MW building (ELN03) is under construction and expected online by mid-2026. These two leases alone account for approximately $7 billion in total revenue.

On August 29, 2025, Applied Digital announced that CoreWeave exercised its option for an additional 150 MW building. This third building (ELN04) is expected to come online in 2027, which brings the total revenue commitment to $11 billion.

Interestingly, all three leases are situated at Polaris Forge 1, a campus with access to over 1GW of potential power capacity. This signals Applied Digital’s potential to expand well beyond the initial 400 MW under contract, should additional hyperscaler clients come onboard.

Financing the Buildout: Capital Raises Accelerate, But With Complexity

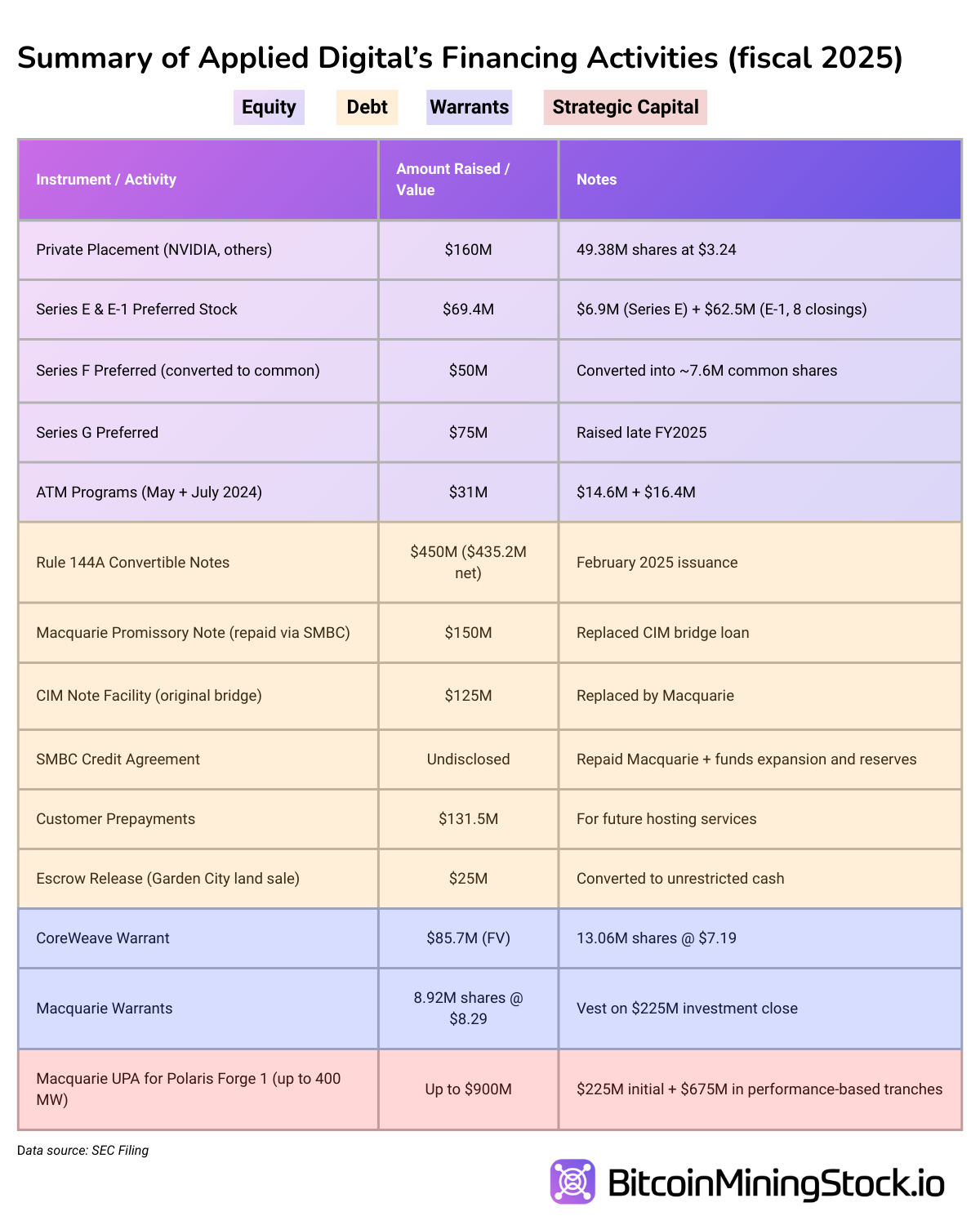

Executing large-scale leases like these requires significant upfront capital. As of May 31, 2025, Applied Digital had $44.9 million in unrestricted cash and equivalents. While not sufficient to fund Ellendale expansion outright, the company pursued a mix of funding mechanisms to support the buildout. Over $874.7 million were raised during the fiscal year, up 496% from the prior years.

Major funding rounds included a $160 million private placement backed by NVIDIA and related companies, a $450 million convertible note, $375 million financing with Sumitomo Mitsui Banking Corporation (“SMBC”), and a multi-tranche $900 million investment commitment from Macquarie Asset Management. These were accompanied by warrant grants to CoreWeave and Macquarie, further adding complexity to the capital structure. Other supplementary funding came from customer deposits, asset disposals, and capital raised through ATM programs.

Together, these tools offer a runway for Ellendale’s buildout but also added complexity, introducing dilution risk, multiple classes of preferred equity, convertible debt, and long-term lease commitments. Investors should keep a close eye on interest costs, dilution triggers, and warrant overhangs.

Final Thoughts: Should You Buy $APLD Now?

Applied Digital has quickly positioned itself as a serious player in the HPC hosting space. Its 15-year, $11 billion contract with CoreWeave offers rare visibility in a market full of LOIs and hype. The first HPC revenues are expected within months, with the rest ramping up through to 2027. In their recent earnings call, management also disclosed ongoing talks with other hyperscale clients, suggesting the pipeline could grow beyond CoreWeave.

At $14.38 per share, the company’s market cap is ~$3.76 billion. Based on FY25 revenue ($51.9 million), the trailing P/S multiple looks inflated at ~72.5x. But forward projections offer context: at full buildout, CoreWeave’s 400 MW could generate ~$733 million annually, plus $63 million from crypto mining hosting. Assuming a conservative 50% EBITDA margin, Applied Digital could produce ~$400 million EBITDA. Based on a current enterprise value of $4.42 billion, that translates to a forward EV/EBITDA multiple of ~11.1x and an EV/revenue multiple of ~5.7x. It's not cheap, but a more grounded valuation for a business with fixed multi-year cash flow visibility.

That said, this model isn’t for everyone. Applied Digital doesn’t mine Bitcoin itself or hold Bitcoin, so it won’t capture BTC upside like vertically integrated miners do. Instead, it's value lies in recurring revenue, capacity execution, and long-term lease economics. For investors seeking exposure to the HPC buildout, with lower volatility and clearer cash flow, Applied Digital offers a tangible play in the space. But for those looking for BTC leverage, you may find better exposure elsewhere.

Disclaimer: The views expressed in this article are my own and are based on publicly available information. This content is intended for informational purposes only and should not be construed as investment advice. Readers are encouraged to conduct their own research before making any investment decisions. Past performance is not indicative of future results. No recommendation or advice is being provided as to the suitability of any investment for any particular investor.