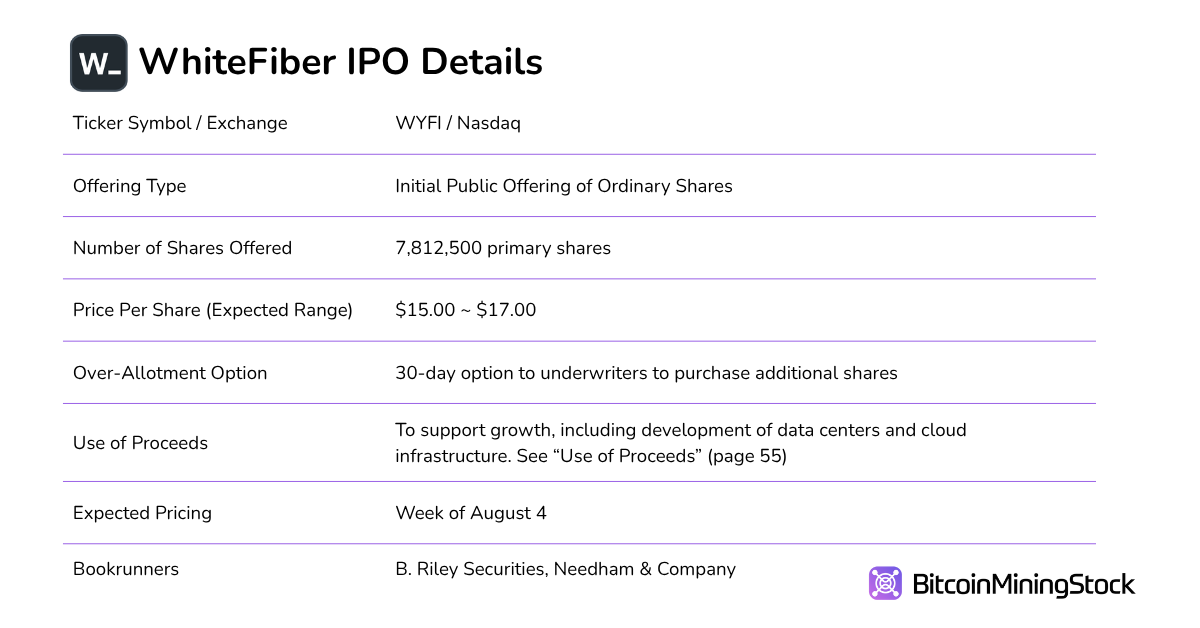

WhiteFiber Inc., the high-performance computing (HPC) and AI infrastructure subsidiary of Bit Digital (NASDAQ: BTBT), has launched its initial public offering. The company is offering 7,812,500 ordinary shares at a proposed price range of $15.00 to $17.00 per share, with underwriters granted a 30-day option to purchase an additional 1,171,875 shares. Upon listing under the ticker WYFI on the Nasdaq Capital Market, WhiteFiber will become a publicly traded provider of AI-focused cloud and data center services.

This public debut is more than a routine capital raise; it’s a deliberate move by Bit Digital to spotlight and monetize its fast-growing AI infrastructure business. The offering comes at a time when the market is rewarding companies tied to AI. Public miners like Core Scientific and IREN are generally appreciated in the capital market. WhiteFiber seems to seek a similar recognition. As I previously covered, Bit Digital’s AI/HPC unit stood out for delivering significant revenue despite having a modest crypto mining footprint.

However, this progress was recently overshadowed by Bit Digital’s pivot from Bitcoin to an Ethereum treasury strategy, a direction not all investors are confident in. As such, WhiteFiber’s IPO can be seen as a strategic step to separate a high-growth infrastructure story from crypto’s volatility.

WhiteFiber’s Relationship with Bit Digital: A Strategic Carve-Out

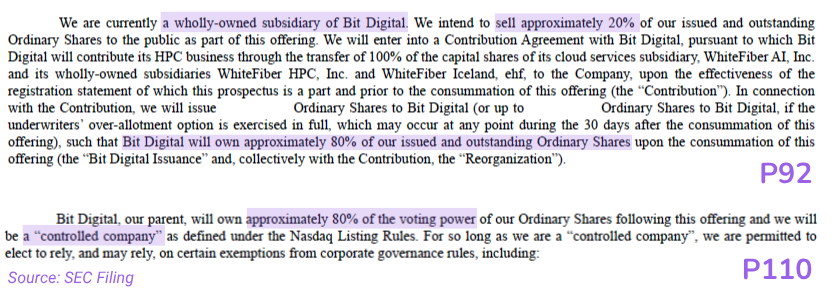

It’s important to note: WhiteFiber is not a spin-off. There will be no share distribution to Bit Digital shareholders. Instead, this is a carve-out IPO where Bit Digital is selling a 20% stake of its AI/HPC business to the public while retaining ~80% ownership and voting control post-offering, qualifying WhiteFiber as a “controlled company” under Nasdaq rules.

This structure allows Bit Digital to maintain exposure to the upside of WhiteFiber’s growth, while giving the latter operational independence and access to capital on its own merits.

What this means for investors: you won’t automatically receive WhiteFiber shares just by holding Bit Digital stock. But Bit Digital’s balance sheet will benefit from any market upsides of WhiteFiber, and the move helps reduce perceived crypto-related risk in WYFI financials.

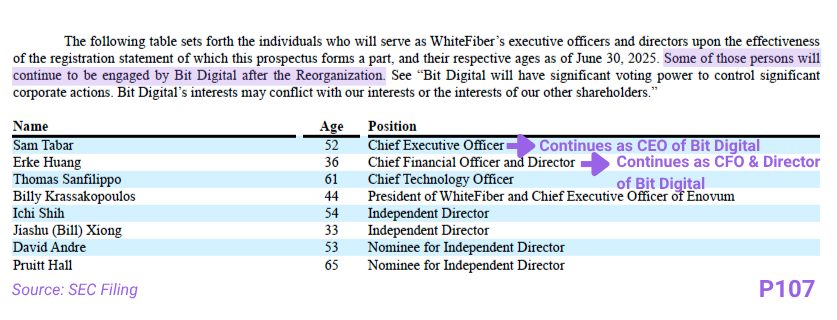

In terms of leadership, WhiteFiber has a newly assembled team but several key members of Bit Digital’s executives will retain overlapping roles. Additionally, it appoints independent directors with domain expertise. Overall, this structure ensures continuity and strategic alignment, especially during a high-growth phase, but also raises questions about eventual governance independence.

Milestones That Signal Intentional Buildout

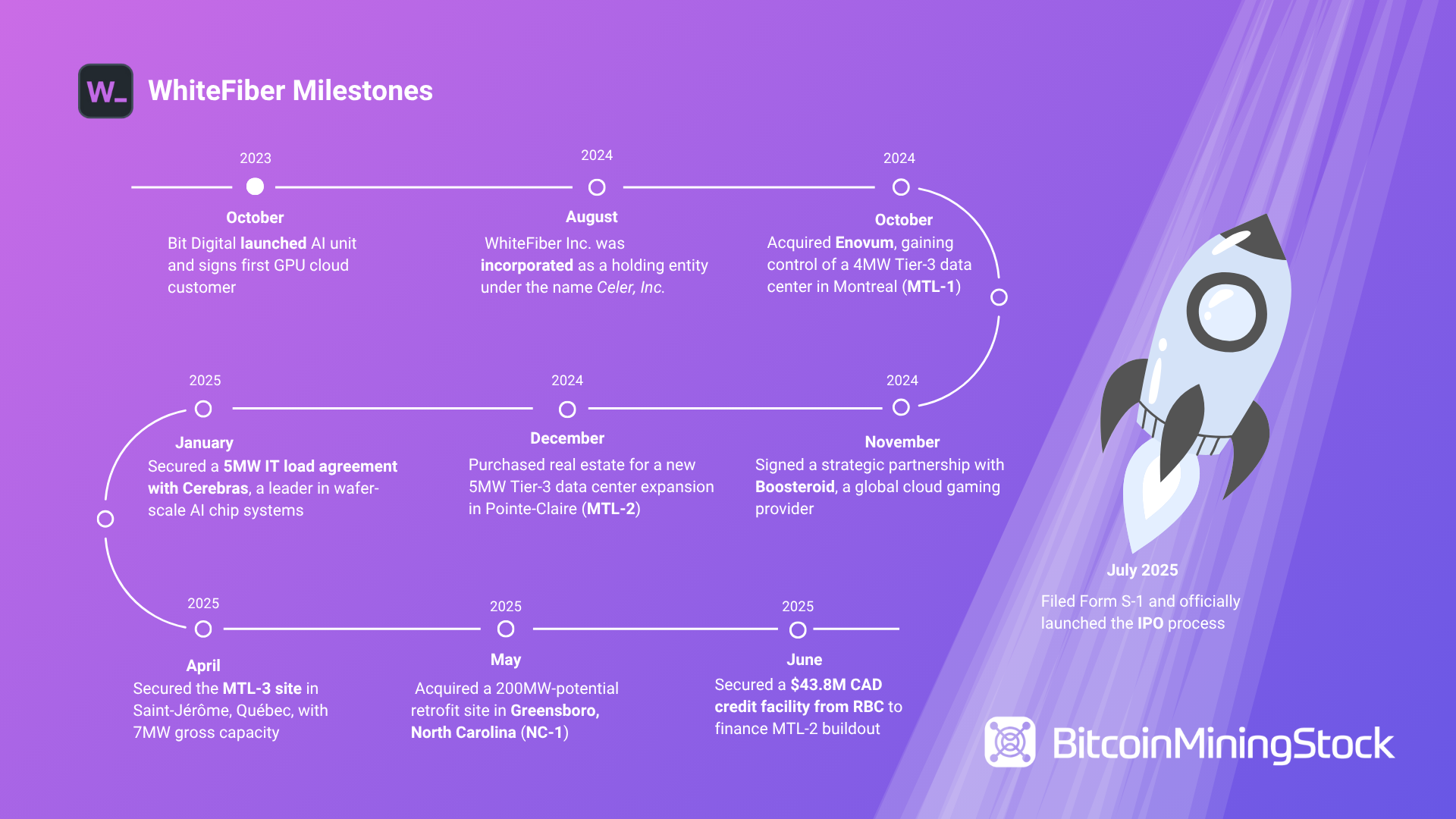

WhiteFiber’s timeline stretches back to October 2023, when Bit Digital launched its AI unit and signed its first GPU cloud services customer under the name Bit Digital AI, Inc. The formal incorporation of WhiteFiber as a holding vehicle followed in August 2024, under the name Celer, Inc. Here’s a condensed timeline of strategic developments:

Pieced together, these milestones reflect a company that is rapidly scaling and doing so through strategic partnerships, targeted acquisitions, and secured power agreements. This is not speculative growth. It is calculated and resource-backed.

What WhiteFiber Actually Offers

WhiteFiber operates two tightly integrated services tailored to generative AI workloads:

- GPU-Based Cloud Services: Customers lease access to high-performance NVIDIA GPUs (including H200, B200, and GB200), which are deployed across WhiteFiber-managed data centers. Clients include AI developers, cloud gaming providers, and ML researchers. The company also developed WhiteFiber Cloud AI, a software layer that links GPU clusters across multiple sites to create a virtual “supercluster.”

- Tier-3 Data Center Colocation Services: WhiteFiber owns and develops Tier-3 data centers that meet Tier-3 design and operational standards, offering N+1 cooling, 150kW rack density, and direct-to-chip liquid cooling. These specs are purpose-built to serve generative AI workloads that require higher power density and cooling than traditional workloads.

Together, this integrated model gives WhiteFiber stronger unit economics than a disaggregated operator, with upside in both infrastructure margin and GPU utilization.

Portfolio and Pipeline: Scale Is the Next Test

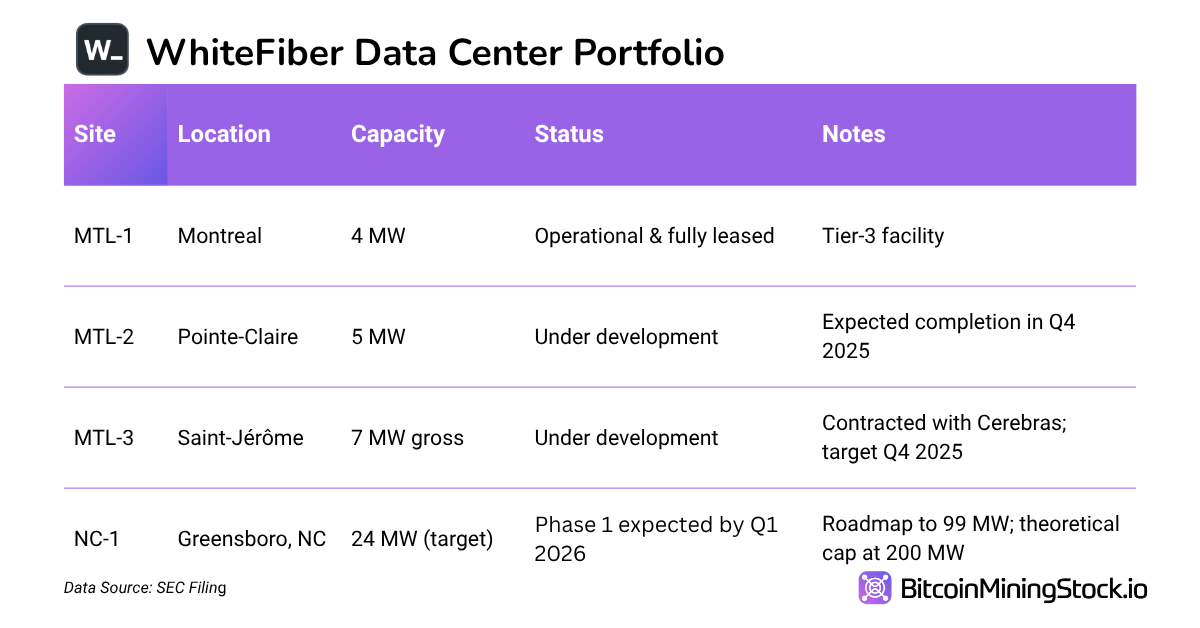

WhiteFiber’s operational portfolio includes:

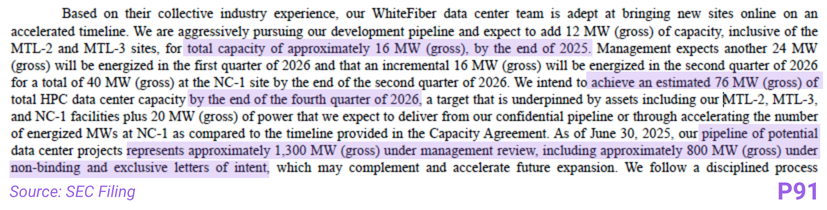

WhiteFiber forecasts reaching 76MW of gross capacity by the end of 2026. The company also notes a broader pipeline under management review totaling ~1,300MW, with 800MW under non-binding letters of intent.

While this suggests scale, the challenge now shifts to conversion and delivery. Timelines must be met. Permits must be secured. And power must actually flow.

Revenue Momentum - But a Word of Caution

WhiteFiber reported $14.8 million in revenue for Q1 2025 from its cloud business, with full-year 2024 revenue reaching $45.7 million. As of June 2025, WhiteFiber had roughly 4,000 GPUs under contract, with more expected.

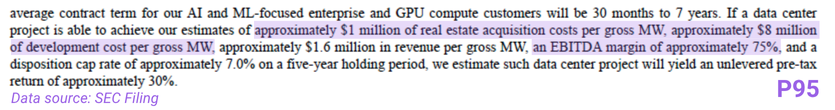

Yet despite the growing bottom line, we must remember that Bit Digital previously missed its $100 million annualized revenue target. The shortfall invites a more cautious interpretation of projections. While management models $1.6 million in annual revenue per MW at ~75% EBITDA margin, these figures remain theoretical until new sites go live and customers scale usage.

Additionally, revenue concentration remains high. Two disclosed anchor customers, Cerebras and Boosteroid, represent a significant portion of current commitments. For example:

- Cerebras: 5MW IT load under a five-year agreement, with rights of first refusal on expansion.

- Boosteroid: Initial 489 GPU order (~$7.9M revenue through 2029), with rights to expand up to 50,000 servers under an MSA.

While these contracts provide important early revenue visibility, they also create risk: if a top customer delays deployment or underutilizes contracted capacity, quarterly revenue could swing sharply.

Capital Requirements and Financing

WhiteFiber’s growth strategy is capital intensive. It estimates data center development costs of $7–9 million per MW, excluding real estate costs of ~$1 million per MW. Approximately 70% of this capex is expected to be financed with facility-level debt, as evidenced by the recent $43.8M CAD facility from Royal Bank of Canada.

Beyond this IPO, WhiteFiber is likely to seek further capital, either from equipment leasing partners, institutional JV capital, or public follow-ons. Its ability to secure this capital efficiently will be critical in meeting its 2026 buildout targets.

Final Thoughts

WhiteFiber’s IPO offers a chance to invest in a pure-play AI infrastructure company with real customers, a meaningful revenue base, and a clearly defined buildout strategy. It also gives Bit Digital a cleaner structure, freeing its crypto-exposed balance sheet from its most promising growth segment. In short, WhiteFiber gains operational clarity and financing flexibility while Bit Digital benefits from its market upsides.

That said, the road ahead isn’t guaranteed. WhiteFiber will now compete with established cloud providers and AI-native infrastructure platforms. Execution timelines will be scrutinized. Contracts will need to convert to revenue. And investors will be watching to see if the company can maintain momentum beyond its initial growth spurt.

Given Bit Digital’s prior revenue miss, I remain conservatively optimistic. The demand is real. The partnerships are strong. But until more of its pipeline turns into recurring, diversified revenue, I’ll stay grounded in what’s already been delivered.

P.S. The primary SEC filing referenced in this report is available here. Page numbers refer to those displayed in the original document.

Disclaimer: The views expressed in this article are my own and are based on publicly available information. This content is intended for informational purposes only and should not be construed as investment advice. Readers are encouraged to conduct their own research before making any investment decisions. Past performance is not indicative of future results. No recommendation or advice is being provided as to the suitability of any investment for any particular investor.