While our team is busy working on the next key feature, I wanted to take a moment to share a quick update on institutional activity in the Bitcoin mining sector - something we’ve been monitoring since the end of last year.

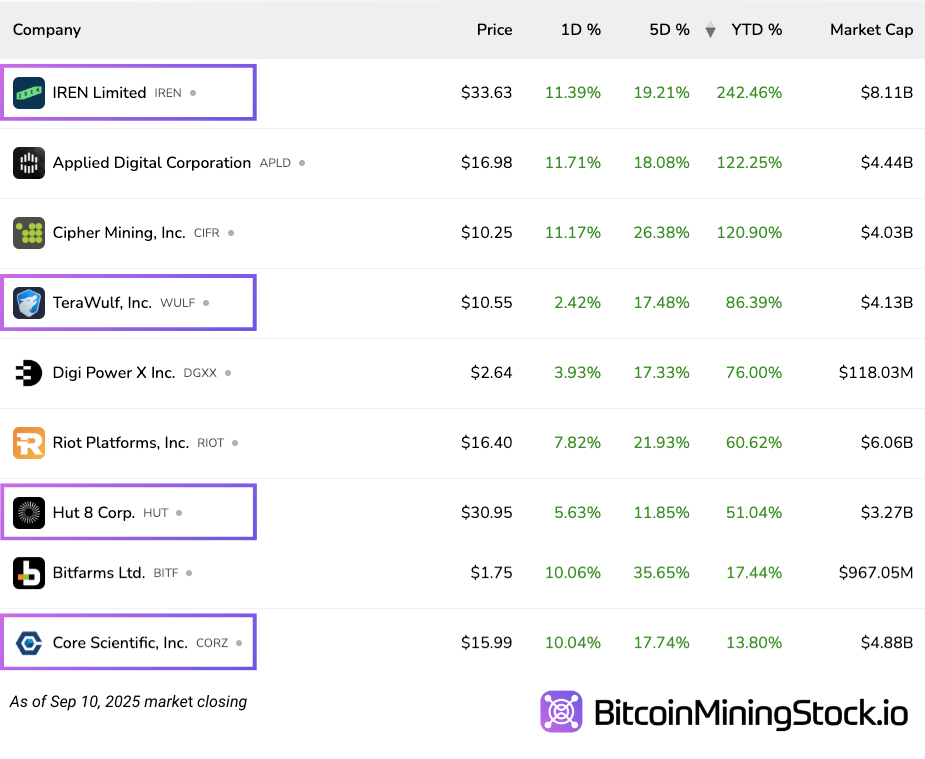

Back in January, we published the 2024 Bitcoin Mining Review that was co-authored with Nico from Digital Mining Solutions. In that report, I mentioned that institutions were “betting big” on CORZ, WULF, IREN, and HUT. So far, those names have generally outperformed the broader mining sector YTD.

In the report, I also flagged 3 institutional trends:

- Institutional interest in Bitcoin miners was broadly rising.

- AI/HPC narratives were attracting outsized attention.

- Large-cap miners continued to be the default choice for institutional capital.

Now that a fresh round of 13F filings is in, it’s a good time to see what’s changed, what still holds. And most importantly, where institutions are making new bets.

Institutions are still rotating in

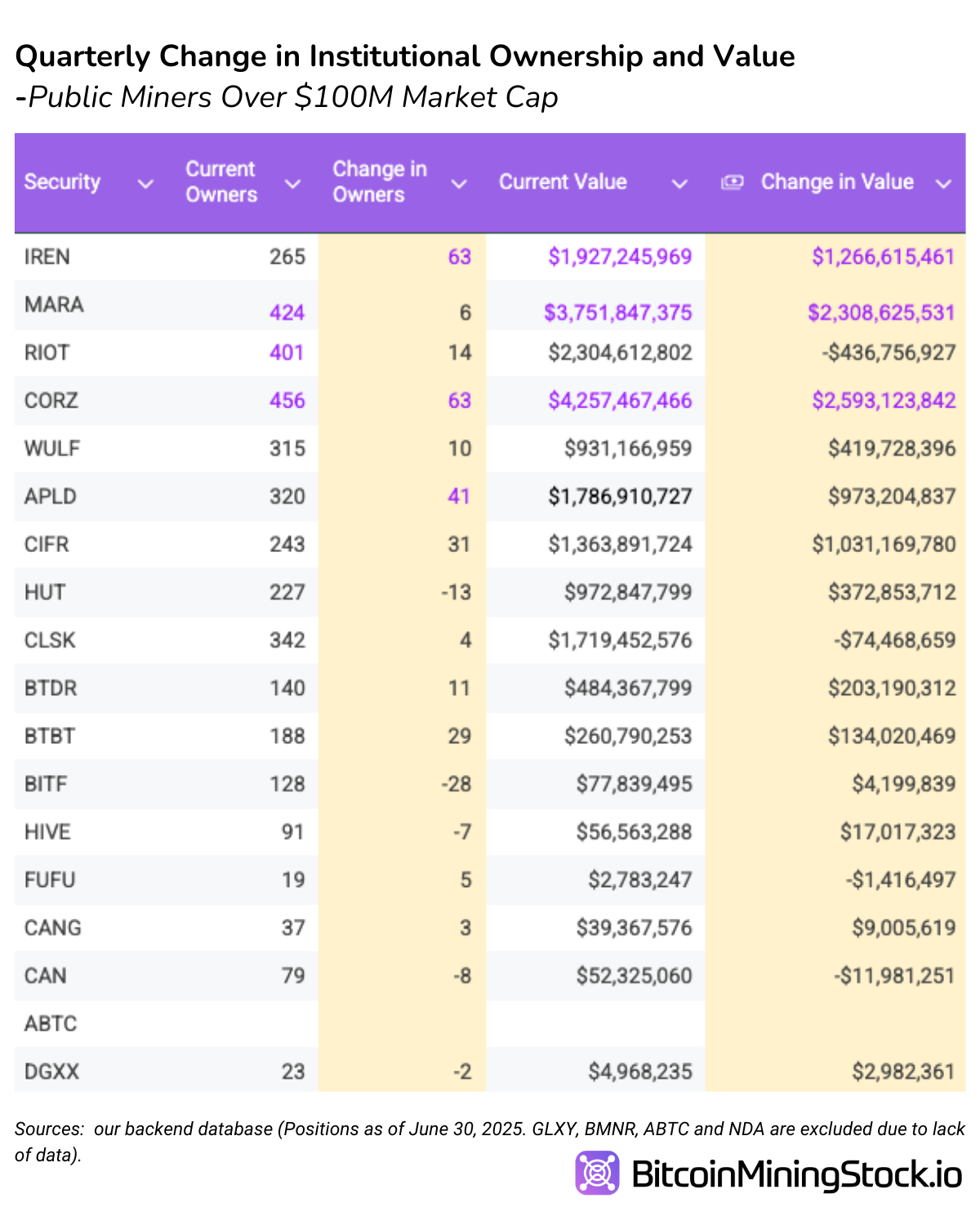

Across miners with market caps above $100 million, the majority saw both an increase in institutional owners and a rise in the total value of capital invested. This confirms the first trend: overall, institutional interest in the sector remained strong through H1 2025.

But what’s more revealing is where that capital is flowing. IREN, CORZ, and APLD led the charge, each adding more than 40 new institutional holders. What do they have in common? All three have direct exposure to AI/HPC.

- CORZ and APLD have signed multibillion-dollar colocation deals with CoreWeave.

- IREN, while yet to announce a major HPC deal, has been consistently updating the market on its GPU deployment progress and AI-ready infrastructure.

This reinforces the idea that the AI/HPC narrative remains the strongest institutional draw across the public mining sector. Institutions are clearly rewarding companies that can monetize data center infrastructure beyond Bitcoin.

Dollar flows tell a similar story. CORZ, MARA, and IREN led in terms of increased institutional investment value, followed closely by CIFR and APLD. MARA stands out as the only top gainer without a valid AI/HPC exposure, but it remains the largest public miner by both hash rate and Bitcoin treasury size. That’s likely why it continued to receive major capital inflows; institutions still wanted pure Bitcoin beta exposure at scale. For a long time, MARA held the top spot by market cap, until recently being overtaken by BMNR and IREN.

Not everyone is getting love

At the same time, not all miners kept pace. BITF, HUT, and CAN lost institutional holders, while RIOT, CLSK, and CAN saw net reductions in the value of institutional holdings.

In some cases, this coincides with weak stock performance. CAN, for example, is down -65.60% YTD. CLSK and BITF showed marginal YTD growth (+4.99% and +6.17%, respectively), lagging behind the peers with similar operational scales.

HUT is an interesting case. Despite losing 13 institutional owners, it still has a strong YTD return. That could reflect rotation, increased retail activity, or rebalancing by funds - but it doesn't appear to be a fundamental confidence issue. By the way, HUT has been actively positioning itself as an energy infrastructure platform, instead of a Bitcoin miner. They even packaged their whole compute segment as an independent company - American Bitcoin.

What’s also telling is that RIOT, CLSK, and BITF have each made announcements about exploring HPC, yet none have reported energized capacity or signed deals so far.

Ownership percentages reveal deeper positioning

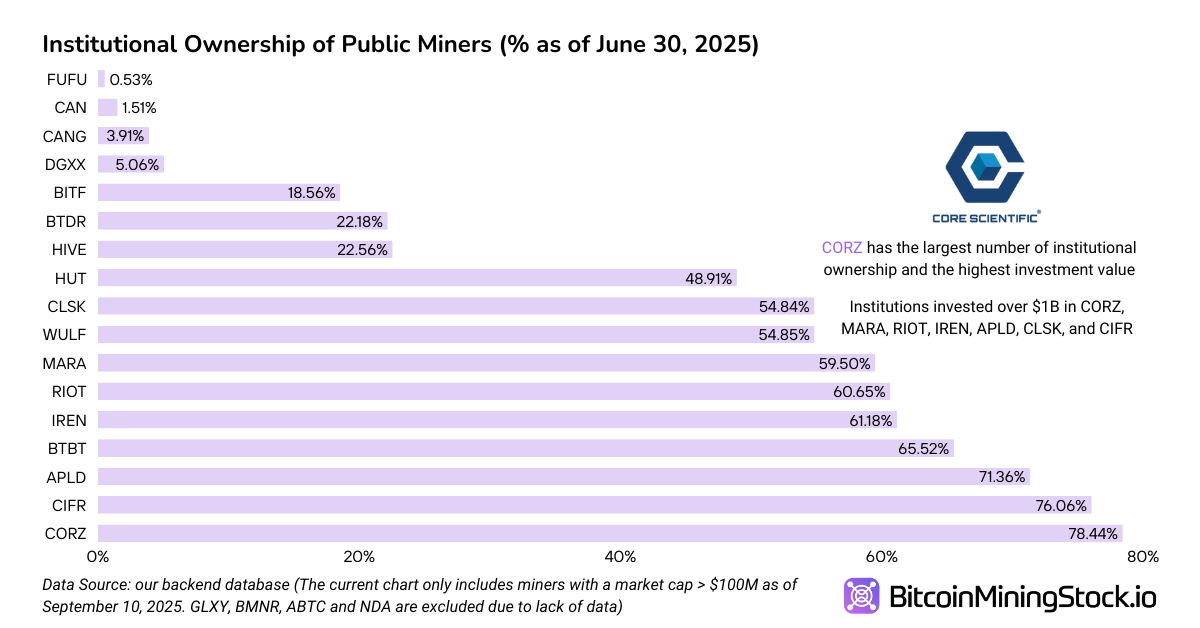

Looking at institutional ownership as a percentage of shares outstanding, a few patterns emerge.

- CORZ (78.44%), CIFR (76.06%), and APLD (71.36%) have the highest institutional penetration.

- Among smaller caps, BTBT is a standout with 65.52% institutional ownership.

- In contrast, BTDR, despite a market cap >$1B, only has 22.18% institutional ownership.

Generally, companies with larger market caps see stronger institutional participation. However, exceptions like BTBT and BTDR show how narrative and visibility matter just as much.

Notably, CIFR, BTBT, and IREN also showed the largest percentage increases in ownership in Q2 2025. All these three have leaned heavily into promoting their HPC/AI ambitions, and institutions have clearly responded.

So what’s changed, and what hasn’t

The latest data largely confirms what we proposed in the annual report: institutions have continued building exposure to the Bitcoin mining sector, but their capital is far from evenly distributed. Larger miners (by market cap) continue to attract the lion’s share of inflows, and within that group, preference is concentrated on companies with signed AI/HPC contracts or visible GPU deployment. That explains why IREN, CORZ, CIFR, and APLD led the field in both new institutional owners and fresh capital allocations.

MARA stands out as the exception. Without an HPC strategy, it has nevertheless held its place as the top non-HPC bet, driven by its largest hash rate and Bitcoin treasury in the sector. By contrast, smaller-cap names, those with no AI exposure, or companies headquartered outside the U.S. continue to struggle in gaining the same level of institutional trust.

Looking ahead, the focus shifts from positioning to delivery. For the HPC-exposed miners, the question is whether they can energize capacity, scale revenue, and hit contract milestones quickly enough to sustain institutional conviction. For the latecomers, the challenge is carving out a clear narrative and backing it up with hard numbers.

It’s also worth noting that companies with already high institutional ownership may begin to face limits simply because so much of their float is already institutionally held. Meanwhile, miners with lower institutional ownership but credible infrastructure and power capacity have room to re-rate if the right catalyst emerges. In other words, institutions have shown where their conviction lies, but the market remains fluid. Ultimately, execution will separate the leaders from the laggards in the quarters ahead.

Methodology & limitations

This update is based on our backend aggregation of the latest 13F filings, as of June 30, 2025. Figures reflect reported long equity positions by U.S. institutional filers and exclude derivatives, swaps, and most non-U.S. filers. Because 13Fs are backward-looking, the positions shown may differ significantly from where institutions stand at the time of writing.

Disclaimer: The views expressed in this article are my own and are based on publicly available information. This content is intended for informational purposes only and should not be construed as investment advice. Readers are encouraged to conduct their own research before making any investment decisions. Past performance is not indicative of future results. No recommendation or advice is being provided as to the suitability of any investment for any particular investor.