If you’re investing in Bitcoin mining stocks, you’ve probably had moments like this: your portfolio is in the red while someone else is bragging about their 3x gains. Or you’ve asked yourself whether you'd be better off just buying Bitcoin directly instead of picking individual miners.

I’ve been there too.

That’s why we launched the Bitcoin Mining Index at the start of this year. It is designed to be a clear and reliable way to track the overall performance of the public Bitcoin mining sector. Think of it like the S&P 500, but for bitcoin miners.

What Is the Bitcoin Mining Index?

It’s a market-cap-weighted benchmark of publicly listed Bitcoin mining companies, currently focused on U.S.-listed stocks only (excluding those listed on the OTC market). Companies included generate at least 10% of their revenue from Bitcoin mining. That way, the index stays relevant and doesn’t get diluted with unrelated businesses.

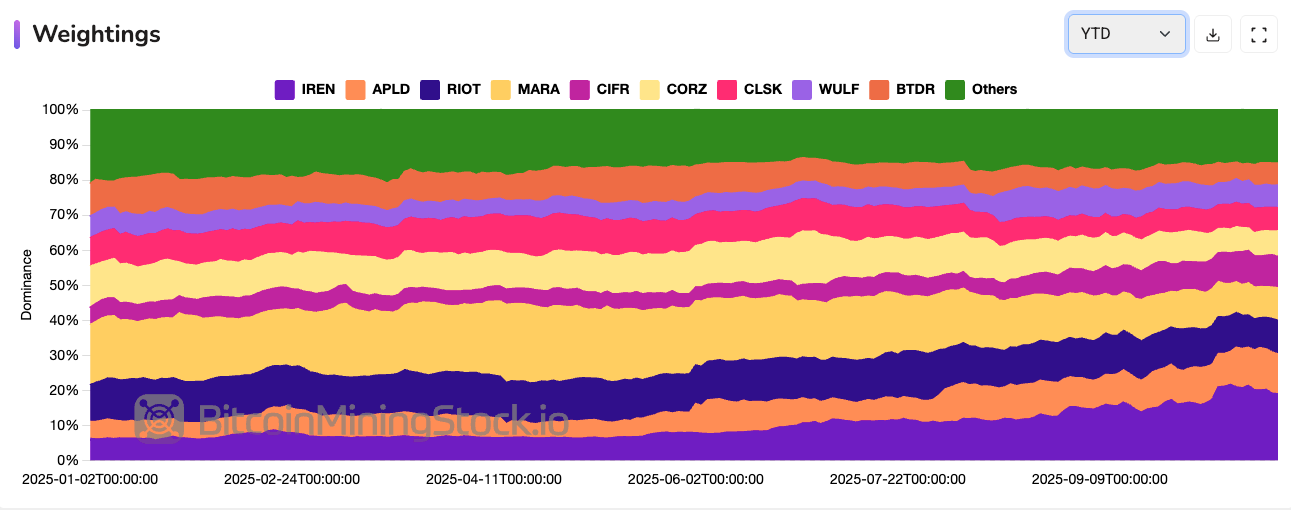

The constituent's weightings are updated every active trading day, based on market cap changes in relation to the combined market cap of all constituents. In some way, this becomes a live benchmark of how capital is moving through the sector.

And that helps.

If you're watching the weightings, you’ll notice how investor confidence shifts over time. When one miner gains share in the index, it usually means the market is rewarding something: a better growth story, stronger financials, or maybe a new narrative (such as HPC/AI data centers, energy infrastructure). When another drops in weighting, it's often a sign of fading sentiment.

These shifts tell a story no price chart alone can.

How You Use It

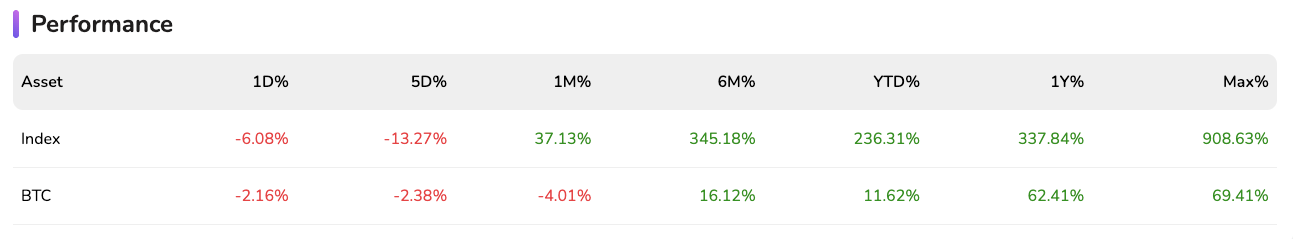

The most obvious use is to benchmark your portfolio. Are your mining stock picks outperforming the sector overall? Or are they lagging behind despite the whole sector going up? The index gives you a neutral reference point to answer that. As a result, you may consider adjusting your strategy accordingly.

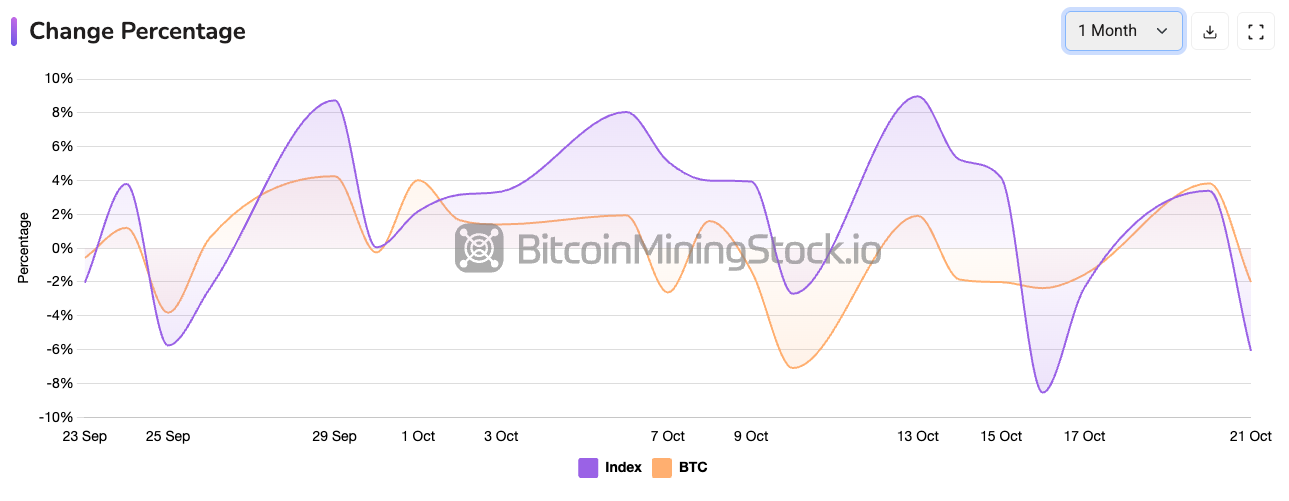

You can also compare it with Bitcoin itself. Bitcoin miners have historically offered a high beta to Bitcoin, does that fact still hold true in this ever-evolving industry? Data helps you determine whether the sector is still mirroring the movement of Bitcoin. So far, that’s still valid, just in a more volatile way.

The index can give you a read on market trends as well. You’ll notice when the mining stocks are in a bullish phase, going flat, or lagging behind. Especially when you compare it side-by-side with Bitcoin’s performance, you’ll be able to tell whether bitcoin mining stocks can be used as a leveraged Bitcoin play.

No more fragmented views or guesswork based on one or two names, this index gives you a way to zoom out and see the whole picture.

Backtesting Made Easy

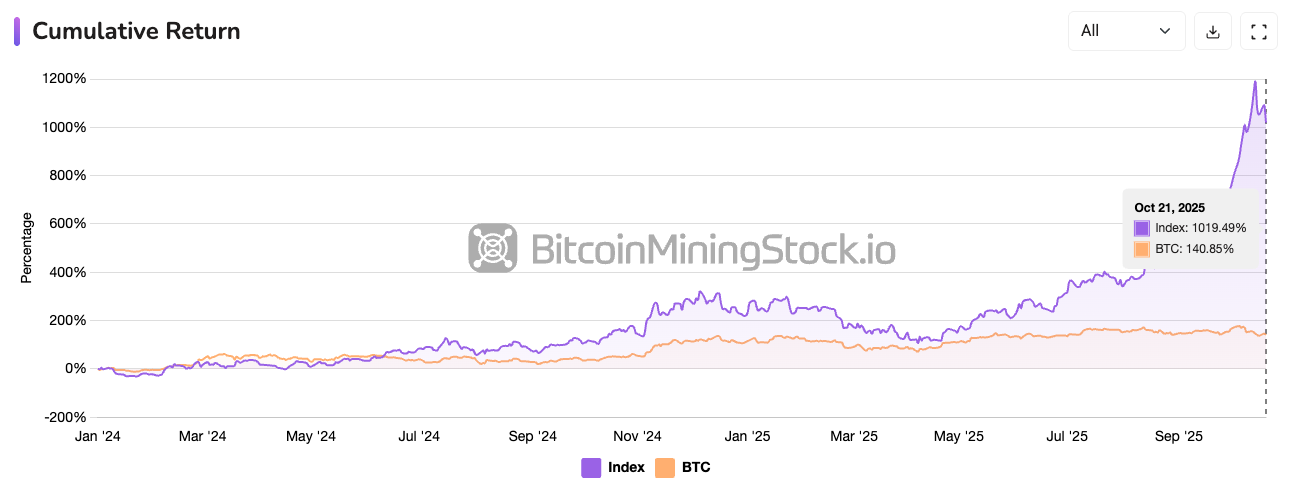

You can customize the index to your own use case. Pick your own group of miners and set a starting date. Simulate what would’ve happened if you allocated your portfolio across the sector on a specific timeframe. It’s not just historical data for the sake of it, you can actually test ideas and compare setups.

Sure, past performance is not indicative of future results, but when you see certain setups consistently outperform or certain miners gaining more weight in the index over time, it gives you real insights.

By default, tracking begins on Jan 3, 2024 (the first trading day in 2024). From this start date, the index has outperformed Bitcoin itself on the long time frame. While there’s no ETF that tracks it (yet), you can use it to alter your decisions, adjust your weightings, or spot early signs of market rotations.

We built this tool to be useful, not just another dashboard with pretty charts. Play around and hopefully, you can make the most of it for your own benefit.

BTW, if you have any feedback or feature suggestions, I’d love to hear them.

As always, thanks for being part of our journey! 🌻 💜