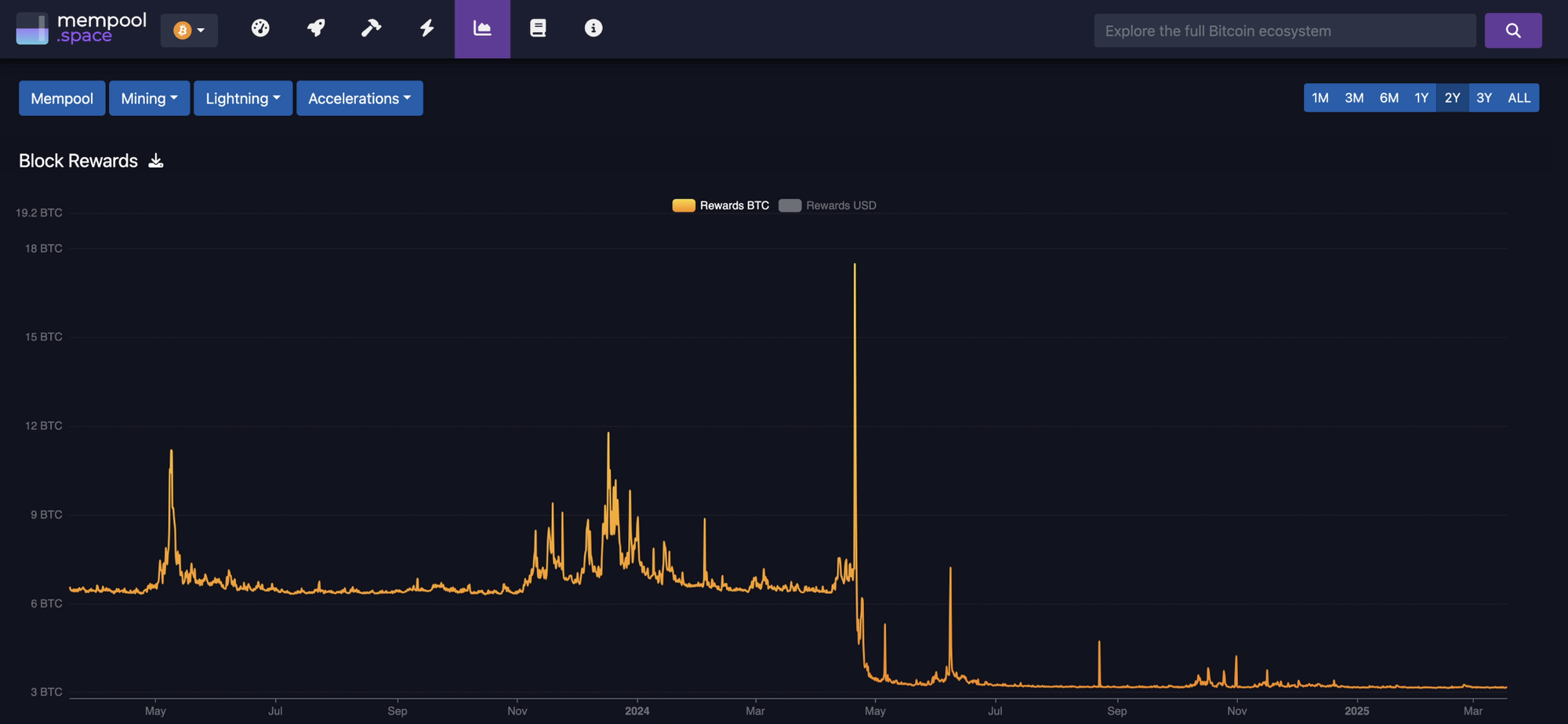

In past Bitcoin bull markets, mining stocks have been rewarding largely because miners can produce Bitcoin at a lower cost than the market price; effectively turning their hardware into money printers. However, the 2024 halving cut block rewards in half, forcing miners to adapt. While Bitcoin’s price has been making new all-time highs, returning miners to profitability, mining companies have begun establishing new business strategies and revenue streams to maintain profitability and stay competitive in this ever-changing landscape.

Exposure to Bitcoin

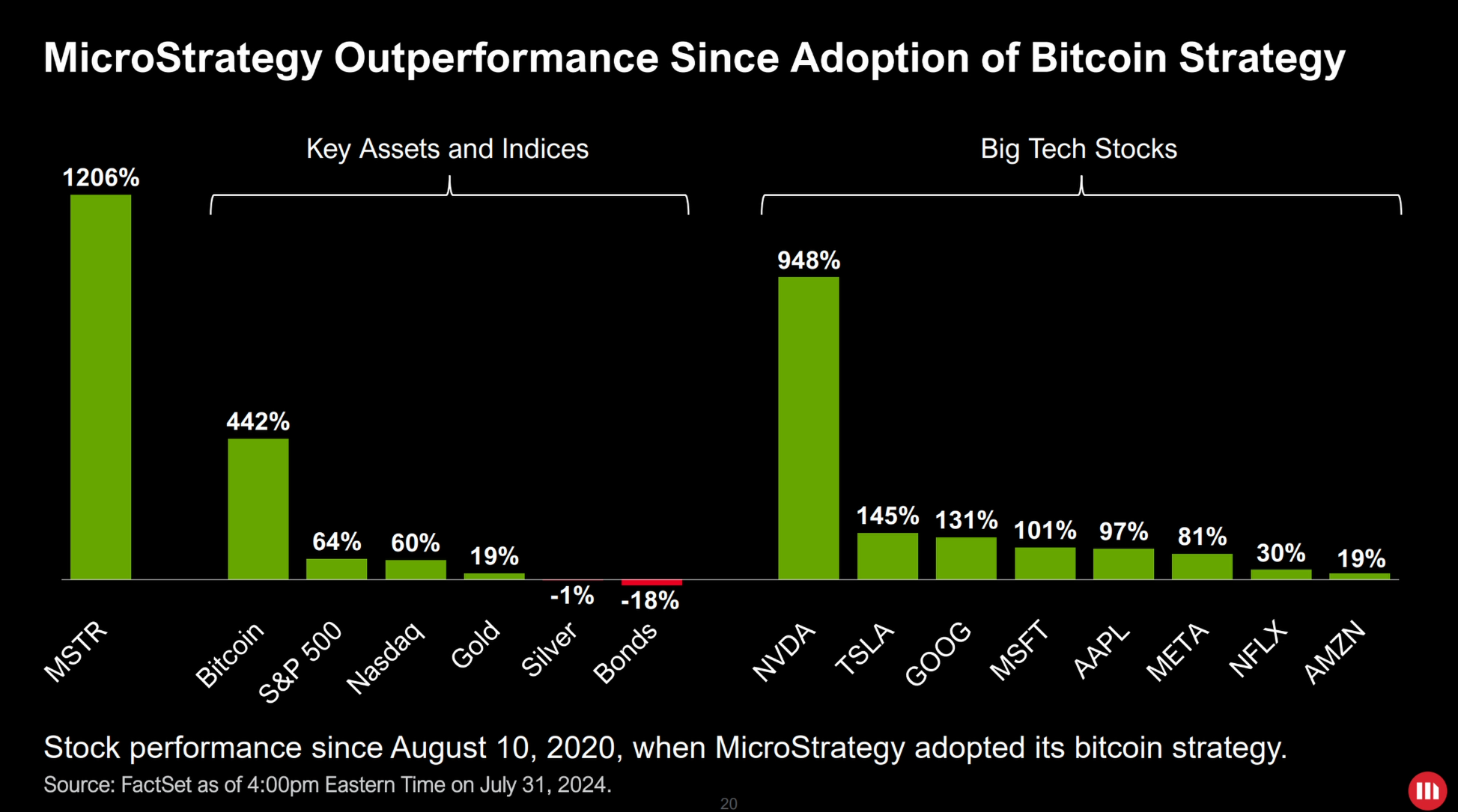

The first reason to buy Bitcoin mining stocks is that many of them have begun employing Bitcoin Treasury strategies, which involves accumulating Bitcoin on the company’s balance sheet. This was pioneered by Strategy whose stock, MSTR, has outperformed all major stocks, indices such as the S&P 500, bullion and even Bitcoin itself. This success is largely driven by Bitcoin’s impressive compounded annual growth rate (CAGR), which has consistently outpaced traditional assets over any four-year period. By adopting the Bitcoin Treasury strategy, companies aim to increase the number of satoshis held per share. This approach allows shareholders to gain indirect exposure to Bitcoin, effectively using the stock as a proxy for Bitcoin itself and increase their theoretical Bitcoin holdings over time with a form of yield.

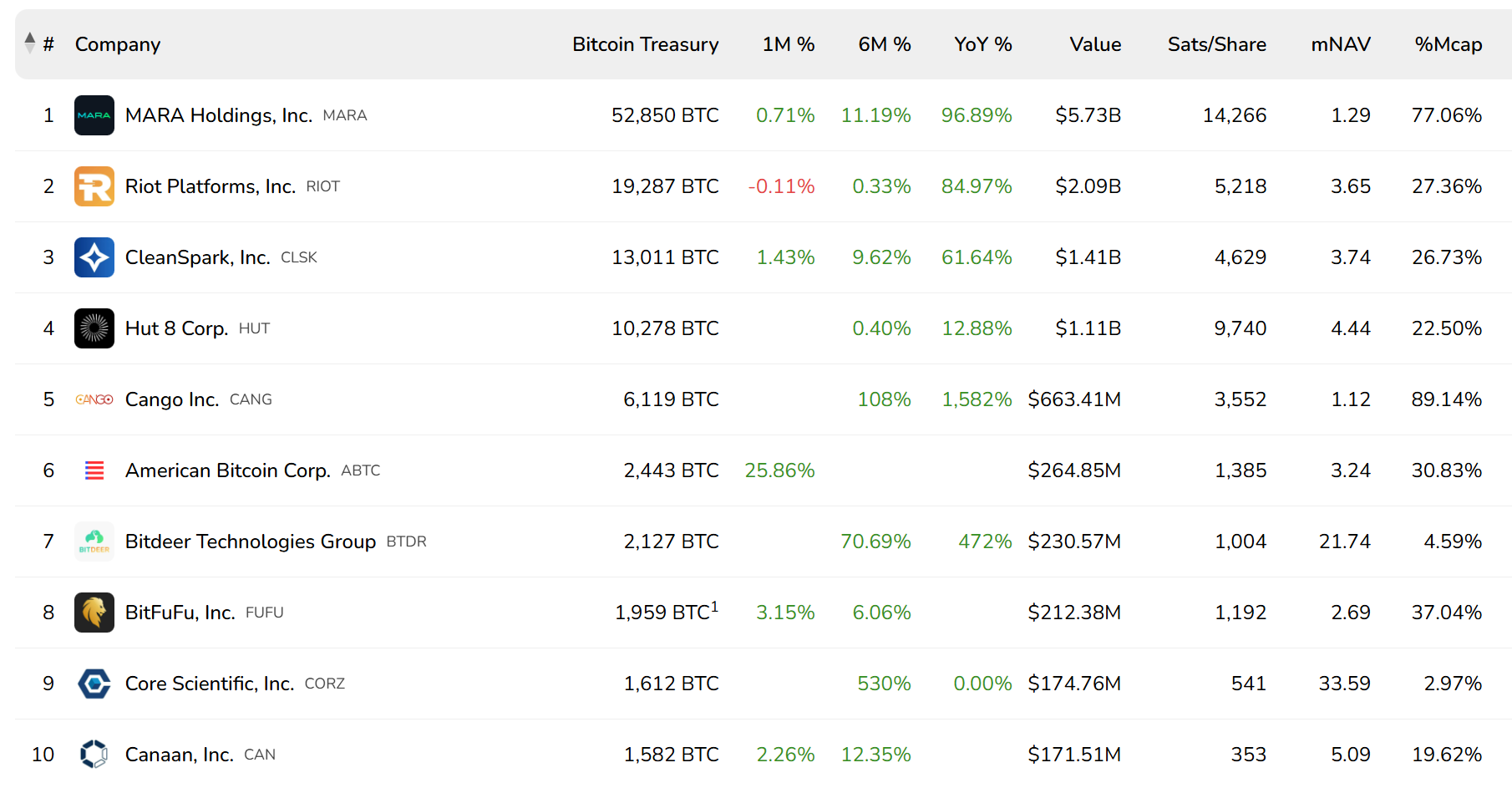

Other companies, both public and private, as well as major governments like the United States, are now following Strategy’s lead. Naturally, the Bitcoin mining sector has a high concentration of companies with Bitcoin treasuries, and in recent times, this strategy has become an even greater focus for many of them. Leading the pack is MARA Holdings, which has increased its Bitcoin treasury by 97% year over year, with its holdings now accounting for over 70% of its market cap. Not far behind are Riot Platforms and CleanSpark, which expanded their Bitcoin treasuries by 85% and 62% year over year, making up 26% and 22% of their market caps, respectively. If you’re bullish on Bitcoin Treasury strategies then Bitcoin miners with strong treasury growth may present a compelling opportunity for future stock appreciation if they follow MSTR’s playbook.

Exposure to AI

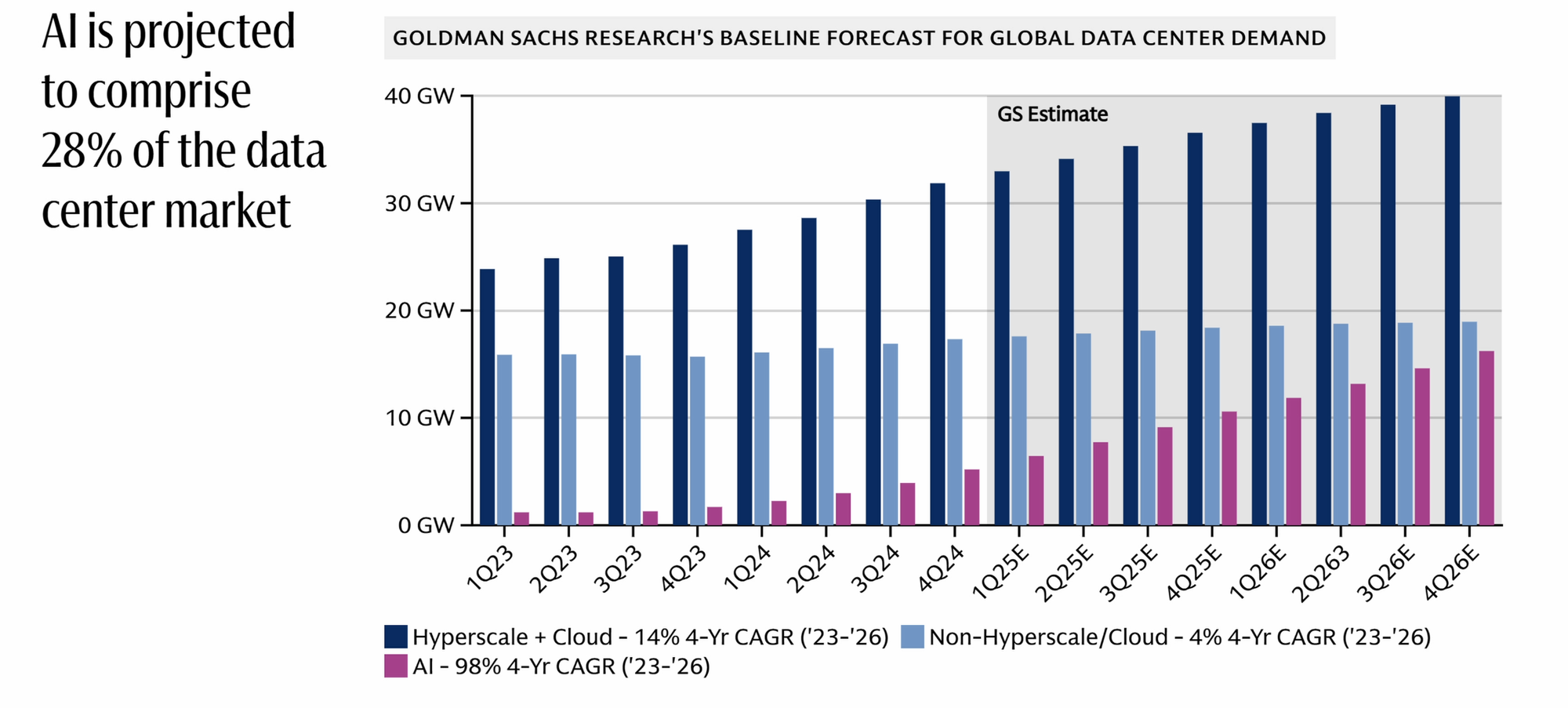

Another area where Bitcoin mining stocks are gaining exposure is artificial intelligence (AI). Since the launch of ChatGPT at the end of 2022, global interest in AI has skyrocketed, leading to a surge in investment that has further accelerated the sector’s growth. Companies like Nvidia, which supplies the hardware essential for high performance computing (HPC), have seen their stock prices soar. Alongside this boom, demand for data centers, which host HPC hardware and provide cloud resources for AI applications, has also surged. Bitcoin miners are already experts in building and operating high-efficiency data centers, precisely the type needed for AI workloads. Additionally, they have secured some of the cheapest large-scale power contracts, making them well-positioned to support the energy-intensive demands of AI data centers. Recognizing this opportunity, many miners have started diversifying by investing in AI infrastructure alongside their existing mining operations. This additional revenue stream provides a financial buffer during Bitcoin downturns, when mining profitability declines.

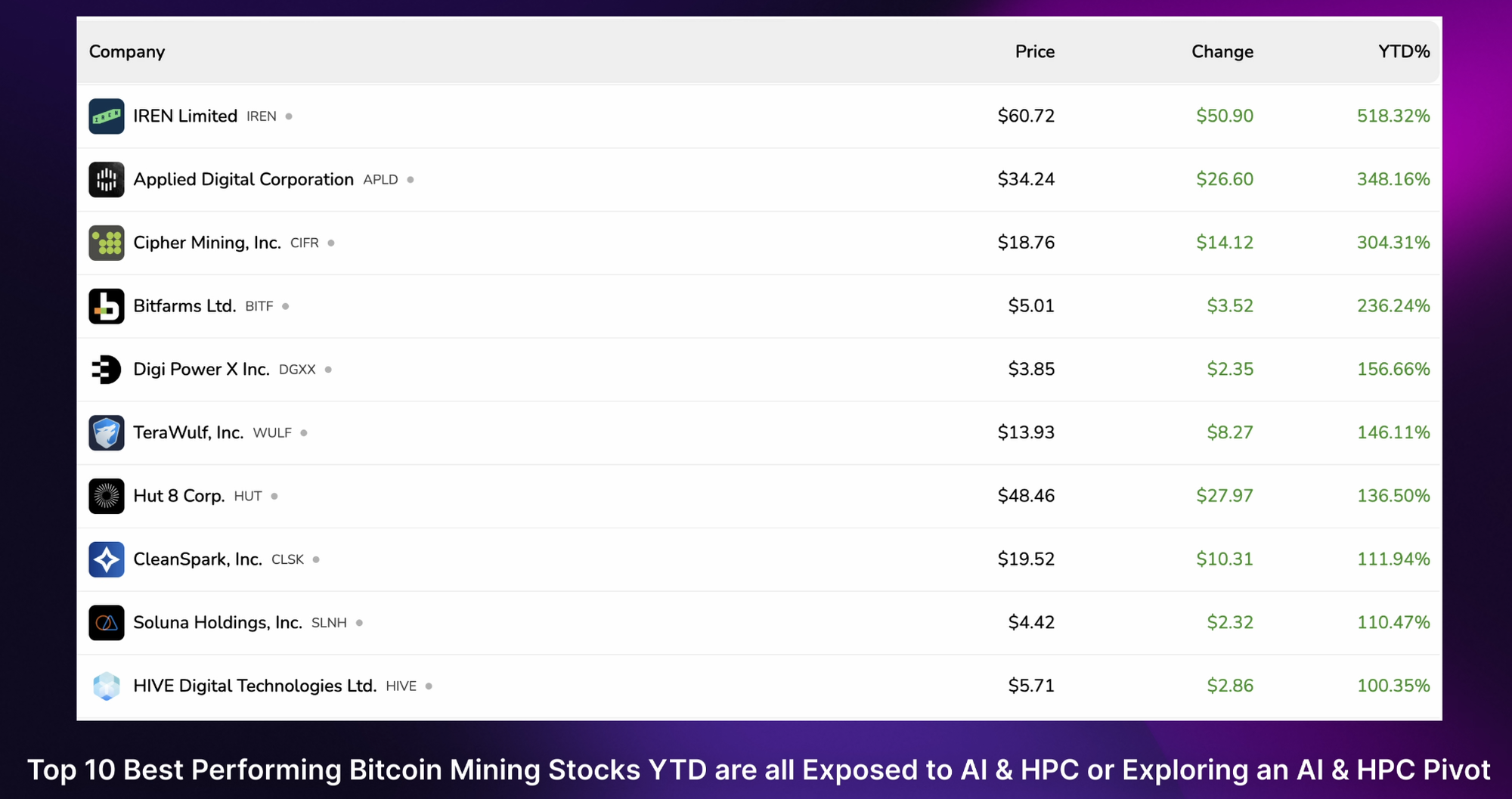

In the last year, these hybrid miners, companies that combine Bitcoin mining with AI and HPC services, have outperformed their Bitcoin-only counterparts. 16 out of the 34 companies we track now fall into this category, including notable players like IREN, Applied Digital, Cipher, Bitfarms and TeraWulf, which has all seen incredible stock gains year-to-date. This is largely due to AI and HPC revenue steadily becoming a larger share of these hybrid miners' total revenue. A deep dive into Bit Digital (BTBT) by my co-founder, Cindy Feng, last year revealed that HPC accounted for 43% of the company's total revenue in Q2 2024, while for others, it was 10% or less at the time. This trend is only accelerating, as companies race to secure contracts to provide AI hyperscaler infrastructure, and when these contracts are secured the share price has been known to surge. Some pure-play Bitcoin miners, like MARA, initially resisted jumping on the AI bandwagon. However, even they have now indicated plans to enter the HPC space, leaving them in catch-up mode compared to early adopters.

Greater Performance Than Bitcoin Itself

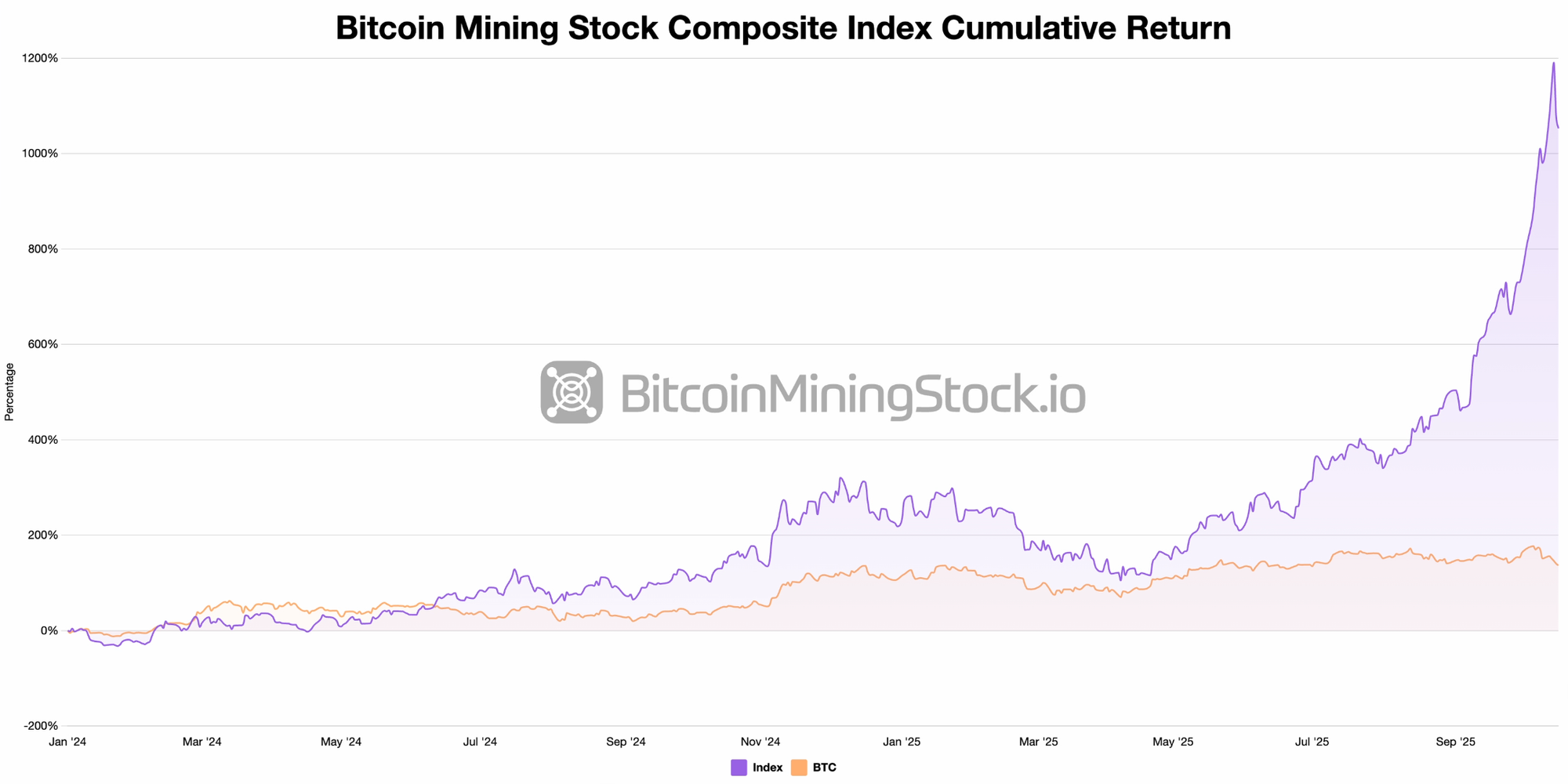

The final reason to pay attention to public Bitcoin miners is that, as a whole, they have delivered greater returns than Bitcoin itself. But how do I know this? To better benchmark the performance of Bitcoin mining stocks, we created our own composite index. This is a market cap-weighted index, meaning that each company's weight is determined by its market capitalization relative to the total market cap of all publicly traded U.S. Bitcoin miners included in the index. This methodology shows that, since the start of 2024, our index has delivered a cumulative return of 1200%, compared to Bitcoin’s 150% return. Additionally, this diversified basket of stocks has helped mitigate the impact of underperforming miners, as gains from high-performing companies have offset losses from weaker ones.

If I were investing in Bitcoin miners today, the strategy our Index employs would be an appealing way to enter the sector. It provides exposure to the entire industry rather than concentrating risk in just one or two companies. For those who prefer more control, the index also offers customization tools, allowing users to modify its constituents to match their preferences; effectively creating a personalized Bitcoin Mining Index. Additionally, if you want to back-test strategies, you can adjust the index’s starting date and compare its historical performance against Bitcoin based on your own custom settings.

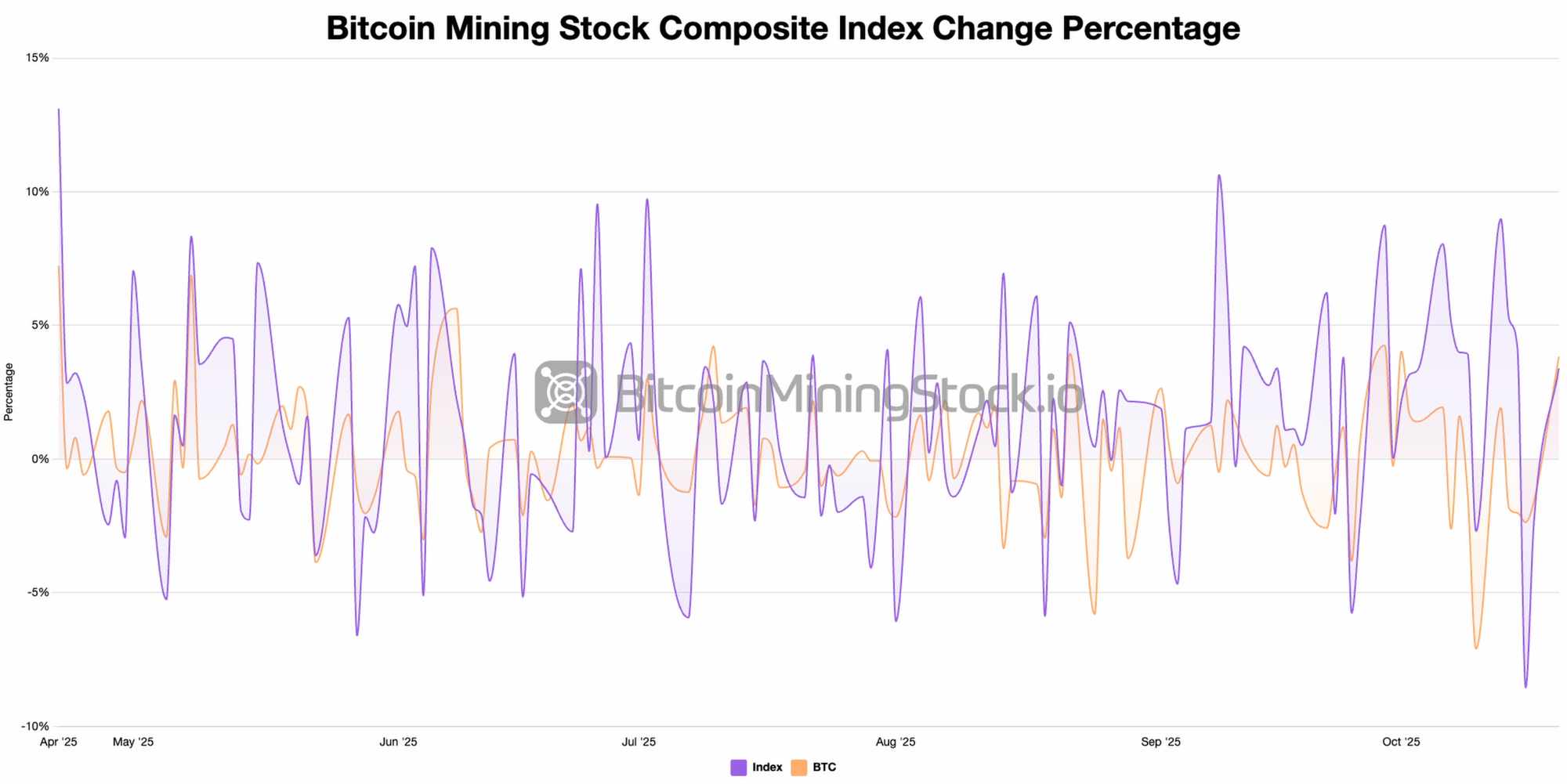

The Index chart clearly illustrates a strong correlation between Bitcoin price movements and Bitcoin mining stocks. When Bitcoin rises, mining stocks tend to rise as well, and when Bitcoin declines, they follow suit. If you’re bullish on Bitcoin, it’s reasonable to assume that miners, as a sector, will perform similarly. However, this relationship is a double-edged sword, offering high risk but also high reward. The percentage change tab further highlights this dynamic, showing the day-to-day volatility of both the Index and Bitcoin. On average, it seems mining stocks experience twice the volatility of Bitcoin. Therefore it’s crucial to follow basic investment principles, manage risk effectively, and conduct thorough due diligence before making any investment decisions.

Conclusion

Bitcoin mining stocks offer a unique mix of opportunities, from Bitcoin exposure through treasury strategies to diversification into AI, all while historically outperforming Bitcoin itself. As miners adapt to the post-halving landscape, those embracing innovative strategies are positioning themselves for long-term success. Staying ahead of market trends is crucial, and that’s where BitcoinMiningStock.io comes in. We provide comprehensive intelligence on Bitcoin mining stocks, including operational data and in-depth company insights; all in one place. Subscribe to our newsletter below to get exclusive Bitcoin mining stock insights delivered straight to your inbox.