October has been buzzing🐝🐝🐝

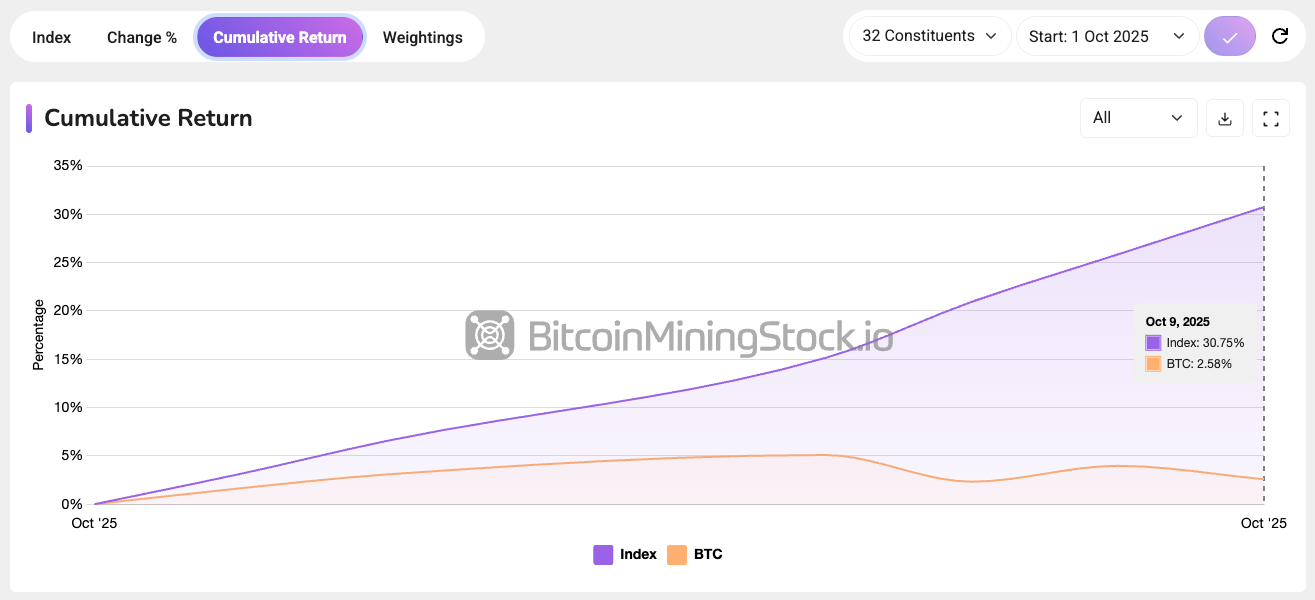

Bitcoin hit a new ATH of $126,080 on October 6th. Several Bitcoin mining stocks also broke their own records. Even our own Bitcoin Mining Stock Index, a hypothetical* market-cap-weighted tracker of the U.S.-listed miners, is up 30.75% since Oct 1, outperforming Bitcoin itself.

*There’s no ETF or fund tracking the Bitcoin Mining Stock Index yet, so any returns shown are hypothetical for illustrative purposes only. (Read more at the FAQ section)

No wonder people call it “Uptober”.

But truth be told, I’ve been feeling the opposite - incredibly flat this week. Just low energy. So instead of a deep-dive analysis, I’m sharing a brief observation that caught my attention.

MARA Sold Bitcoin for the First Time Since June 2024

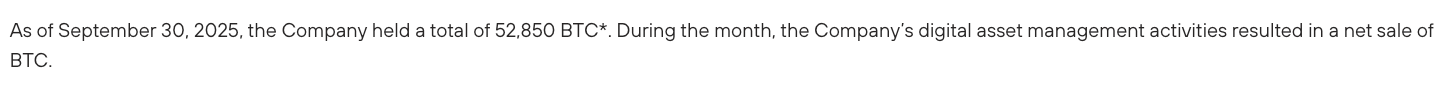

In MARA’s September operation update, the company disclosed that its “digital asset management activities resulted in a net sale of BTC”. No detail beyond that, no amount, no breakdown.

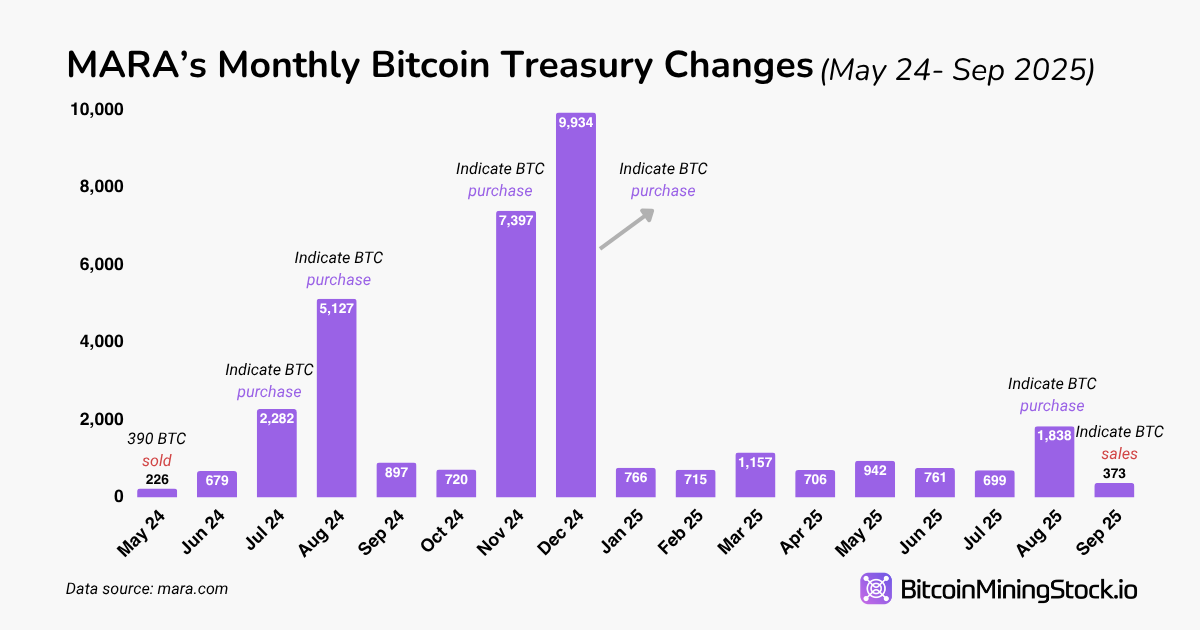

This is the first sale since June 2024.**

**Since June 2024, MARA consistently stated it had “opted not to sell any BTC,” or simply reported mining additions without any mention of sales, until the September 2025 update.

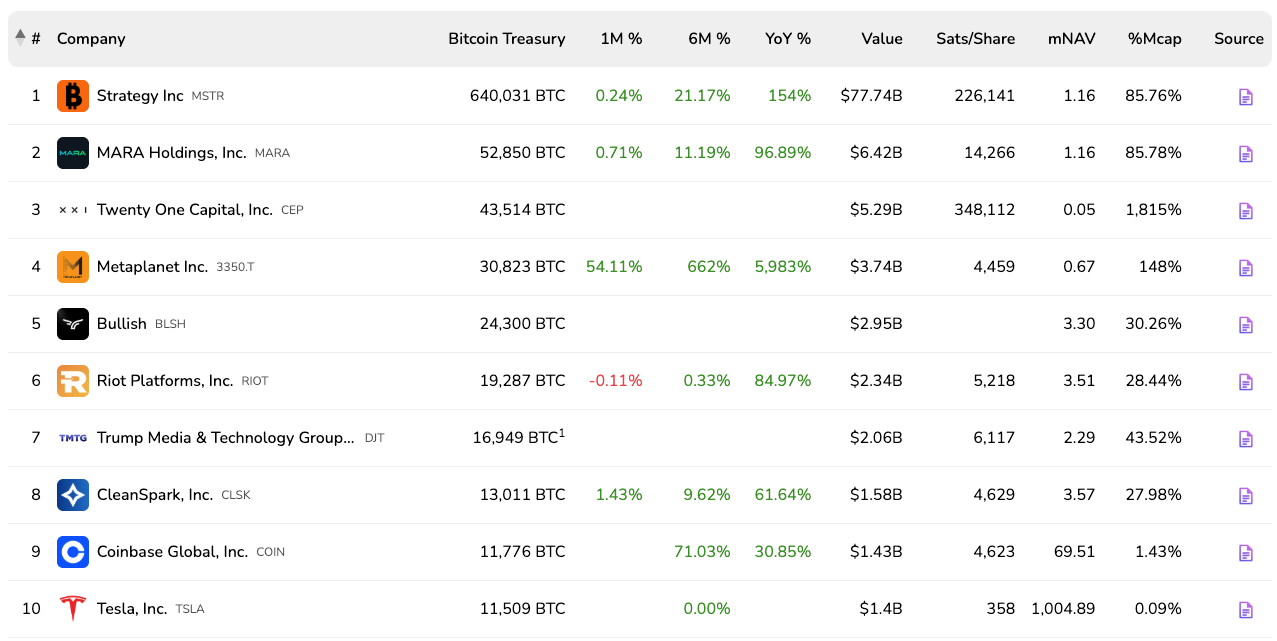

That said, their total holdings still increased to 52,850 BTC, up 373 BTC from August. So it's not a dramatic move and in context peers like Riot and CleanSpark have been regularly selling a portion of their mining production to fund operations.

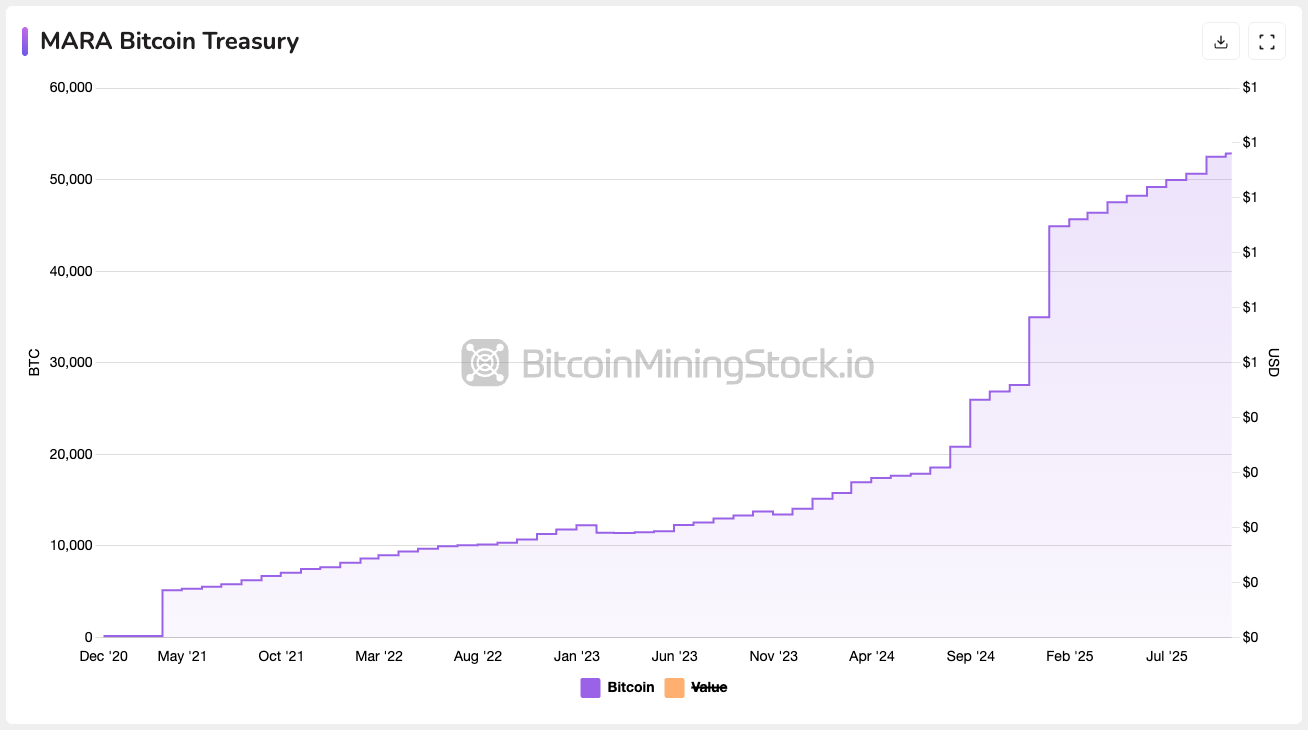

What makes MARA interesting is their position as the second-largest public holder of Bitcoin. Every action involving its treasury could signal a broader strategic shift - even if it's subtle. Treasury behavior isn't just about cash flow; it can reflect market views, liquidity management, or upcoming moves.

Last September, I talked about MARA’s accumulation strategy well before the "Bitcoin treasury" narrative gained momentum. Now, a sale however small raises new questions.

Is it a one-off opportunistic sale? A cash management move? A signal about market expectations? Too early to tell. But it's worth watching.

That’s all from me this week. No deep dive, just an observation that may prove meaningful in hindsight.

Wishing you a great weekend! ☀️

Disclaimer: The views expressed in this article are my own and are based on publicly available information. This content is intended for informational purposes only and should not be construed as investment advice. Readers are encouraged to conduct their own research before making any investment decisions. Past performance is not indicative of future results. No recommendation or advice is being provided as to the suitability of any investment for any particular investor.