Among all equity investments, Bitcoin mining stocks have emerged as a compelling option for investors seeking exposure to the digital asset ecosystem without directly holding Bitcoin. Over time, traditional investors including hedge funds and retail traders are increasingly turning to Bitcoin mining stocks for diversification, potential high returns tied to Bitcoin's performance, and the added upside from emerging trends like AI infrastructure pivots.

This guide breaks down everything you need to know about Bitcoin mining stocks, from definitions to evaluation tips, helping you navigate this sector with confidence.

What Are Bitcoin Mining Stocks?

At the most practical level, Bitcoin mining stocks are shares of publicly listed companies that generate a meaningful portion of their revenue from proof-of-work mining activities.

On our platform, Bitcoin mining stocks are defined as companies deriving at least 40% of revenue from Bitcoin mining-related operations (including hosting and equipment sales) and listed on major stock exchanges (excluding over-the-counter desks).

These companies operate vast networks of specialized hardware to validate transactions on the Bitcoin blockchain, earning newly minted Bitcoin as rewards. Unlike direct Bitcoin investments, mining stocks provide exposure through corporate structures, which can include dividends, stock buybacks, and operational efficiencies.

How to Evaluate a Bitcoin Mining Stock?

Evaluating Bitcoin mining stocks requires a mix of financial benchmarks and operational metrics. Here's a step-by-step guide to assess them effectively:

Financial Benchmarks: Look at revenue growth, EBITDA margins, and debt levels. Companies with strong balance sheets, like those holding significant Bitcoin treasuries, weather volatility better.

Operational Numbers: Help you stay grounded with this industry since bitcoin mining companies don't always have the best financial benchmarks. Some of industry specific metrics you can look at:

- Hash Rate: Measures computing power (e.g., in EH/s). Higher rates indicate scalability; top firms like IREN lead with efficient expansions.

- Bitcoin Production: Monthly output volumes directly tie to revenue.

- Treasury Holdings: Bitcoin held on the corporate balance sheet.

💡Use tools on our platform for charts and comparisons to benchmark against peers.

Emerging AI/HPC Trend: In 2025, many bitcoin mining companies established as AI data centers by using their power infrastructure, which in return got rewarded by the capital market. Companies landed multi-billion HPC/AI contracts were leading the annual performance, per our Bitcoin Mining Market Review (2025-2026 edition).

💡You can read more about the 2025 Bitcoin Mining Stock Performance here.

International Bitcoin Mining Companies

Even majority of Bitcoin mining stocks are traded in the U.S., not all of these companies are U.S.-based, which can affect valuation and trading behavior in ways investors overlook.

For those mining companies, they often file annual reports on Form 20-F and provide updates via Form 6-K. This matters because disclosure patterns can differ from U.S. domestic filers, and investors may need to rely more on press releases and furnished reports for operational updates.

💡 You can visit News for the latest company updates; Alternatively, follow us on X or Telegram for notifications.

Foreign entities can also influence investor base (some funds have mandates that limit foreign exposure), and sometimes introduces extra layers of perceived jurisdiction or governance risk.

As of January 2026, the following bitcoin mining companies with market cap> $50M are not headquartered in the U.S.: Bitdeer, Bitfarms, Northern Data, Hive Digital, Cango, BitFuFu, Canaan, Neptune Digital Assets.

Bitcoin Mining Stocks vs. Bitcoin

Bitcoin mining stocks are treated as a proxy for Bitcoin, because they generally move in the same direction as Bitcoin's price based on the past performance.

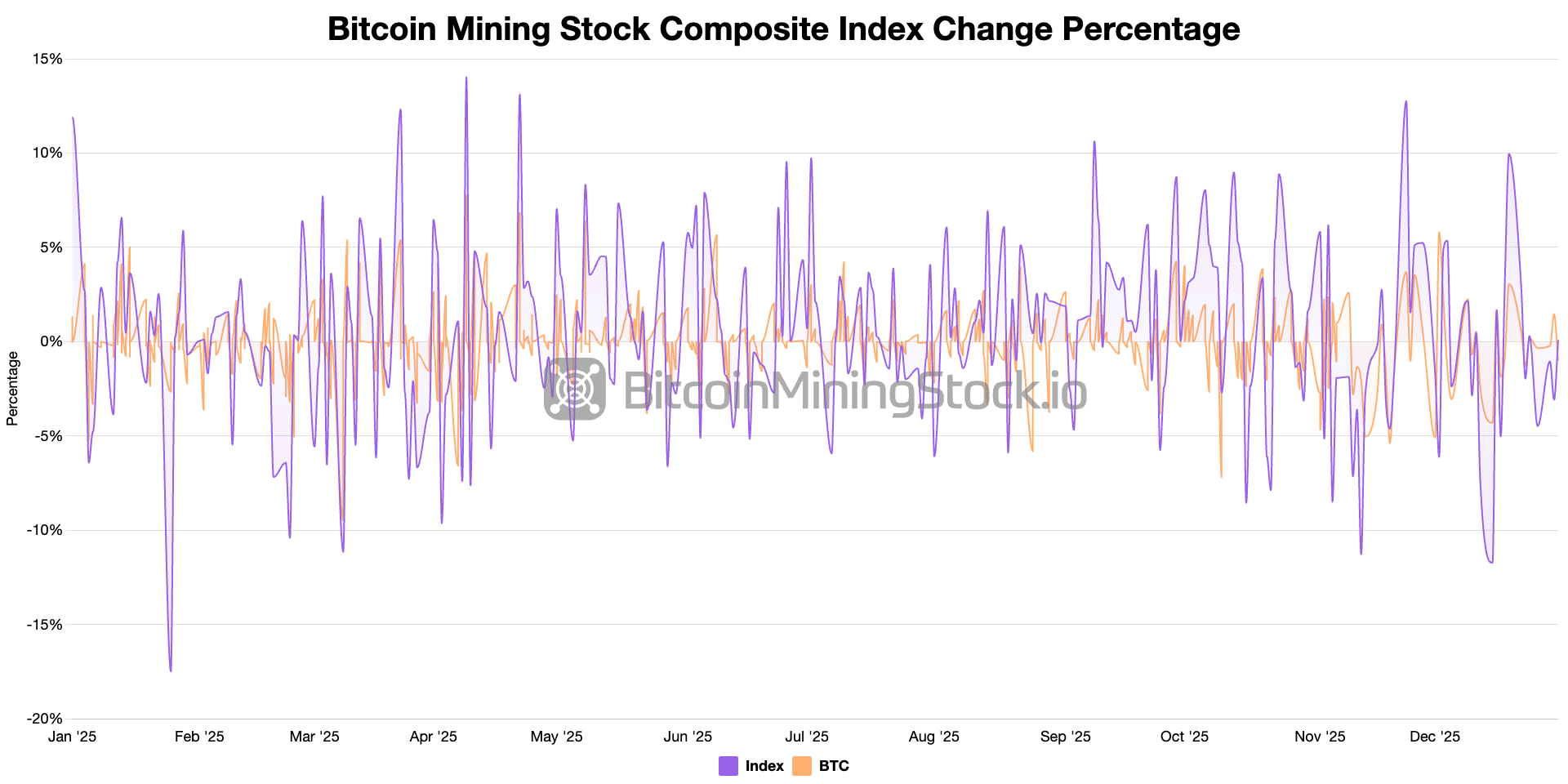

Our Composite Index is a market-cap weighted benchmark of major U.S.-listed miners, to help investors monitor the movement of bitcoin mining stocks against Bitcoin. Looking at the historical patterns, Bitcoin mining stocks generally move in the same direction as Bitcoin's price but exhibit significantly higher volatility, amplifying both gains and losses.

However, an individual mining stock may not mirror the movement of Bitcoin price due to numerous company-specific factors, such as management decisions, energy costs, debt levels, and pivots to non-mining revenue like AI/HPC.

Bitcoin Mining ETFs

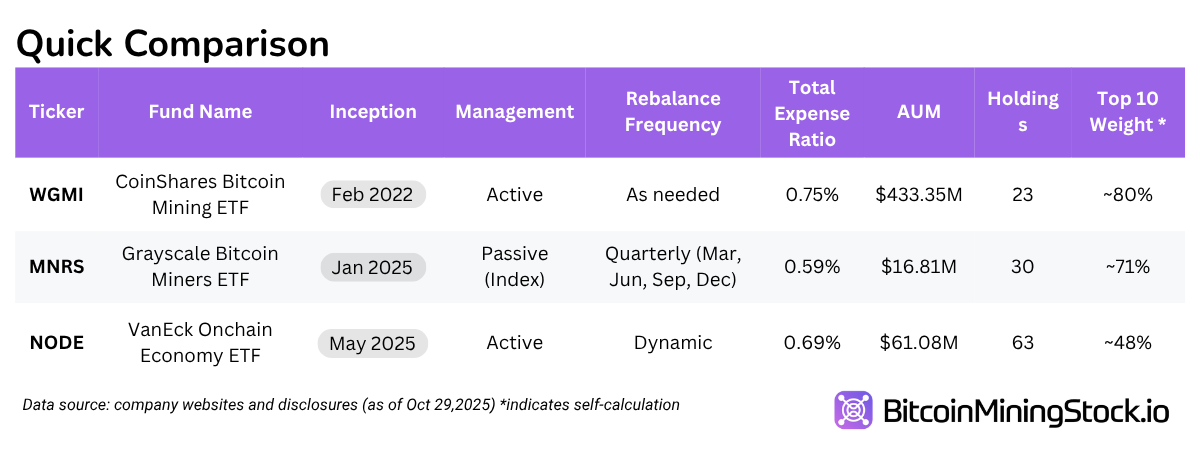

For those preferring diversified exposure without picking individual stocks, Bitcoin mining ETFs offer a convenient entry. These funds track baskets of mining companies, reducing single-stock risk. As of January 2026, major Bitcoin mining ETFs include:

- Valkyrie Bitcoin Miners ETF (WGMI) is an actively managed fund that focuses on public Bitcoin miners (≥ 50% revenue/profits from Bitcoin mining operations) and supporting infrastructure (companies providing specialized chips, hardware, software, or other services to Bitcoin mining companies).

- Grayscale Bitcoin Miners ETF (MNRS) offers passive exposure to the Bitcoin miners and the Bitcoin mining ecosystem by tracking the Bitcoin Miners Index. The index applies quantitative screens to select constituents, with criteria based on pure-play (≥50% revenue from mining), market capitalization (≥$50 million), and liquidity.

Other options like VanEck Onchain Economy ETF (NODE) is actively managed and takes a broader approach than its peers. While not explicitly a Bitcoin mining ETF, 80% of NODE’s top 10 holdings are public Bitcoin miners, making it a meaningful proxy for sector exposure within a diversified crypto equity portfolio. These ETFs saw inflows in 2025 and are projected to grow further by year-end 2026, making them ideal for passive investors.

💡You can read this if you want to learn more difference among WGMI, MNRS and NODE.

Risks & Challenges of Bitcoin Mining Stocks

Investing in Bitcoin mining stocks comes with significant risks, amplified in 2026 by market maturity and external pressures:

- Volatility Tied to Bitcoin Price: Stocks often amplify Bitcoin's swings; a potential 2026 correction could lead to sharp declines.

- Operational Challenges: Rising energy costs, mining difficulty (hitting records in 2025), and equipment depreciation erode margins. Payback periods now exceed 1,000 days for some setups.

- AI Pivot Risks: While diversification into AI/HPC is promising, it diverts resources from core mining and exposes companies to new competition and tech bubbles.

- Regulatory and Environmental Concerns: Global regulations on energy use and carbon emissions could increase costs, especially for non-renewable operators. Geopolitical risks, like those affecting international firms, add uncertainty.

- Debt and Cash Flow Issues: Many miners carry high debt from expansions, risking defaults if Bitcoin prices decline significantly.

Disclaimer: This article is provided for informational and educational purposes only and does not constitute financial, investment, legal, accounting, or tax advice. Nothing on BitcoinMiningStock.io is a recommendation, offer, or solicitation to buy or sell any security, digital asset, or financial product. Investing in Bitcoin mining stocks and digital-asset equities involves significant risk and may result in the loss of principal. Past performance is not indicative of future results. You should conduct your own research and consult a licensed financial adviser before making any investment decisions.