Nvidia’s market cap briefly reached $4 trillion—becoming the first U.S. company to hit that milestone. That’s more than the entire stock markets of countries like Canada, the U.K., France, and Germany. A decade ago, it was a penny stock. What an interesting time we are living in!

Index Update

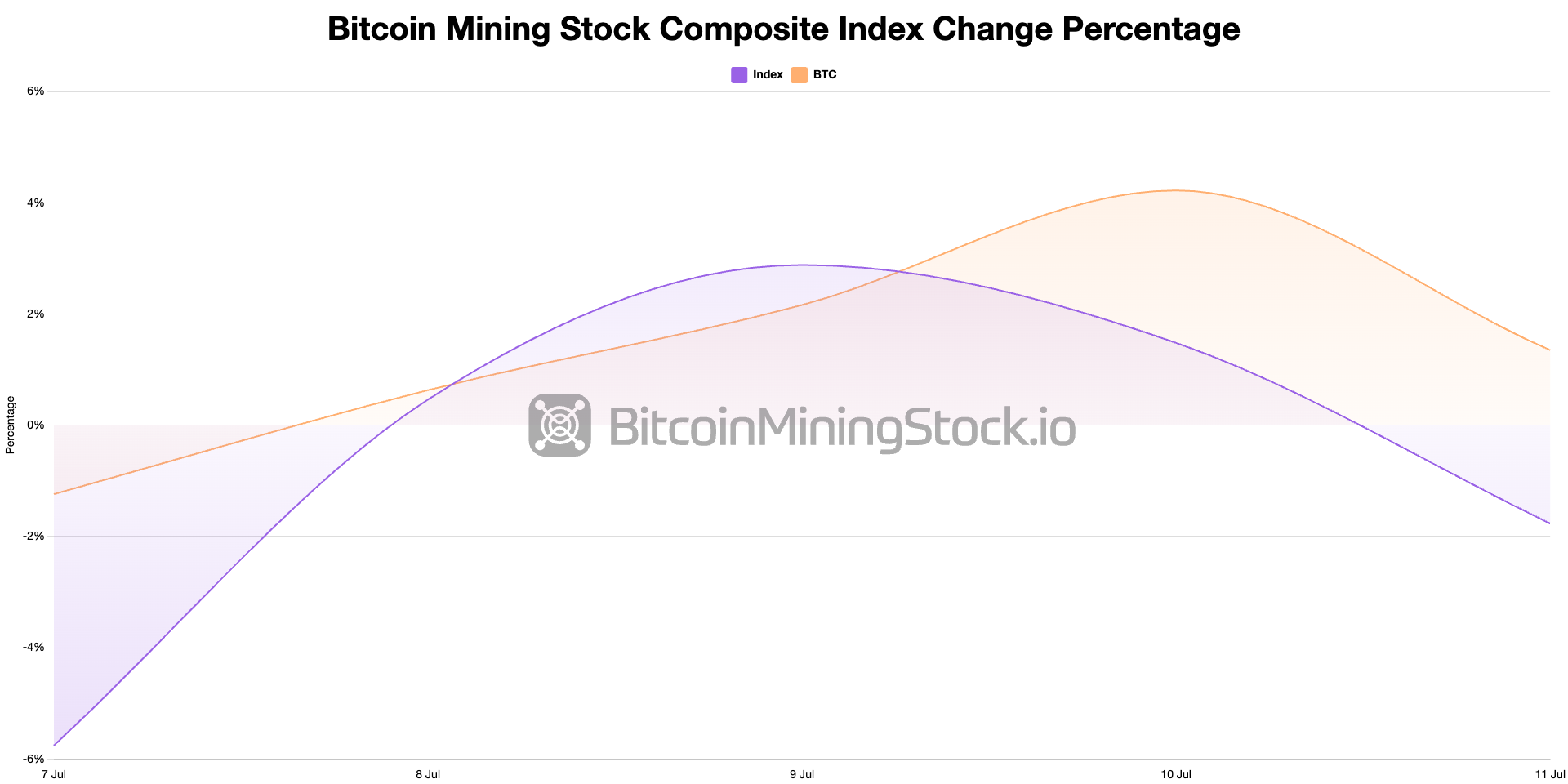

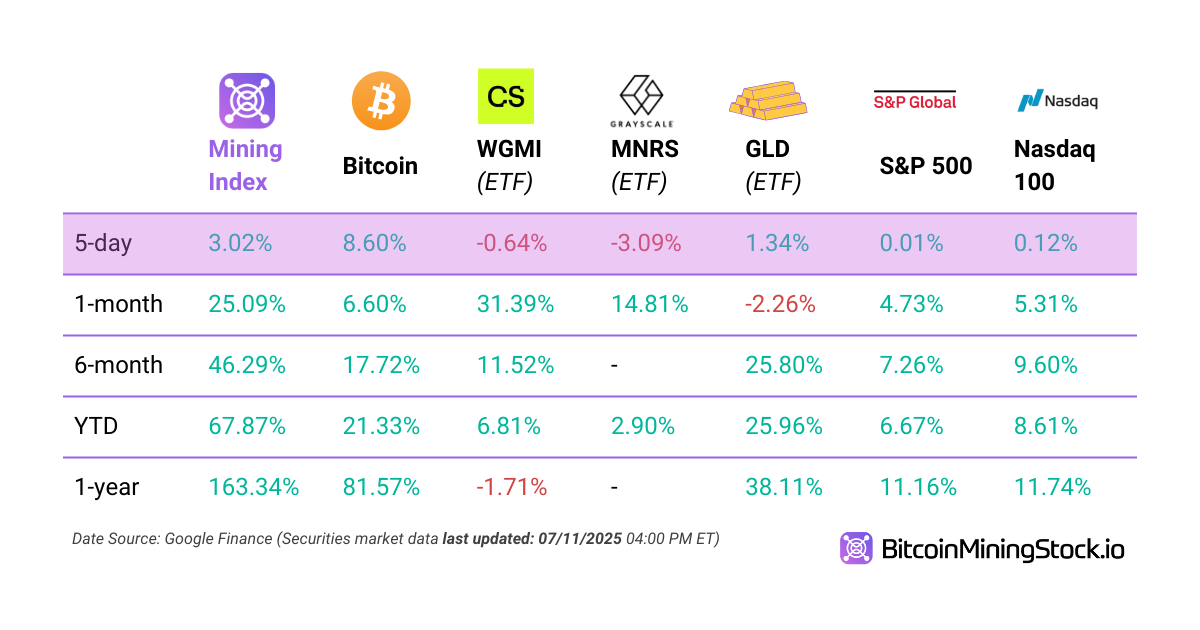

5-D Volatility: Overall, Bitcoin mining stocks tracked Bitcoin’s volatility throughout last week. Here’s how they performed compared to other major stocks 👇👇

Major Company Updates

- Cathedra Bitcoin announces leadership transition (link)

- HIVE Digital Technologies exceeds 12 EH/s milestone, achieves $250 million annual run rate revenue as Paraguay expansion progresses (link)

- MARA appoints Nir Rikovitch as chief product officer (link)

- BitFuFu reaffirms commitment to sustainable and efficient Bitcoin mining in 2025 (link)

- Soluna fills rack capacity at Dorothy 2 with 30 MW expansion with top-tier Bitcoin miner (link)

- Bit Digital shifts entire treasury to Ethereum, becomes one of the largest ETH holders among public companies (link)

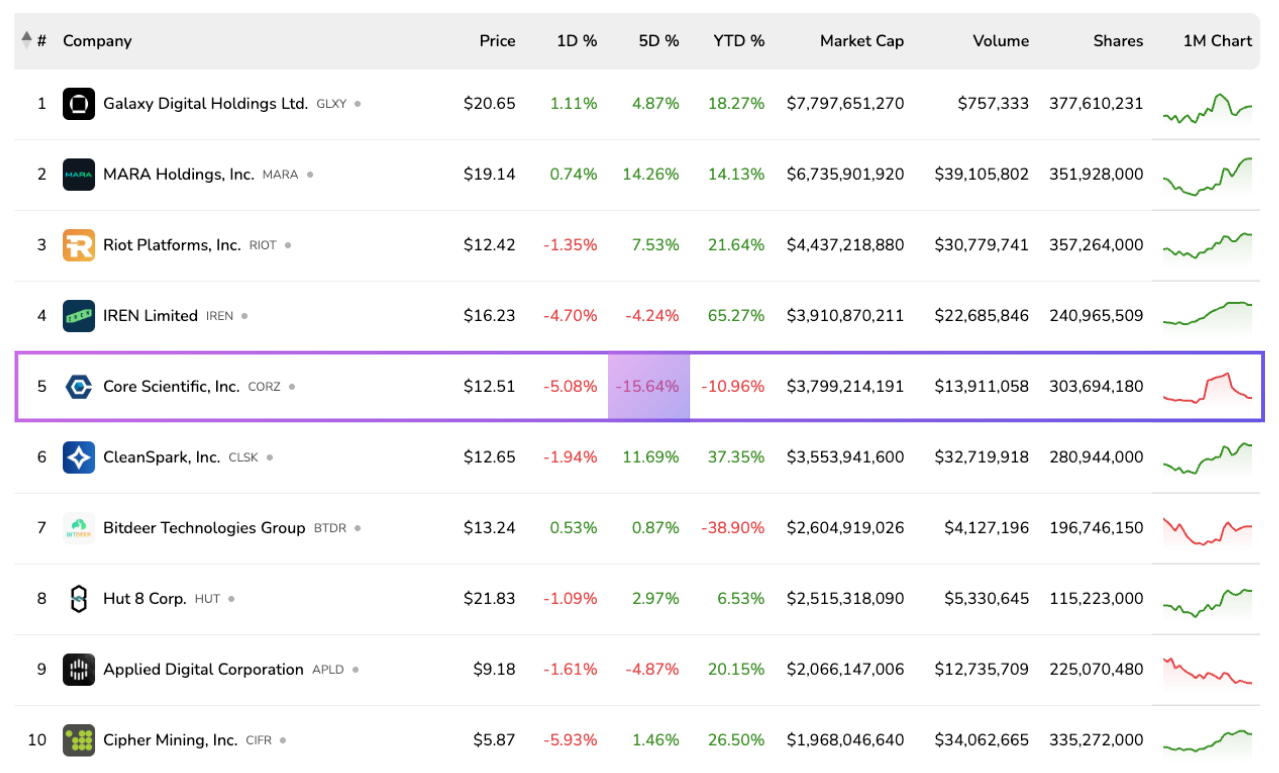

Must Read: CoreWeave to acquire Core Scientific (link)

What Happened: On July 3, 2025, CoreWeave (NASDAQ: CRWV) announced a definitive all-stock agreement to acquire Core Scientific (NASDAQ: CORZ), with shareholders of Core Scientific receiving 0.1235 CoreWeave shares per CORZ share. Valued at approximately $9 billion, the deal is expected to close in Q4 2025, pending regulatory and shareholder approval.

Cindy's Thoughts: The announcement sent a ripple through the market, prompting many investors to hit the "sell" button—reflected clearly in CORZ's share price drop. For CRWV investors, however, the news signals a strong strategic move: the acquisition enhances vertical integration, significantly cuts lease overhead, and positions the company for improved cost efficiency. From perspectives of CORZ’s investors, though, the deal may not appear as favorable. I’ve shared a brief analysis here that breaks it down. Interestingly, several Wall Street analysts have also downgraded CORZ.

Curious to hear your thoughts—how do you see this deal playing out for both sides?

That’s all for this week! Feel free to drop us a message if you have any suggestions, feedback, or just want to say hi.

Thanks for being part of our journey-see you next week!

Cindy & the BMS Team 💜