About: Cango Inc. (NYSE: CANG) is primarily engaged in the Bitcoin mining business, with operations strategically deployed across North America, the Middle East, South America, and East Africa. For more information, please visit: ir.cangoonline.com.

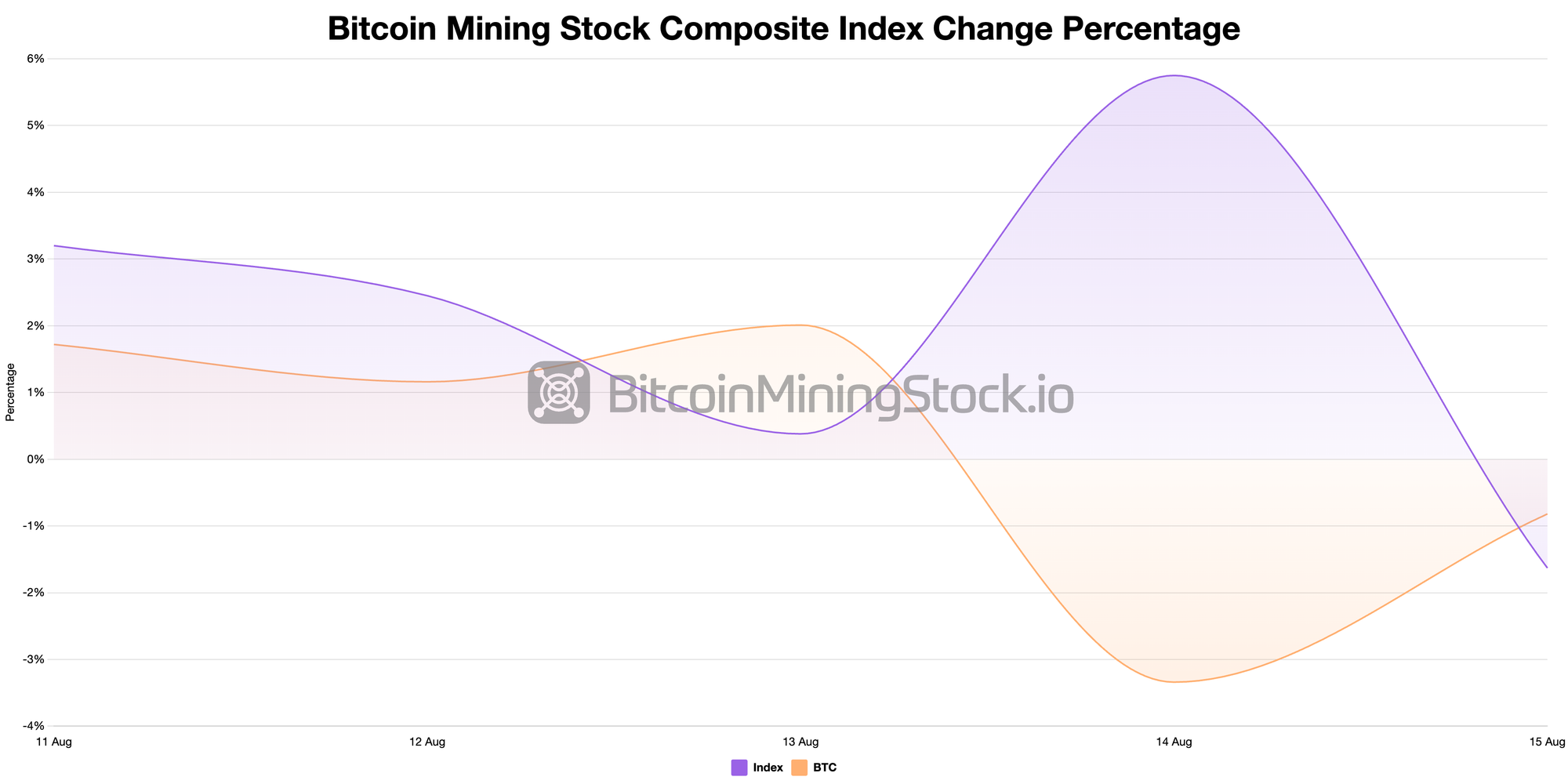

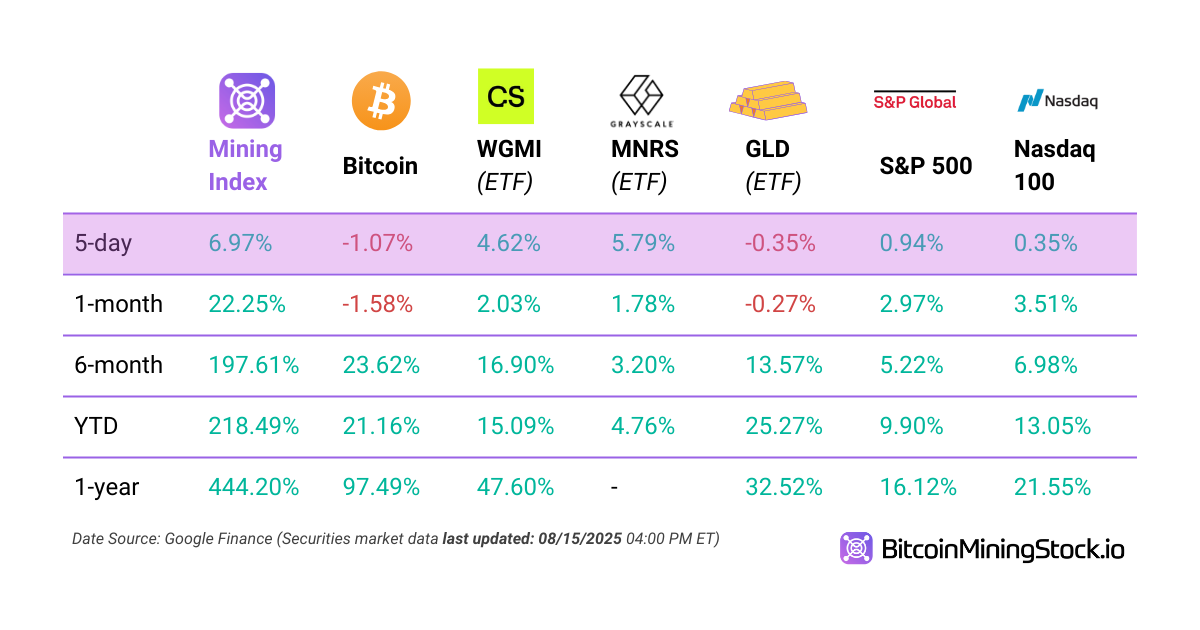

Index Update

5-D Volatility: Bitcoin mining stocks move more erratically compared to Bitcoin itself. Here’s how they performed compared to other major stocks 👇👇

Major Company Updates

- Cango Inc. acquires 50 MW Bitcoin mining facility in Georgia, laying groundwork for future energy strategy (link)

- Northern Data Group has been informed of a potential exchange offer to its shareholders by Rumble Inc. (link)

- CleanSpark appoints Matt Schultz CEO (link)

- BitMine Immersion (BMNR) ETH holdings exceed 1.15 million tokens, valued in excess of $4.96 billion, and largest ETH treasury in world (link)

- MARA and EDF Pulse Ventures sign investment agreement in subsidiary Exaion to expand MARA’s global AI/HPC capabilities (link)

- Soluna expands partnership with Galaxy Digital to deploy 48 MW at Project Kati (link)

- Bit Origin surpasses 70 million Dogecoin (DOGE) holdings following private placement (link)

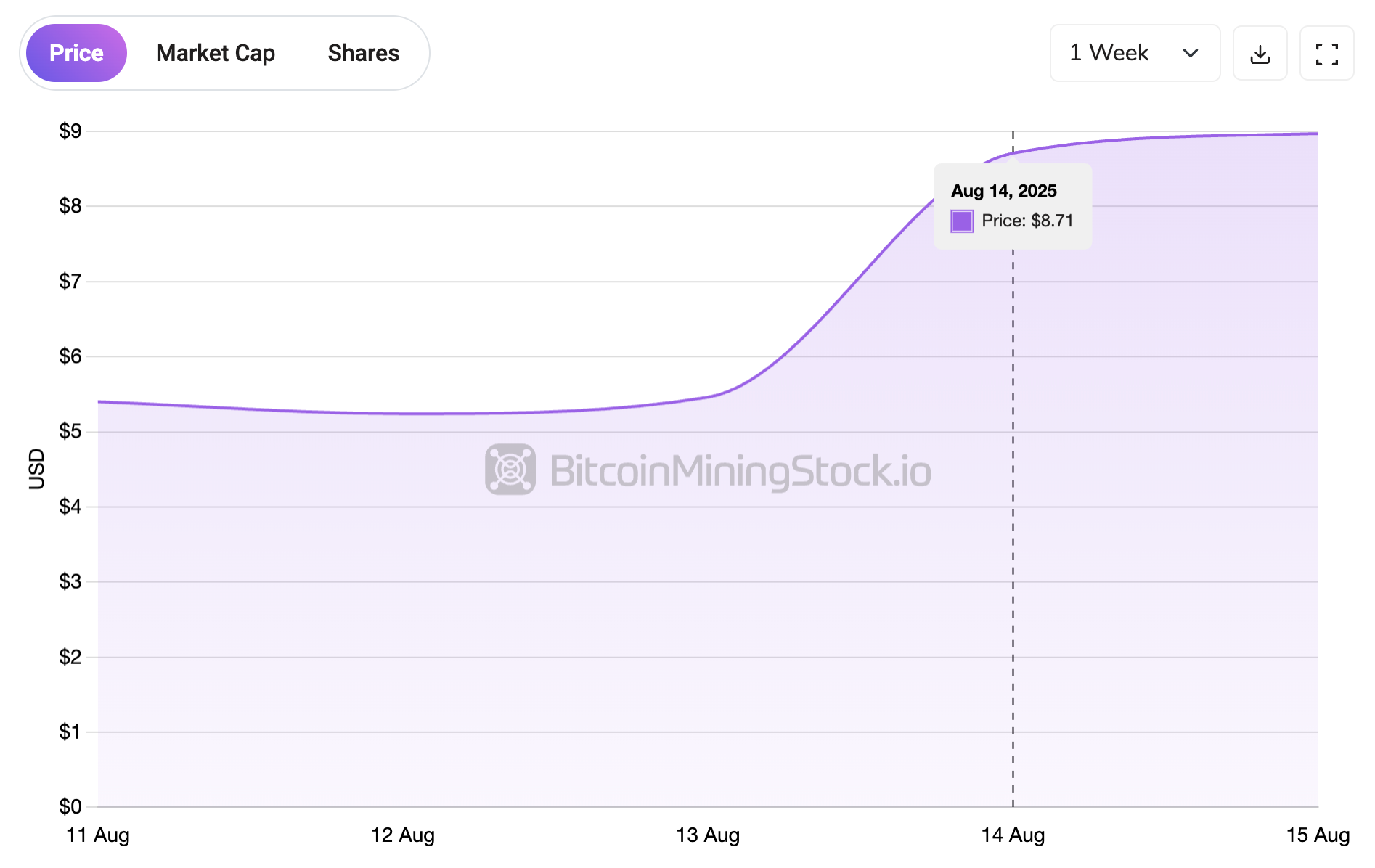

Must Read: TeraWulf signs 200+ MW, 10-year AI hosting agreements with Fluidstack (link)

What happened: On August 14, 2025, TeraWulf signed two 10-year AI hosting agreements with Fluidstack to deploy over 200 MW of critical IT load at its Lake Mariner campus. The contracts total $3.7 billion in revenue, with options extending it to $8.7 billion. Google is backing $1.8 billion of Fluidstack’s lease obligations and will receive ~8% equity in TeraWulf via warrants. Initial deployment of 40 MW is expected in H1 2026, with full capacity online by year-end.

Cindy's Thoughts: TeraWulf’s HPC hosting deal is one of the most significant we’ve seen among Bitcoin miners- on par with Core Scientific’s. It stands out in both scale and economics, and it’s no surprise the market responded strongly.

What I respect is that WULF got this done without much speculative noise. It just executed. That’s one reason I highlighted their management last year. Hopefully, this opens the door for more miners to land meaningful AI/HPC partnerships.

That’s all for this week! Feel free to drop us a message if you have any suggestions, feedback, or just want to say hi.

Thanks for being part of our journey - see you next week!

Cindy & the BMS Team 💜