This year, the market trend around Bitcoin miners has shifted toward HPC/AI narratives. A growing number of pubcos have embraced the AI/HPC pivot, and the market has rewarded these hybrid miners handsomely with soaring share prices, irrespective of whether they have secured clients or simply diversified their infrastructure footprint.

Meanwhile, pure-play Bitcoin miners have largely underperformed, often posting negative YTD returns. The reason might be simple: investors are in favor of predictable and recurring large revenues. The market now sees traditional Bitcoin mining as riskier, tied to volatile BTC pricing, and structurally disadvantaged compared to the HPC infrastructure play. This valuation gap is real.

But what if a company can build a recurring, cash-generative engine from Bitcoin mining itself?

BitFuFu’s Model: Recurring Revenue Built on Bitcoin Mining

BitFuFu may not yet have an HPC narrative, but it has something functionally similar: a predictable recurring revenue engine powered by cloud mining.

Unlike traditional Bitcoin miners who bear the full cost of infrastructure and are directly exposed to Bitcoin’s price swings, cloud mining service providers have a different model. Through prepaid cloud mining contracts, companies sell access to their hash rate in advance. This setup brings in revenue upfront, limits the company’s Bitcoin price exposure, and reduces the capital needed for buildout. As a result, service providers benefit from more predictable revenues and can scale their operations in a more capital-efficient way.

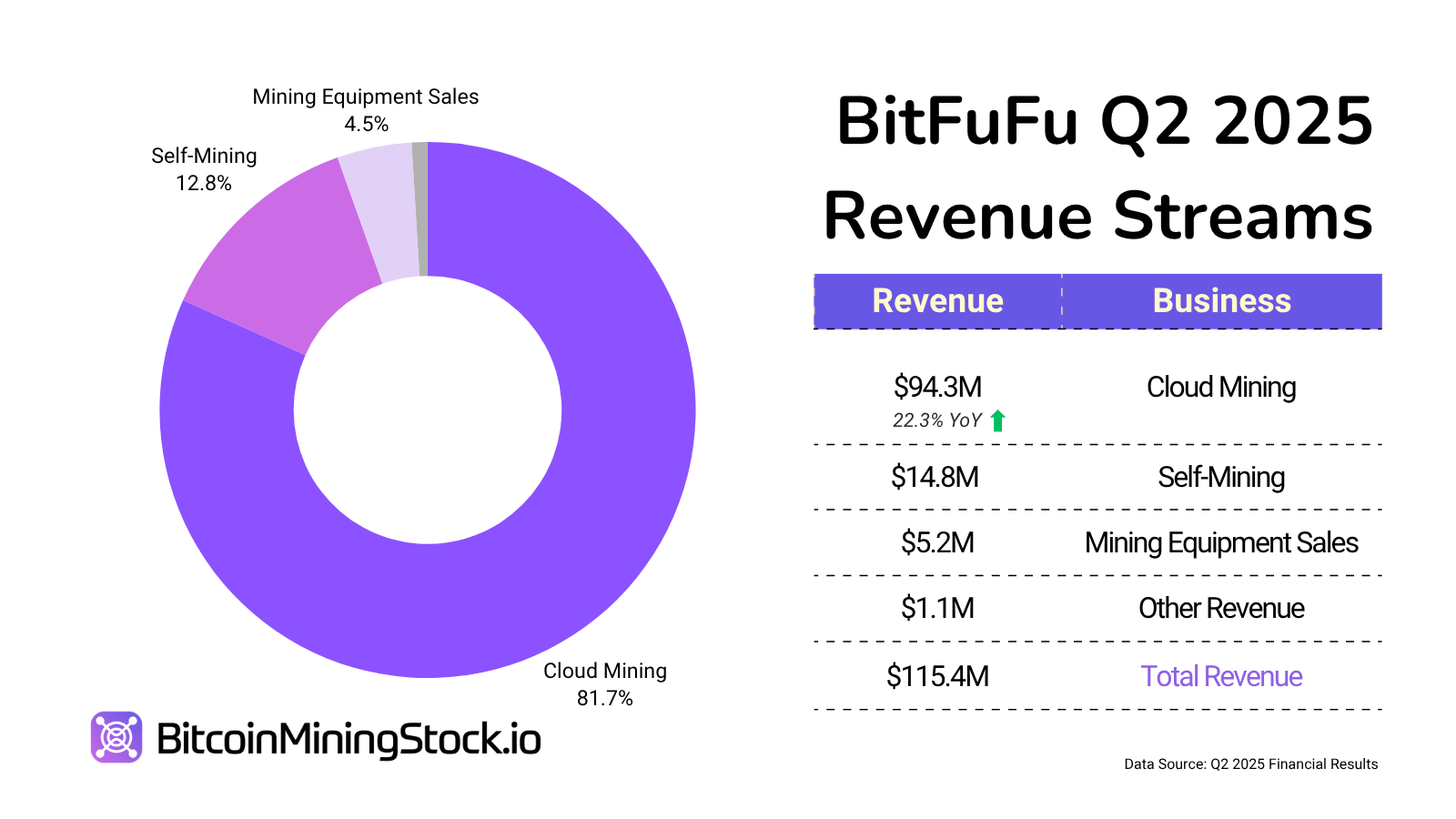

This applies to BitFuFu pretty well because cloud mining is the core engine for its business. In Q2 2025, the company reported $115.4 million in revenue, with 81.7% derived from cloud mining services. For those who assume cloud mining is a fading model, BitFuFu’s recent performance suggests otherwise:

- Cloud mining revenue rose 22.3% YoY and 75.7% QoQ.

- Registered users increased from 591,751 in the prior year to over 641,000 by September.

- Net dollar retention reached 59.5%, indicating strong recurring revenue and customer stickiness.

- Major clients' contribution remains high. Based on previous SEC filings and my industry experience, a handful of major customers likely account for a large portion of revenue through long-term bulk contracts.

- Institutional demand is growing, as suggested by management commentary and filings in Q2.

In short, cloud mining demand is far from dead. As the world’s largest provider of cloud mining services (per Frost & Sullivan), BitFuFu is well positioned to benefit from institutional adoption, capital-light business models, and continued retail demand.

Assuming similar market conditions, BitFuFu could generate approximately $340 million in cloud mining revenue annually, not just in 2025, but also in the years ahead.

Dual-Engine Flywheel

BitFuFu’s operational model allows it to dynamically allocate machines between cloud mining contracts and self-mining based on demand and market conditions. When cloud demand is strong, hash rate is directed to clients. When demand slows or hash price rises sharply, capacity is redirected to self-mining. This flexibility supports monetization efficiency across market cycles.

The structure also provides a built-in hedge. During bull markets, cloud mining attracts capital from users aiming to gain BTC exposure, while in downturns, prepaid long-term service contracts help stabilize revenues.

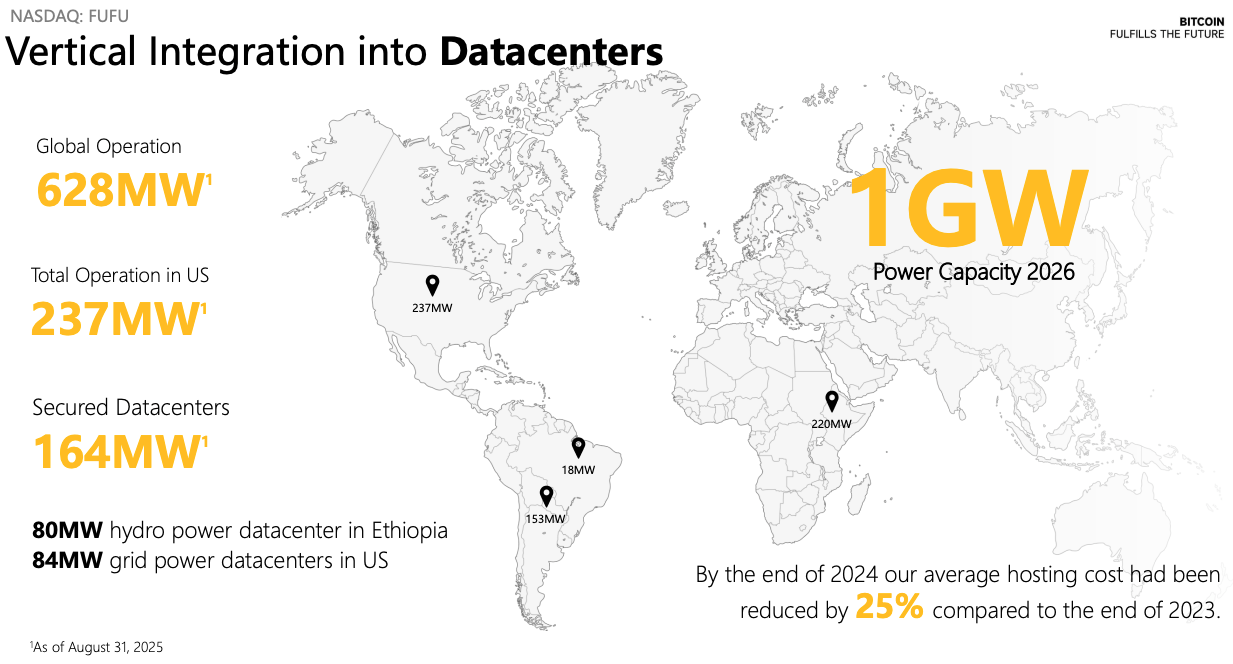

As of September 2025, BitFuFu manages 36 EH/s of total capacity, up from 23.5 EH/s at the end of 2024. Of that, 5 EH/s is self-owned hash rate, an increase from 3.1 EH/s. Notably, this expansion was achieved without significant debt or equity issuance. Given the company’s disclosed 1 GW of power capacity target in 2026, its infrastructure footprint, currently 628 MW, has room to scale further.

Vertical integration further reinforces this model. BitFuFu sources machines directly from Bitmain as an S-level client, which provides advantages in miner availability, delivery schedules, and access to shared infrastructure. It also operates its own facilities and deploys in-house software (including BitFuFuPool and BitFuFuOS firmware). These elements contribute to a reported fleet efficiency of 17.3 J/TH, which is competitive among peers.

Ultimately, BitFuFu’s model allows it to capture demand, secure revenue upfront, and deliver returns from infrastructure it owns and operates. All without overextending balance sheet risk.

Other Notable Business Activities

Most recently, BitFuFu announced the launch of ANTMINER S21+ Hyd for both purchase and hosting. The hosting service itself was introduced in July, and this new offering adds a competitive ASIC option to the mix, which further strengthens BitFuFu’s dual-engine flywheel. While cloud mining and hosting are operationally similar, hosting clients retain full machine ownership. Given BitFuFu’s partnership with Bitmain, this move effectively leverages its early access and favorable terms on new-generation ASICs.

On the Q2 earnings call, BitFuFu also disclosed active exploration of self-generated power models. The company is evaluating sourcing natural gas in North America and Africa. According to CEO Leo Lu, based on current AECO gas prices and a 33% generator efficiency, electricity generation costs could fall below $0.01/kWh, which is potentially a meaningful structural advantage. If realized, this site-level integration would improve cost control, reduce reliance on third-party hosting, and support long-term profitability amid tighter mining cycles.

Another forward-looking initiative involves treating Bitcoin hash rate as a tokenizable real-world asset (RWA). BitFuFu is exploring ways to structure mining output or income rights into digital assets, potentially giving investors exposure to BTC-linked cash flow without direct operational risk. While no RWA pilot has been launched, this direction aligns well with the mechanics of BitFuFu’s existing cloud mining model.

Valuation: A Clear Gap to Peers

Despite being the 7th largest public miner by hash rate size, BitFuFu’s share performance significantly lags its peers. As of October 30, the company operated 36 EH/s with a market cap of ~$563.5 million, implying a valuation of just $15.65 million per EH/s. In contrast, Riot sits at $213.69 million per EH, MARA at $108.94 million, and CleanSpark around $99.44 million.

The discount extends beyond hash rate. Adjusting for $215.07 million in Bitcoin holdings (1,959 BTC at $109,789), $40.09 million in cash, and $141.3 million in debt, BitFuFu’s enterprise value stands at approximately $449.54 million. With Q2 revenue of $115.4 million, a conservative $400 million annual run rate implies an EV/revenue multiple of 1.12x, well below the 3x-4x range seen in bullish cycles.

Profitability also appears undervalued. The company posted $49.9 million in adjusted EBITDA in H1, annualizing to roughly $100 million, which translates to an EV/EBITDA multiple of just ~4.49x. Top-tier miners in favorable markets often trade at 10–20x.

On an asset basis, BitFuFu reported $467.61 million in total assets (including crypto holdings) and $265.25 million in liabilities, resulting in a P/B ratio of 2.78x. The balance sheet remains healthy, with $40.09 million in cash and $171.36 million in digital assets providing ample liquidity.

From a valuation perspective, BitFuFu appears meaningfully underpriced across revenue, earnings, and asset-based metrics.

Final Thoughts

Mining is a tough business. It’s capital intensive, margin sensitive, and often misunderstood by markets. But BitFuFu has a different way to monetize Bitcoin mining, one that may prove more resilient across Bitcoin cycles. Its dual-engine flywheel model allows it to execute in ways that many of its larger peers cannot, delivering recurring revenue streams under all market conditions. With self-mining, vertical integration, and growing Bitcoin reserves, BitFuFu is well-positioned to scale its cloud mining business while selectively expanding its mining footprint.

While it may not look like a traditional miner, that’s exactly the point. BitFuFu’s strategy is grounded in hash rate monetization: leveraging infrastructure through cloud contracts, optimizing operations through vertical integration, and potentially unlocking new capital flows via tokenized yield products. Its growing Bitcoin treasuries and direct access to Bitmain further strengthen this position.

The market has yet to fully grasp the investment case for BitFuFu. Not because of poor performance, but rather structural misunderstanding and investor unfamiliarity. Liquidity limitations and its identity as a foreign entity further weigh on its valuation. In other words, BitFuFu’s business may be running just fine, but unless the company builds visibility among U.S. investors, it risks being misunderstood, or worse, ignored by capital markets.

Nonetheless, as long as Bitcoin exists, there will be clients who want access to hash rate. Particularly institutional players seeking exposure without the burden of managing machines. BitFuFu is one of the few public companies positioned to serve that need at scale. The company still has execution risks, especially around power cost management and public market communication. But the underlying thesis is sound: demand for hash rate persists, then value continues to be created around it.

Disclosure: This article was commissioned by BitFuFu. BitcoinMiningStock.io retained full editorial control. The sponsor reviewed the piece solely for factual accuracy and had no influence over the analysis or conclusions. I do not hold any position in BitFuFu at the time of writing. The views expressed are my own and based on publicly available information. This content is for informational purposes only and does not constitute investment advice. Readers should conduct their own due diligence before making any investment decisions.