Digital asset treasury stocks might sound complex, but they're actually a straightforward way to dip your toes into crypto without buying Bitcoin or other cryptocurrencies directly. Imagine owning shares in a regular public company, like a tech firm or a mining operation that keeps a portion of its cash reserves in cryptocurrencies such as Bitcoin, Ethereum, or Solana. As these digital assets grow in value, so does the company's balance sheet, potentially boosting its stock price.

This category has grown rapidly since 2024, as companies began disclosing material Bitcoin holdings and, in some cases, making digital assets a core part of their capital allocation strategy. Today, treasury exposure is measurable, comparable, and increasingly priced by the market.

What Are Digital Asset Treasury Stocks?

A digital asset treasury stock is defined by balance-sheet exposure, not by business model. These companies may operate in software, payments, mining, or unrelated industries, but they share one feature: cryptocurrency is held as a treasury asset.

On our platform, treasury companies are categorized by the primary digital asset held:

This distinction matters because each asset exhibits different volatility, liquidity, and correlation profiles, which directly affect equity behavior.

Importantly, not all “crypto stocks” qualify as treasury stocks. Exchanges, miners, and blockchain service providers may have crypto exposure through operations, but treasury stocks are specifically those where crypto appears on the balance sheet as a reserve asset.

Why Companies Hold Crypto on Their Balance Sheets?

You might wonder why a company would choose to hold volatile assets like crypto instead of safe options like cash or Treasury bonds. It boils down to several strategic reasons.

The first is capital appreciation. Bitcoin, in particular, has outperformed most traditional assets over multi-year periods. Firms that accumulated BTC early saw treasury values increase materially during bull cycles, often exceeding operating income in magnitude. This is observable directly in balance sheets and quarterly filings.

Another motivation is macro positioning. In environments where monetary expansion and currency debasement are concerns, Bitcoin is sometimes viewed as a macro hedge against fiat dilution. While this view is not universal, it has influenced treasury decisions among firms with strong convictions around digital scarcity.

There is also a market-structure incentive. Holding digital assets can attract a crypto-native investor base, increase trading liquidity, and reposition a company within the digital-asset equity universe. In several cases, treasury adoption has changed how a company is valued by the market, independent of its original operating business.

These strategies fall under broader corporate finance and treasury strategy decisions, and they introduce a new layer of balance-sheet dynamics that investors must understand.

Public Companies Holding Bitcoin and Crypto Assets

A growing number of listed firms hold Bitcoin, Ethereum, or other crypto assets as part of their treasury. These holdings are publicly disclosed through financial statements and regulatory filings.

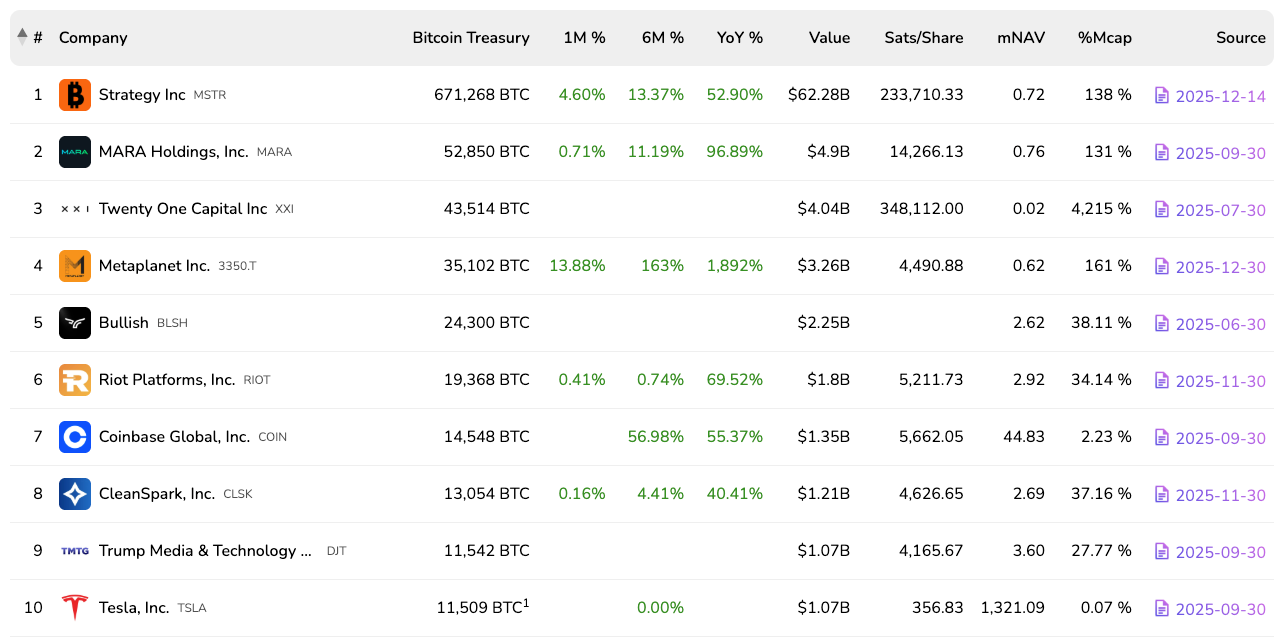

Top 10 Bitcoin Treasury Stocks (by Bitcoin holdings; as of Jan 5, 2026; View live updates )

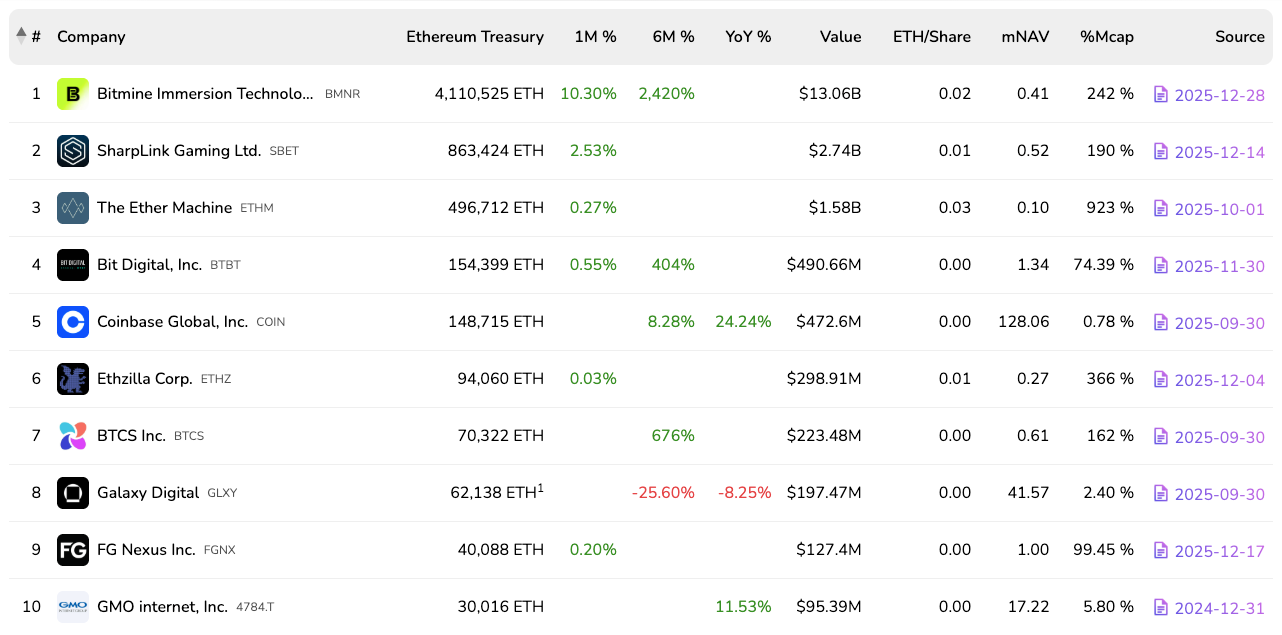

Top 10 Ethereum Treasury Stocks (by Ethereum holdings; as of Jan 5, 2026; View live updates )

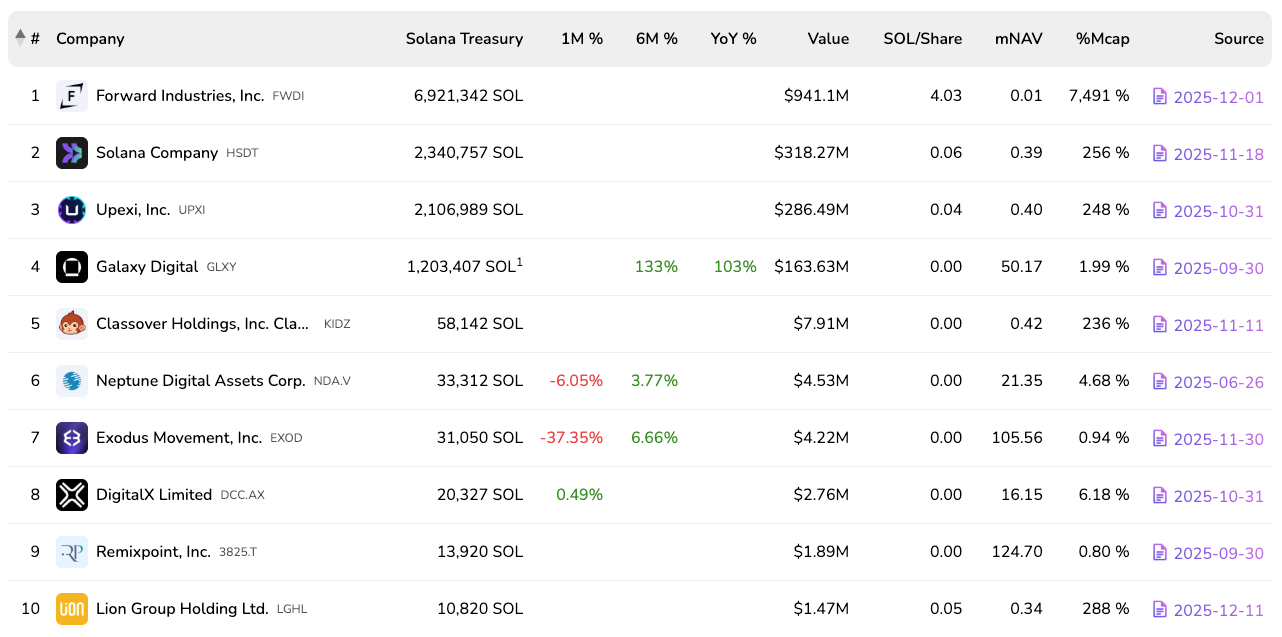

Top 10 Solana Treasury Stocks (by Solana holdings; as of Jan 5, 2026; View live updates )

Remember, these figures can change with market fluctuations or new purchases, but you can always check updates on our website.

How Crypto Holdings Affect Stock Price & Valuation?

When a company holds digital assets, its stock price often develops a direct correlation with the underlying crypto asset, particularly when the treasury position is large relative to market capitalization.

When a company holds digital assets, their value directly feeds into the balance sheet. If Bitcoin's price climbs, the treasury appreciates, which can lead to higher earnings reports and attract more investors, driving up the stock price. This creates a "premium" where the stock trades higher than its non-crypto assets would suggest a built-in leverage to crypto growth.

On the flip side, if crypto prices drop, companies might face impairment charges, reducing reported profits and pressuring the stock downward. In 2026, with Bitcoin's maturity, these effects are more pronounced during market rallies or dips. Factors like overall crypto sentiment, company announcements (e.g., new buys), and even AI integrations play a role.

Investing in Digital Asset Treasury Stocks vs ETFs vs Tokens

Investors can gain crypto exposure in three primary ways: holding tokens directly, buying crypto ETFs, or investing in treasury stocks.

Treasury stocks sit between ETFs and tokens. Unlike tokens, they trade on stock exchanges and fit into traditional portfolios. Unlike ETFs, they include operational and managerial risk, because shareholders are exposed to how management handles capital allocation and treasury decisions.

For institutional and traditional investors, treasury stocks can offer regulatory familiarity, equity liquidity, and standard custody, while still providing indirect crypto exposure. Tax treatment may also differ, as gains are realized through equity appreciation rather than direct token transactions.

Each vehicle serves a different purpose, and understanding these distinctions is essential when constructing a crypto-linked equity strategy.

Valuation Models for Digital Asset Treasury Stocks

Valuing treasury stocks requires combining traditional equity analysis with crypto-specific adjustments.

One common approach is net asset value (NAV) analysis, where the market value of crypto reserves is added to (or separated from) the operating business. In practice, investors often simplify NAV by treating the market value of digital assets held (e.g. Bitcoin, Ethereum, Solana) as the core net asset value, especially when treasury holdings dominate the balance sheet.

Building on this, many market participants reference mNAV (market-to-net-asset-value), which compares a company’s market capitalization to the market value of its digital asset holdings. An mNAV above 1.0 implies the stock trades at a premium to its crypto reserves, which often reflects expectations of future accumulation, leverage, or operating optionality; while an mNAV below 1.0 indicates the market is discounting treasury value due to dilution risk, execution concerns, or weak core operations.

Other popular approaches include % of Market Cap (how much of the stock's value comes from crypto) and Satoshi Per Share (divides Bitcoin holdings by shares outstanding; e.g., how many satoshis you own per stock).

These valuation approaches help spot undervalued gems. You can always view latest numbers on our website when comparing treasury companies across different assets and market conditions.

Risk Factors of Investing in Crypto-Holding Companies

No investment is risk-free, especially with crypto involved. Market volatility is the big one: crypto swings can make stock prices jump or plummet overnight. Regulatory changes, like new SEC rules, could force companies to sell holdings or face penalties. Operational risks include hacks on crypto custodians or high debt from buying sprees.

Impairment losses under accounting rules can hit earnings hard during downturns, and over-reliance on crypto might distract from the core business. In 2026, experts warn of a potential "survival crisis" for smaller holders if markets cool.

Regulatory Reporting and Accounting Treatment

Diving into the rules might seem dry, but it's crucial for trust. Under U.S. GAAP (set by FASB), crypto is classified as intangible assets, valued at fair market price with quarterly updates per ASU 2023-08. This means companies report gains but must impair for losses, creating potential gaps between book value and reality.

The SEC requires detailed disclosures in filings like 10-Ks, scrutinizing crypto to prevent misleading investors- risking restatements if done wrong. Internationally, IFRS offers similar fair value options, with ongoing pushes for standardized crypto rules. Keywords like "crypto accounting rules," "GAAP Bitcoin treatment," "crypto stock disclosure," "Bitcoin reporting SEC," and "treasury crypto regulations" are worth searching for more.

Where Digital Asset Treasury Stocks Are Heading

Treasury strategies are no longer limited to Bitcoin alone. Ethereum and Solana treasury companies are emerging, each introducing different risk and return characteristics tied to network economics and asset liquidity. Over time, treasury exposure may become more structured, diversified, and integrated with broader digital-asset infrastructure.

Meanwhile, challenges like tighter regulations persist, but overall, this sector promises innovation for investors.

Disclaimer: This article is provided for informational and educational purposes only and does not constitute financial, investment, legal, accounting, or tax advice. Nothing on BitcoinMiningStock.io is a recommendation, offer, or solicitation to buy or sell any security, digital asset, or financial product. Investing in Bitcoin mining stocks and digital-asset equities involves significant risk and may result in the loss of principal. Past performance is not indicative of future results. You should conduct your own research and consult a licensed financial adviser before making any investment decisions.