While I’ve covered a few major HPC/AI pivots and deals from public Bitcoin miners, quite a few followers have increasingly pointed me toward a lesser-known name: Soluna Holdings (NASDAQ: SLNH). The argument? It’s a microcap player with what appears to be a massive energy pipeline (> 1GW), building HPC data centers and, most recently, a $100 million credit facility to fund Project Kati - its next-generation renewable-powered site meant to serve both Bitcoin mining and AI customers.

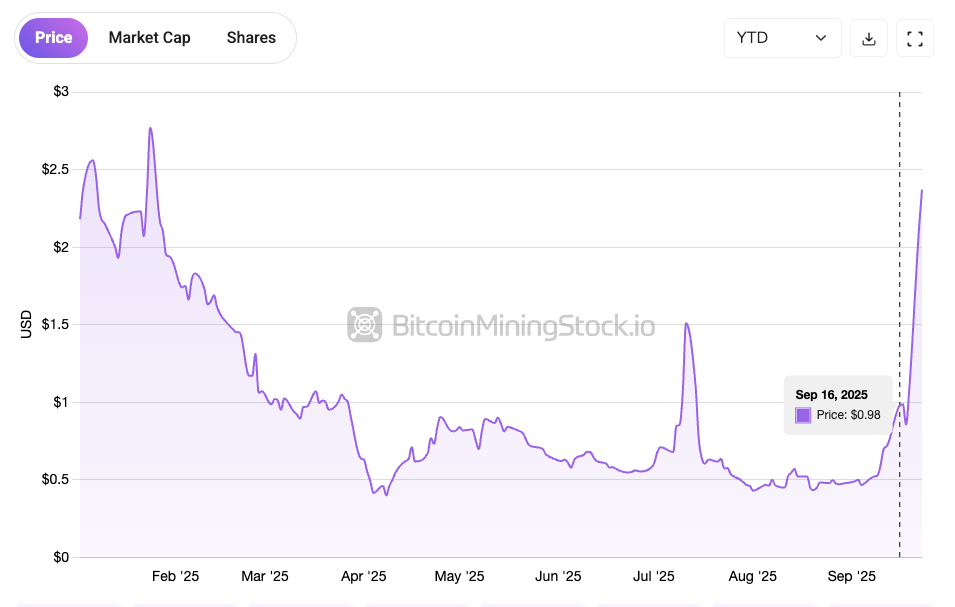

Some believe Soluna could follow a similar path to IREN or CIFR: shares largely underpriced until the market realizes its huge HPC/AI potential. But let’s move beyond speculation. The question is does the hype hold up when piecing together scattered facts?

Let’s dive in!

Soluna’s Infrastructure Footprint: Over 1 GW in Play

Soluna Holdings is a U.S.-based developer of modular green data centers, specifically designed for intensive computing applications like Bitcoin mining and AI workloads. The company positions itself as a bridge between underutilized renewable energy assets and compute demand.

It currently operates or is building a number of modular sites across Texas and the U.S., most of them co-located with renewable generation. As of Q2 2025, Soluna claimed a total clean energy pipeline of 2.8 GW, with a 1.023 GW subset focused on near-to-mid-term development. That puts them in the same capacity league as Bitfarms (1.2 GW)* - but with a market cap that, until recently, was nearly 1.5/100th of the latter.

*Despite reporting a similar range of energy capacity, Soluna had 3.345 EH/s of installed hash rate as of August 2025 (with 0.526 EH/s dedicated to self-mining), compared to Bitfarms' 19.5 EH/s.

Here’s a breakdown of Soluna's project portfolio based on public disclosures:

Project Kati is Soluna’s largest site to date and marks a clear move beyond Bitcoin mining into AI and high-performance computing (HPC) infrastructure. The site is structured as a two-phase, 166 MW buildout.

Construction of Kati 1 (83 MW) began in September 2025 and is expected to be operational in early 2026. Of this, 48 MW has already been leased to Galaxy Digital under a hosting agreement, while the remaining 35 MW is reserved for Soluna’s own Bitcoin hosting clients.

The second phase, Kati 2, will add another 83 MW and is purpose-built to support AI and high-performance computing (HPC) workloads. This expansion, along with other data center buildout plans, positions Soluna as an emerging infrastructure provider for the AI economy.

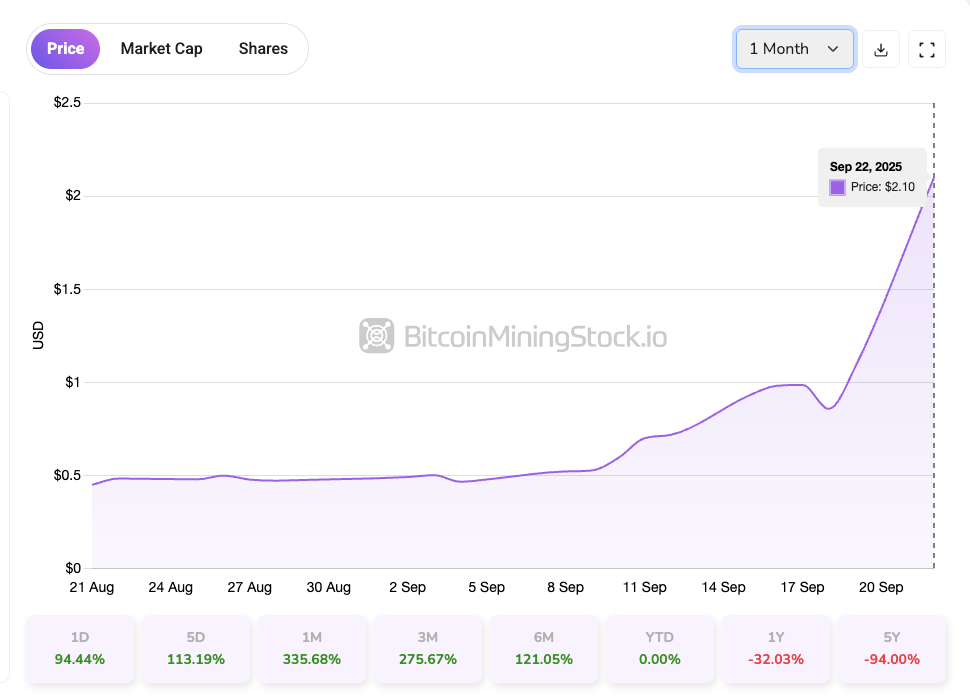

The market appears to start pricing in Soluna’s HPC/AI pivot, especially following the announcement of Soluna’s $100 million credit facility.

The $100 Million Credit Facility: Capital Comes at a Cost

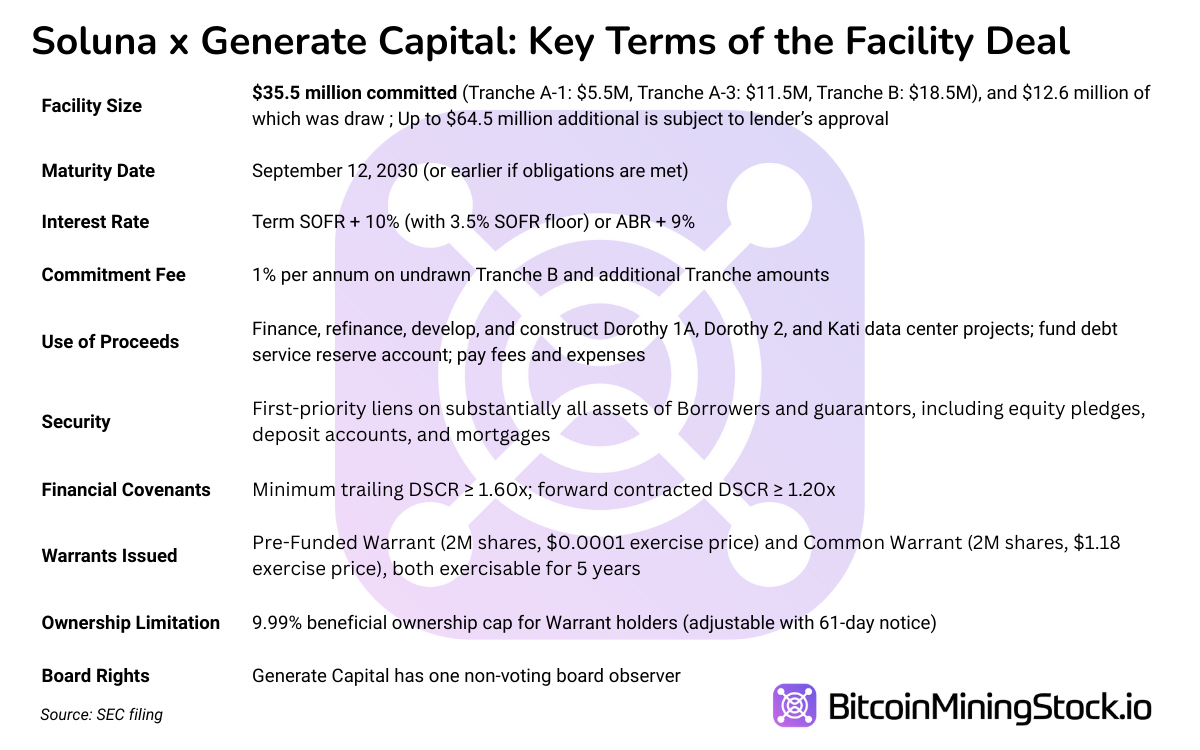

In September 2025, Soluna announced a credit facility of up to $100 million from Generate Capital, a lender known for backing sustainable infrastructure. For a company with $6.15 million in quarterly revenue and $9.85 million in unrestricted cash, the deal marks a significant step forward in securing long-term project funding. But while the headline figure is substantial, the structure of the agreement is layered with milestones and conditions that shape how and when the capital becomes available.

Of the total facility, $35.5 million is currently committed. This includes an initial $12.6 million draw used to refinance Dorothy 1A and Dorothy 2, as well as a further $22.9 million to support continued development of Dorothy 2 and the first phase of Project Kati. The remaining $64.5 million is uncommitted, which may be made available at Generate’s discretion, depending on future milestones and performance. In short, the headline figure is a ceiling, not a guarantee.

Unlocking the capital isn’t cheap. The loan carries an interest rate of SOFR + 10%, with a minimum SOFR floor of 3.50%, resulting in a starting interest rate of at least 13.5%. Alternatively, Soluna may choose to borrow at an ABR + 9% rate. That rate alone would be considered aggressive. On top of that, Soluna pays a 1% annual fee on unused funds in certain tranches, which means the clock starts ticking whether the money is deployed or not. Even if Soluna never touches the remaining facility, keeping it available comes at a cost.

Then there are the restrictions. The funds are ring-fenced and may only be used for three specific assets: Dorothy 1A, Dorothy 2, and Project Kati. Likewise, the collateral is project-level. Generate Capital has first claim over the borrowing entities’ equity, assets, cash accounts, and real estate; but notably excludes any guarantee from Soluna’s parent entity. This setup limits the company’s liability beyond the projects while giving Generate clear enforcement paths tied to project performance.

The deal also includes financial covenants designed to monitor ongoing viability. Soluna must maintain a trailing debt service coverage ratio (DSCR) of at least 1.60x and a forward contracted DSCR of at least 1.20x. These coverage tests are standard for project finance and aim to ensure that project-level cash flows remain sufficient to cover scheduled debt obligations.

Alongside the loan, Generate also received equity-linked incentives in the form of two tranches of warrants: a pre-funded warrant for up to 2 million shares at a near-zero strike price and a common warrant for another 2 million shares at $1.18. Both are immediately exercisable over a five-year term, with a 9.99% cap on ownership to avoid triggering disclosure thresholds. Such a structure gives Generate a long-term stake in Soluna’s future but also introduces dilution risk.

All told, this is a classic case of equity-linked infrastructure financing designed for high-risk, high-upside scenarios. The structure gives Soluna a critical runway to refinance existing assets and fund construction of its flagship buildouts. Meanwhile, it introduces new layers of cost, oversight, and milestone-based conditions. For a company with limited traditional financing options, the deal could be a high-leverage growth enabler. But it also puts Soluna on a tight leash. Execution is now non-negotiable. If Soluna stumbles, the lender holds both the capital and the control levers.

Final Thoughts

The bull thesis on Soluna is straightforward: if management delivers on Kati 1 and successfully transitions into high-margin AI hosting with Kati 2, the company could unlock predictable recurring revenue at a scale not previously seen in its history.

Assuming $1.5M annualized revenue per MW for AI/HPC workloads, a rough benchmark based on peer disclosures indicate Kati 2 could eventually generate $124M at full capacity (83 MW × $1.5M). That’s nearly 20x Soluna’s current quarterly run rate. For a company with a sub-$100M market cap, the upside is clearly transformative.

But the downside risk is equally significant. Generate Capital’s loan terms leave very little room for error. Any slip up, whether it’s a missed DSCR covenant, construction delay, or underperformance, could trigger penalties, asset loss, or dilution through warrant exercises or emergency fundraising.

In effect, Soluna has placed a high-conviction bet on its ability to execute.

Best case: it follows the path of IREN or CORZ, scaling into a legitimate HPC infrastructure player with diversified revenue and strategic relevance.

Worst case: tight covenants and high debt costs choke the company before its projects mature.

Speculation around potential JVs or M&A may keep investor interest elevated. A recent tweet from the CEO hinted at inbound interest from hyperscale miners, power plant owners, and infrastructure funds:

At @SolunaHoldings We’re ripe for the picking…

— John Belizaire (@jbelizaireCEO) September 22, 2025

Like a ripe apple 🍎 during harvest time.

We’re picked by the top Hyperscale miners.

We’re picked by the top Power Plant owners.

We’re picked by the top Infrastructure Funds.

With over 1GW clean computing projects in… pic.twitter.com/ARn4GYybPj

There’s no public confirmation of deals from “top hyperscale miners”, but with Galaxy Digital as an anchor tenant and Generate Capital on board as a lender, the foundation is being laid for future partnerships.

Either way, Soluna has entered a high-stakes phase. The credit facility buys it time, not certainty.

For now, the 94% spike reflects investor enthusiasm. What comes next will depend on execution.

Disclaimer: The views expressed in this article are my own and are based on publicly available information. This content is intended for informational purposes only and should not be construed as investment advice. Readers are encouraged to conduct their own research before making any investment decisions. Past performance is not indicative of future results. No recommendation or advice is being provided as to the suitability of any investment for any particular investor.