Happy New Year!

As we step into 2025, it’s the perfect time to reflect on the lessons from 2024—a monumental year for crypto history. From the approval of spot Bitcoin ETFs, to the 4th Bitcoin halving and Bitcoin reaching a new all-time high, the year was filled with milestones that fueled the sector’s growth.

For publicly listed Bitcoin miners, often viewed as a proxy for Bitcoin, 2024 brought a wide range of outcomes. Some companies thrived by adopting forward-thinking strategies, while others faced operational setbacks and declining stock prices.

Let’s take a close look at some of the best performing companies from 2024 and explore the strategies that propelled their success. These examples might just offer valuable lessons for investors and the mining industry alike.

1. Adapting Through Diversification, especially with HPC/AI

Example: Core Scientific (CORZ)

- Market Cap: $3.92 billion

- 2024 Stock Growth: +308.43%

Core Scientific staged a remarkable comeback in 2024 after relisting in January, following its emergence from Chapter 11 bankruptcy. Despite previous financial struggles, the company maintained a large-scale Bitcoin operation with a hash rate capacity of 20.3 EH/s.

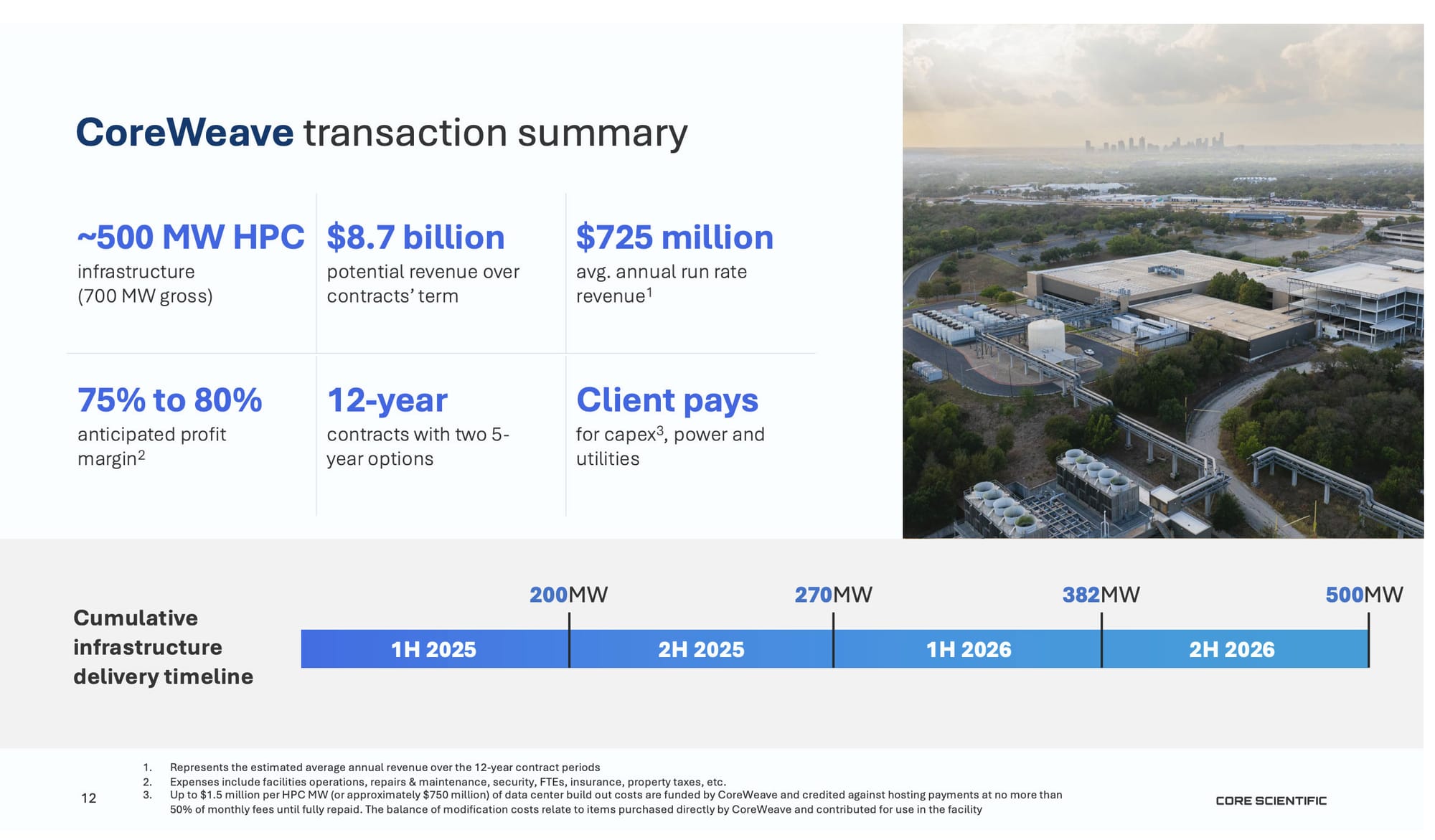

However, what truly set Core Scientific apart was its pivot to high-performance computing (HPC) and AI hosting. The 12-year contract with CoreWeave, expected to generate $8.7 billion in revenue. This is the largest HPC/AI contract among public miners, and it has drawn significant attention from Wall Street analysts and investors. Such deals provide stable, predictable revenues and help offset the volatility and risks associated with Bitcoin mining, particularly during bear markets.

Core Scientific’s ability to secure this groundbreaking HPC/AI agreement is its “winning” strategy.

2. Operational Efficiency Matters

Example: TeraWulf (WULF)

- Market Cap: $2.18 billion

- 2024 Stock Growth: +135.83%

TeraWulf approached Bitcoin mining like a traditional commodity business, focusing on operational efficiency and minimizing marginal costs per unit. With a hash rate of 10 EH/s, the company achieved one of the lowest mining costs per Bitcoin in the sector.

This success can largely be attributed to its experienced management team, whose expertise in finance and energy enabled disciplined execution. By offering clear and transparent cost metrics, TeraWulf reduced investor uncertainty and gained both institutional and retail investor confidence.

Its focus on shareholder value and strategic cost management defined its “winning” strategy in 2024.

3. Vertical Integration

Example: Bitdeer (BTDR)

- Market Cap: $3.02 billion

- 2024 Stock Growth: +119.77%

Although Bitdeer has extensive global operations with a total of 20.7 EH/s under management, its stock had underperformed for much of the year, trading below its initial offering price of $10. In late November 2024, investor sentiment shifted dramatically. This change was driven by two key developments: the breakthrough in ASIC development and a private placement of $360 million in convertible senior notes to fund further data center expansion.

These moves boosted investor confidence, particularly with the launch of SEALMINER ASICs to the public. If these specifications deliver as advertised, Bitdeer could position itself as the most vertically integrated Bitcoin miner in the market.

Vertical integration was Bitdeer’s key to success in 2024—a “winning” strategy that sets it apart in a competitive market.

Discover More in the Full Report

Enjoy reading? This represents just a small portion of the insights available in the 2024 Bitcoin Mining Annual Review. The report provides a comprehensive analysis of industry trends, strategies, and challenges, offering valuable takeaways for investors and industry professionals alike.

Get Your Free Copy: Join the waitlist today and receive your copy on 7th January.

Start 2025 with the insights you need to make smarter, data-driven decisions🚀